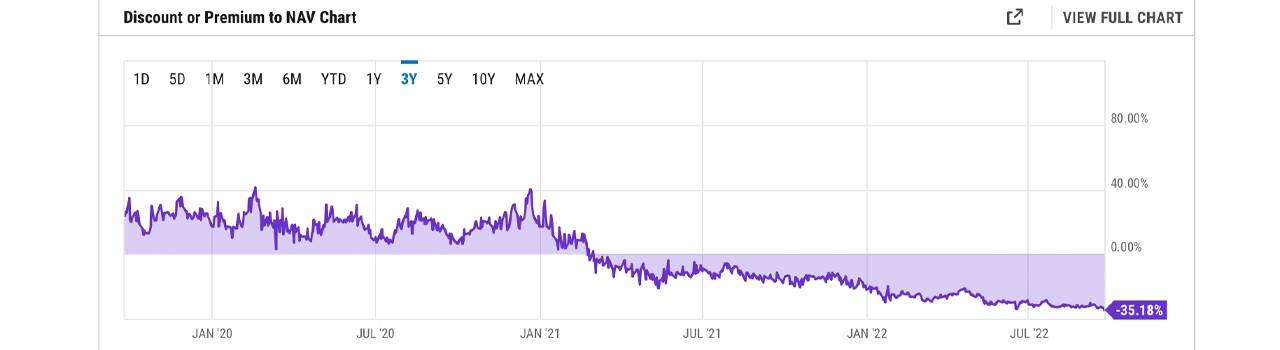

Grayscale Investment’s Bitcoin Trust (GBTC) has dropped to a new low this week as the bitcoin fund tapped a record 35.18% low against bitcoin spot prices. GBTC’s discount to spot has been underwater for a total of 577 consecutive days.

GBTC Discount to NAV Widens by 35% — Fund Reaches an All-Time Low Against BTC Spot Price

Grayscale Bitcoin Trust (OTCMKTS GBTC: GBTC), is one of the most recognizable and oldest bitcoin (BTC), funds currently on the market. However, in recent times GBTC has been suffering from a discount compared to BTC’s spot market values. Unfortunately, GBTC trades at a discount and not a premium, for approximately 577 consecutive days since February 26, 2021.

GBTC’s current pre-market value is $11.20 and according to Securities and Exchange Commission (SEC) filings, there’s 643,572 BTC held by the trust. According to metrics, the trust holds 643,572 BTC which is 3.065% of 21 million bitcoin supply. GBTC’s 35.18% discount is the fund’s all-time low against BTC spot price values since the fund started.

Many people believe GBTC’s discount derives from the fact that there are several exchange-traded funds now, and Grayscale’s efforts to transform GBTC into an ETF (exchange-traded fund) have failed so far. The U.S. SEC rejected the company’s latest attempt in June, and Grayscale decided to sue the SEC over the rejection.

Bob Loukas was a trader, and an entrepreneur. “Grayscale bitcoin discount widened record 35%,” Loukas tweeted. “At Oct 2020 blow-off point. Institutions that are meh. This is what happens if BTC drops to the teens in the coming months. [is]This is a great option. Be willing to wait. [the]Point where the redemption option unlocks value. Even so, must be limit to discount,” Loukas added.

Glassnode statistics revealed that GBTC fell to nearly 30% last March. Institutional investors were flocking at the time to buy GBTC. Grayscale’s parent company Digital Currency Group, (DCG), attempted to repair the discount with share buybacks.

While institutional investors flocked in the past and Loukas explained that GBTC could be a good option, investors don’t seem to be rushing toward GBTC’s discounted price. “Who thought gaining exposure to [bitcoin] through GBTC was a good idea in the first place?” Tom Mitchelhill tweetedIt will be available for purchase on Monday. “They’re literally selling it at a 36% discount and the market still refuses to touch it,” Mitchelhill added.

If the SEC approved GBTC to transfer into an ETF, the discount to BTC’s spot prices could be erased. However, the U.S. regulator has not yet approved a spot-market exchange-traded funds and has stated that market manipulation was one reason to deny funds with these elements. Many traders believe that BTC spot prices will rise to the low teens.

“Some of us have been talking about needing to see $8-12K BTC before we can reset and get a new bull [underway],” the Twitter account Classical Ape tweetedThis week. “Still not there yet. For about one year, my company has held this goal. Oh, and the GBTC discount is an issue too.”

How do you feel about GBTC trading at a discount of 35% from the bitcoin spot price this week? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki commons. Editorial photo credit to: Rcc_Btn. Shutterstock.com.

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or allegedly cause any kind of damage.