The bitcoin economy has managed to maintain its $2 trillion level for the past five days. This is despite the fact that it was not able to surpass the mark on March 22. The global crypto market capitalization has risen 1.3% in the past 24 hours to $2.1 trillion. Additionally, bitcoin’s price surpassed the $46K level on Sunday to capture an $870 million market cap.

The Week in Digital Assets: Bitcoin cracks $46K and TVL for Defi holds above $200 Billion

Digital currencies have gained in value during the last seven days and for five consecutive days, the crypto economy’s total value has held above $2 trillion. It was March’s first week that the cryptocurrency economy was at or above $2 trillion.

The price of bitcoin (BTC), which increased 8.9% over the previous seven days, and Ethereum (ETH) rose 8.5% against U.S. dollars. Out of the top ten largest crypto market caps, cardano (ADA) saw the biggest seven-day gain with 26.5% this week.

The market value for the 13421 crypto assets that are currently being traded on 587 Exchanges stands at $2.1 trillion. This has been augmented by 1.3% over the course of the last 24 hours.

Zilliqa (ZIL), which jumped 148%, convex finance, 53.2% higher (CVX), and vechain, 44.9%, were the biggest winners over the past week.

In the last 24 hours, top privacy coins increased in market value by 3.4% and top smart contract platform coins rose in market capitalization by 1.7%. In addition, top rebase coins by market capitalization grew by 9% over the 24 hour period against the U.S. dollars.

While the value of the crypto economy is $2.1 trillion on Sunday, over the last day there’s been $78.5 billion in global trade volume on exchanges.

At the time of writing, bitcoin (BTC) has a market dominance of around 40.3% of the crypto economy’s value and ethereum (ETH) represents 18% of the $2.1 trillion. The stablecoin tether (USDT), which is the third-largest crypto market valuation, has a market dominance today of around 3.84%.

42.7 billion trades on global exchanges account for $78.5 billion. As of Sunday, $188.9 trillion was the overall value for stablecoins.

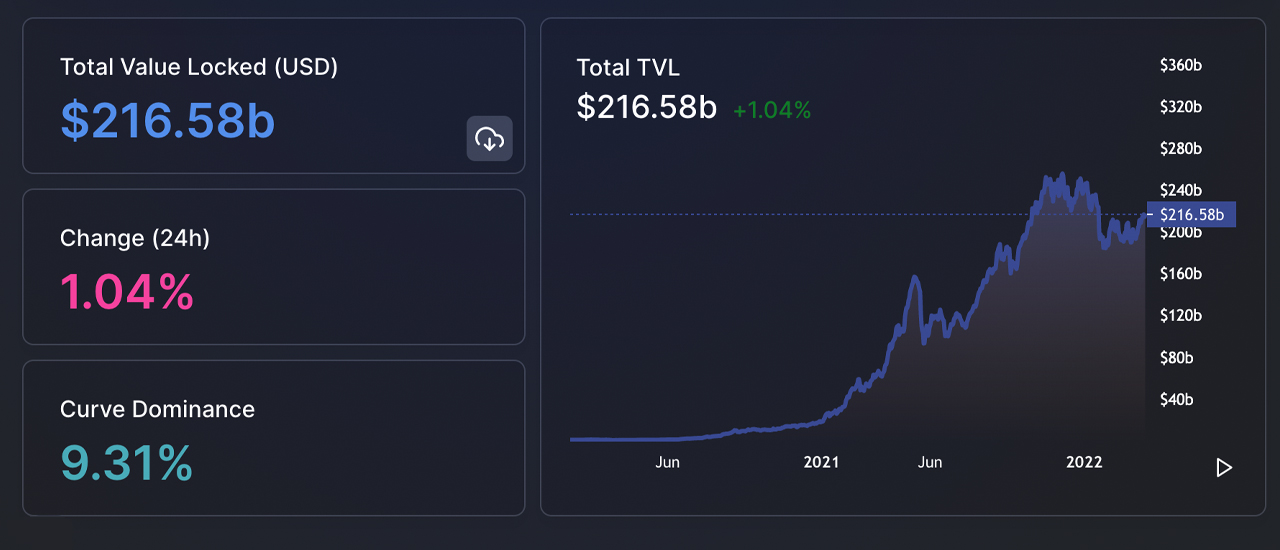

Additional to $2.1 trillion in crypto currency, $216.58 million is also locked up in decentralized finance protocols (defi). In the last 24 hour, defi’s total value locked (TVL), has increased by 1.04%. Curve Finance and Anchor are the largest defi protocol in terms of TVL.

Do you have any thoughts about how the crypto economy managed to stay above the $2 trillion mark for five consecutive days. What do you think about digital assets rising in value this week, or falling? Comment below and let us know how you feel about the subject.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.