As a result, the crypto economy is now below $1 trillion and in the $970 billion area. A large percentage of digital currencies has lost over half its USD value since November 2021. Bitcoin is down 70% from the all-time high last year, and a new report from Glassnode Insights calls the current bear market “a bear of historic proportions,” while highlighting that “it can reasonably be argued that 2022 is the most significant bear market in digital asset history.”

Glassnode Researchers: ‘Bitcoin Is Currently Experiencing the Largest Capital Outflow Event in History’

Although many know the current bear market in crypto, few people have any idea of where it will go or what it will bring to an end. Although the cryptocurrency and its economy have seen several bear market cycles, a Glassnode Insights recent report suggests that it may be one of the worst. The analytics company Glassnode provides an analysis of bitcoin’s (BTC) current price drop and how the digital asset slipped below the 200-day moving average (DMA). This 40-week period gives traders an idea of whether or not this trend will continue to drop lower. It can also help identify potential floor price levels.

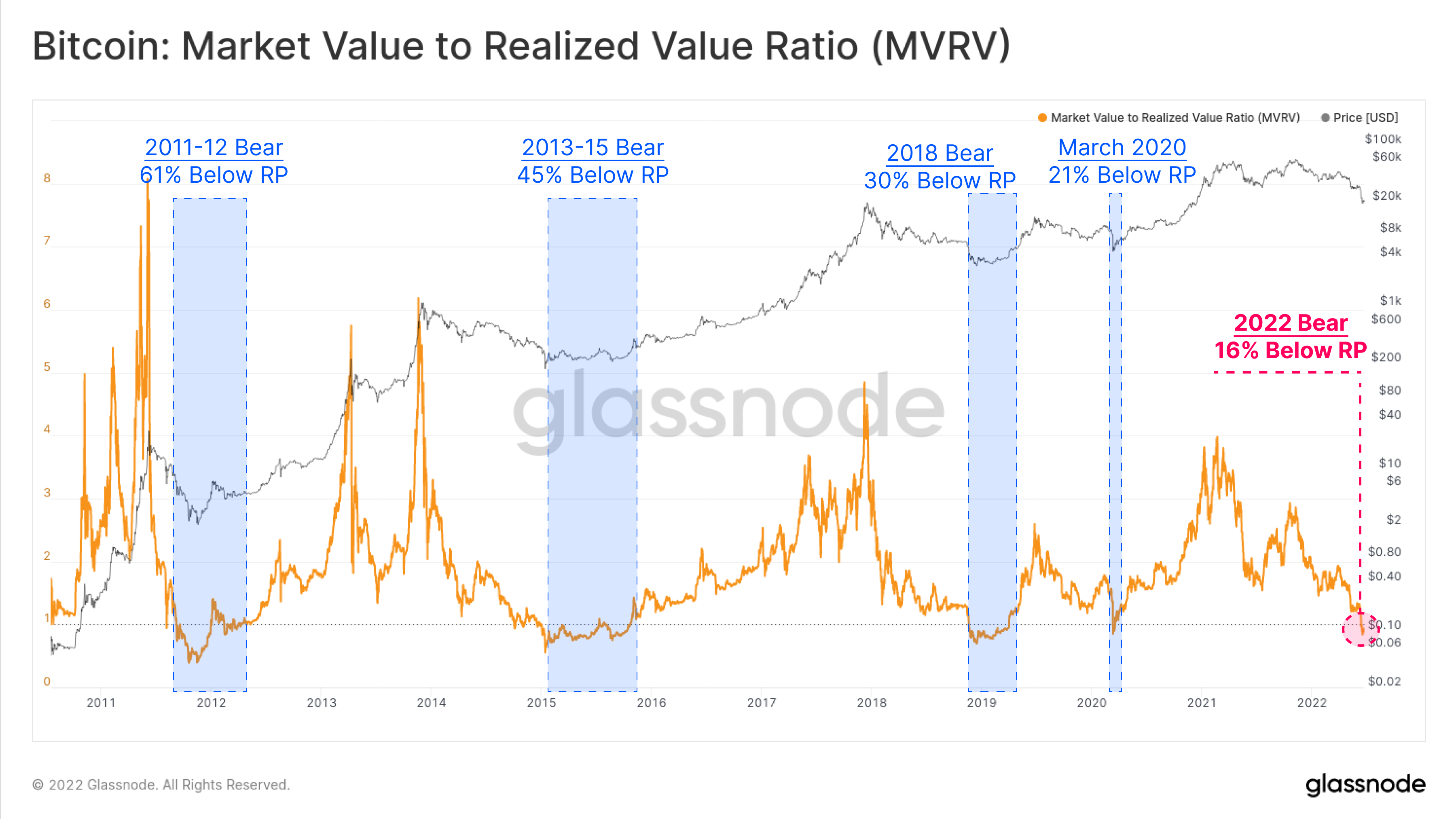

Glassnode’s post describes the Mayer Multiple and the 200DMA and how they can signal a bear or bull market. “When prices trade below the 200DMA, it is often considered a bear market,” Glassnode’s analysis notes. “When prices trade above the 200DMA, it is often considered a bull market.” Additionally, Glassnode leverages data like “realized price,” “realized cap,” and the market value and realized value oscillator (MVRV Ratio).

“The 30-day position change of the realized cap (Z-Score) allows us to view the relative monthly capital inflow/outflow into the BTC asset on a statistical basis,” Glassnode’s blog post explains. “By this measure, bitcoin is currently experiencing the largest capital outflow event in history, hitting -2.73 standard deviations (SD) from the mean. This is one whole SD larger than the next largest events, occurring at the end of the 2018 Bear Market, and again in the March 2020 sell-off.”

Glassnode has been researching and discussing the current bear market for quite some time and on June 13, it published a video called “The Darkest Phase of the Bear.” The video looks into whether or not it is the final phase or final capitulation period in bitcoin’s price cycle. BTC dropped by 80%+ in all major bear markets. A 80% decrease of price from $69K to $13,800 is a record. Some investors in crypto believe the bear is over, while others feel that maximum pain still exists. The bottom, max pain, despair to the limit, and the lowest lows may still be possible.

Glassnode’s report details that because bitcoin got so large, the impact has been magnified. “As the bitcoin market matures over time, the magnitude of potential USD denominated losses (or profits) will naturally scale alongside network growth,” Glassnode’s research report says. “However, even on a relative basis, this does not minimize the severity of this $4+ billion net loss.”

Glassnode researchers also delve into ethereum (ETH), a coin that often drops lower than BTC’s 80% drawdown. “Ethereum prices have spent 37.5% of its trading life in a similar regime under the realized price, a stark comparison to bitcoin at 13.9%,” Glassnode researchers wrote. “This is likely a reflection of the historical out-performance of BTC during bear markets as investors pull capital higher up the risk curve, leading to longer periods of ETH trading below investor cost bases.”

Glassnode was added

Current MVRV cycle low is 0.60. Only 277 trading days have recorded a lower MVRV value. This equals 11% of historical trading.

BTC and ETH prices gained in value last week after suffering a severe hit during the previous week. They remained stable for the majority of the week. BTC prices are still down 8.1% during the past two weeks and the crypto asset’s USD value is down 0.3% over the last 24 hours. The ETH value has dropped 0.1% in the past 24 hours, while the two-week statistics show that ETH is only down 1.3% against the U.S. Dollar. Glassnode’s post shows that the data and studies done point to one of the most significant crypto bear markets in history.

Glassnode Insights’ report ends with these words:

These studies highlight investor losses of staggering magnitude, capital destruction and capitulation events that have been observed over recent months. The bear market that dominated 2022 is the longest and largest in digital asset history.

What do you think about Glassnode’s bear market report? Are you able to say this market has been the worst ever? Please comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki Commons