The digital belongings business has been profitable at attracting a document variety of customers inside a short while. If we have a look at the numbers, we’ll see simply how phenomenal the expansion has been within the digital belongings business.

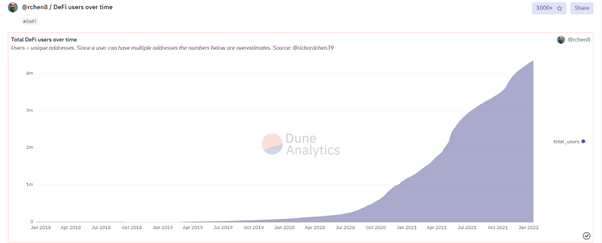

Presently, the variety of crypto holders hovers round 300 million. The DeFi area has grown from a mere 26000 customers in April 2020 to a document 4.3 million-plus customers right this moment.

DeFi customers are on a bull run. (Picture Supply)

Now, the query is: How was the crypto business in a position to obtain such large progress? The reply is that, in terms of probably the most profitable funding choices obtainable available in the market right this moment, DeFi and the crypto area, on the whole, will come out on high.

The Lack of Borrowing Choices for Holders of Smaller Market Cap Cash

Do all these 300 million customers personal solely the preferred cash, the numero uno cash of the crypto world, like Bitcoin, Ethereum, Binance Coin, and so forth? After all not! Many of those customers additionally maintain cryptocurrencies with far smaller market caps.

The explanation why numerous customers personal new cash with small market caps is that they’re much more risky than their bigger counterparts, which implies an enormous upside potential. Nonetheless, there’s one caveat when holding onto cash which have a smaller cap.

Holders of such cash have few to no choices to acquire funds by lending their cash, as there aren’t any takers for them. The likes of Nexo, BlockFi, Celsius, amongst others, don’t lend funds on these cash, which leaves the holders with no different possibility than to promote their cash in occasions of want.

That’s the place Fringe Finance, previously Bonded Finance, comes into the image. Amidst an absence of

simple, no-nonsense methods of acquiring funding on smaller cash, the Fringe Finance crew determined to take it upon themselves to unravel this drawback.

The Fringe Finance Answer

Fringe Finance’s methodology is uniquely easy: Fringe accepts a various set of smaller altcoins and permits them as collateral for stablecoin loans.

The crypto market – owing to its emergent and creating nature – is extra risky than conventional buying and selling markets. It’s no surprise that smaller altcoins are much more risky than well-known, high-liquidity ones. However, Fringe Finance ensures, with the usage of a wide range of parameters and sensible contract mechanisms, together with state-of-the-art value feeds and safety audits by high corporations, the soundness and monetary safety of the platform ought to keep intact even in occasions of excessive volatility.

The Approval Mechanism to take part in Fringe

Any new challenge can apply for token inclusion within the Fringe platform. The Fringe Finance Admins then conduct a rigorous evaluation and assign tokens a tier that helps resolve how the platform will collateralize them. Accepted tasks and their tokens then change into eligible for debtors to deposit as collateral.

Assessments stand on 4 standards: liquidity, value volatility, non-circulating provide, and the ratio of impending non-circulating provide vs liquidity.

How shut the liquidity is to the market value is a crucial parameter of riskiness because it impacts a person’s danger to fall into liquidation. When a person will get liquidated, they may nonetheless get better a few of their collateral, though most of will probably be offered within the open market to pay for his or her mortgage.

Value volatility can also be an necessary parameter to guage a token’s inclusion-readiness in Fringe Finance. Tokens that traditionally have lower cost volatility indicate decrease danger. Decrease-risk tokens, in flip, obtain a greater tier score.

The third issue, non-circulating provide, can also be a vital parameter as tokens which have an imminent provide launch might show to be dangerous for the potential of close to or mid-term volatility. Lastly, Fringe Finance seems to be into the ratio of non-circulating provide vs liquidity. The decrease the ratio, the decrease the chance profile assigned to a token.

After judging by way of the prism of all these parameters, Fringe Finance assigns a tier to every token. These tiers assist Fringe Finance change into optimally inclusive, allocating totally different liquidator charges and platform liquidation charges to totally different tokens.

For instance, Tier 0 tokens are the preferred, vastly traded, and fewer volatility-prone ones, similar to ETH and WBTC. The tier quantity then progressively will increase with the perceived elevated danger. What’s attractive about this technique is that these tiers can all the time change. In its preliminary days, a token would possibly get included in a high-risk tier however, with time, it may change or modify its danger classification. The Fringe Finance governance (which can ultimately be led by a DAO, a Decentralized Autonomous Group) has the ability to reclassify a token’s assigned tier to replicate its current danger stage.

Now that we all know how Fringe Finance contains new and lesser-known altcoins into the lending and borrowing financial system by making them eligible as collateral, allow us to have a look at the opposite options of Fringe.

Yield Farming

The DeFi area is brimming with some glorious Yield Farming platforms already. This has, to date, helped embody much more traders within the digital belongings area. The Fringe Finance platform can even allow yield farming alternatives briefly to incentivize person participation. As an example, it might enable customers to stake their ftokens as qualifiers of their participation as lenders inside the platform and ultimately obtain FRIN token yield farming rewards.

The USB Stablecoin Platform

Minters can leverage this platform to deposit altcoin collateral and mint USB stablecoins towards it. These altcoins, in flip, acquire extra effectivity and value. The USB stablecoin is a USD-pegged coin that runs on the backing of crypto belongings, just like Maker’s $DAI. Any Tier 0 to Tier 4 coin can qualify as collateral for USB minting. To reclaim entry to their tokens, customers ought to burn their minted USB to unlock their Line of Credit score in line with the quantity repaid.

FRIN Tokens

The native FRIN tokens of the platform make holders eligible to obtain rewards upon staking inside the FRIN staking pool. The platform sources these rewards from the charges collected by the platform. Basically, it’s nothing however the platform reinvesting in its neighborhood. Furthermore, FRIN stakers can even have a say through which path the platform goes to evolve, as they will vote for DAO proposals.

The imaginative and prescient of the platform is to transition its governance to the Fringe Finance DAO in the long term. The sustainable adoption of the DAO will imply the Fringe Finance neighborhood guiding the platform sooner or later.

How Do Curiosity Charges Work In Fringe?

The rate of interest dynamics on Fringe’s Main Lending Platform are well-thought-out and versatile. The platform fees debtors curiosity on their open positions, whereas lenders obtain curiosity on the capital they add to the pool.

The platform ensures that there’s a stability within the curiosity charged in order that participation is rewarding for each stakeholders. When the borrower demand is excessive, Fringe Finance algorithmically will increase the speed charged to them in order that there are extra lenders within the platform, matching as much as the demand. On the opposite finish, when there’s low demand from debtors, the platform decreases the rate of interest charged to them, rising the quantity of debtors ultimately.

On this context, we should additionally remember that the specifics of those rate of interest dynamics fluctuate with the stablecoin.

There are numerous advantages of such adjustable rates of interest. Since there isn’t a deterministic rate of interest, the market has the liberty to regulate, appropriate, and optimize itself in line with the provision and demand quantity of debtors. This helps convey extra lenders to the platform when the borrower demand is excessive. Additionally, this helps charges keep aggressive compared with its friends always.

Take part within the Fringe Finance Financial system

As a crypto challenge, you possibly can all the time apply to have your altcoin listed in Fringe’s platform, each for lending and USB minting. Though whereas the platform is in bootstrapping phases the ultimate resolution rests on the platform’s directors, the choice course of will ultimately be absolutely democratic. It’s going to function by way of the Fringe DAO as soon as it goes stay.

General, Fringe Finance strengthens the crypto financial system by permitting each token – regardless of how large or small they’re – an opportunity to take part in a DeFilending and borrowing ecosystem. It helps make cash precious, acquire traction and show their value in the long term. It additionally lowers the entry barrier for brand new tasks by making them usable and holding-worthy from the very starting of their life. Fringe Finance is, within the present panorama, an enormous milestone to achieve for your entire DeFi financial system.