The on-chain data indicates that Bitcoin funding rates turned positive. It suggests there are some new long openings for derivative exchanges.

Bitcoin Funding Rate Turns Green After Derivative Exchange Inflows Spike Up

An analyst pointed out in CryptoQuant that the prices can rise in the near term due to the addition of long positions.

Two indicators that are most relevant to Bitcoin include the derivate exchange inflow CDD and the funding rate.

First, the “derivative exchange inflow CDD” is a metric that tells us whether old BTC supply is moving into derivative exchange wallets or not.

If this metric is valued high, that means that many previously unaccounted coins are being traded on these exchanges.

Due to the fact that investors deposit BTC to futures positions to make new trades on the futures exchange, it can cause higher volatility for the cryptocurrency.

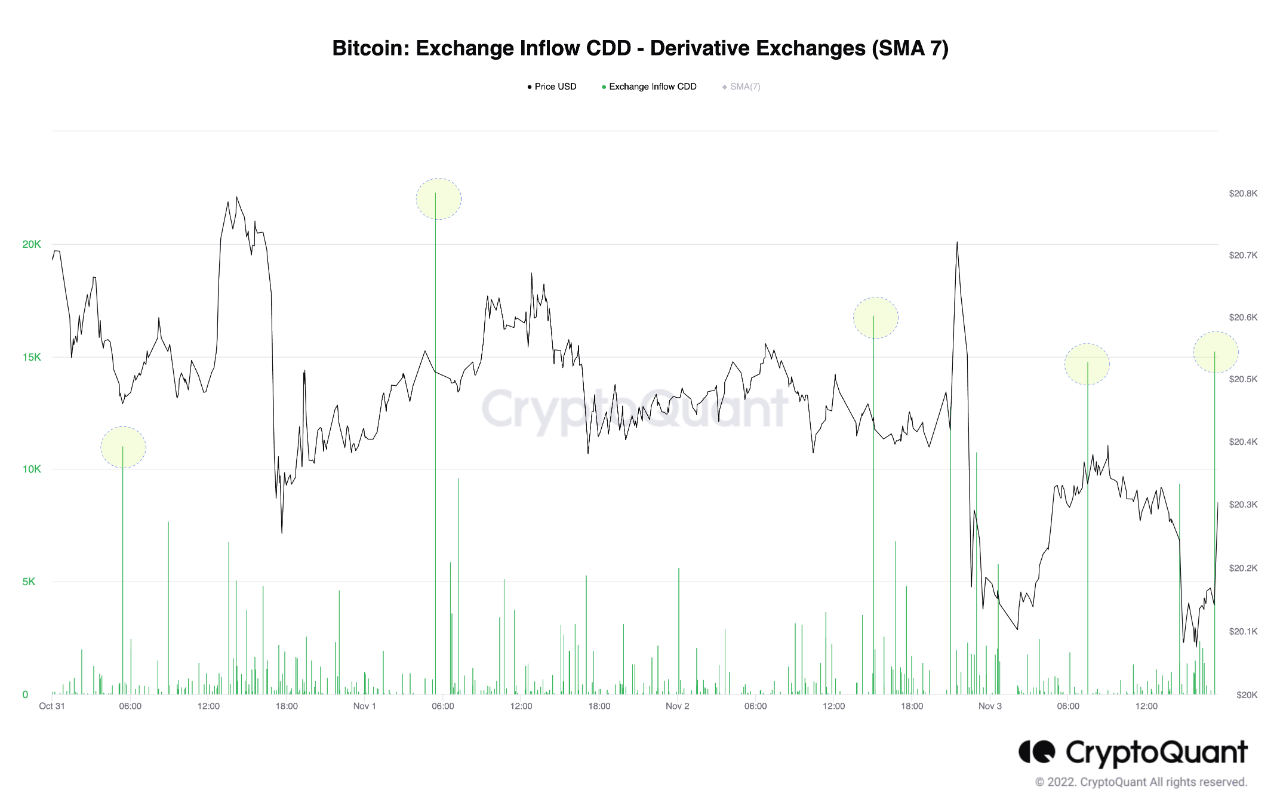

Below is a chart that illustrates the change in 7-day moving average Bitcoin derivative Exchange Inflow CDD inflows over the past few weeks:

The 7-day MA Value of the Metric has seen a recent spike in value | Source: CryptoQuant

The graph above shows that the Bitcoin derivatives exchange inflow CDD spiked over the last day. This suggests that an older supply of BTC has been transferred to these platforms.

The market’s most determined holders are the ones with the largest dormant supply. Any movement can impact the crypto.

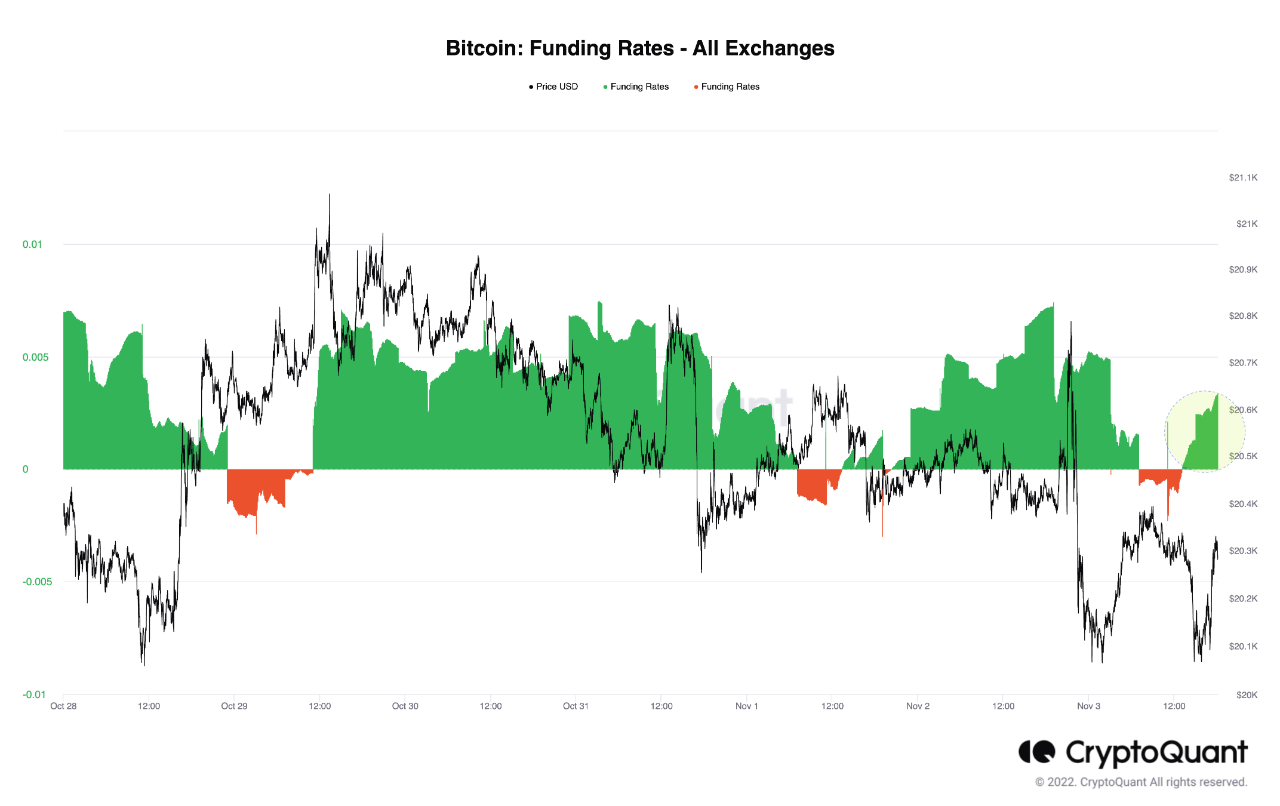

The other metric of interest here is the “funding rate,” which measures the periodic fee being exchanged between traders on the futures market.

If this indicator shows positive values it indicates that there are more short positions than longs. Conversely, negative indicators indicate shorts have overtaken longs in the current market.

The chart below shows the latest trend in Bitcoin funding rates.

Source: CryptoQuant| Source: CryptoQuant

From the chart, it’s apparent that following the latest inflows, the funding rates have turned turned back to positive after being slightly negative yesterday.

This suggests that the HODLers of these coins may have created new long positions on the futures markets by transferring them.

These new long positions may support Bitcoin short-term, as quant noted in the post.

BTC Prices

At the time of writing, Bitcoin’s price floats around $20.5k, up 2% in the last week.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Bastian Riccardi featured image on Unsplash.com. Charts from TradingView.com and CryptoQuant.com.