The World Economic Forum (WEF) has released its latest report on “digital currency governance” this month, addressing stablecoins, cryptocurrencies, and “barriers to financial inclusion.” Like most central banks, regulators, think tanks, and politicians, the WEF publication gives lip service to the power of crypto, but never addresses the elephant in the room: instead of actual access to the utility cryptocurrencies already freely provide, the “unbanked” and impoverished individuals of the world are forced to use a co-opted, fiat 2.0.

‘Financial Inclusion’ and ‘Sensible Regulation’: Freedom for Me, Compliance for Thee

According to the World Economic Forum’s November 2021 White Paper Series Report “What is the Value Proposition of Stablecoins for Financial Inclusion”:

The problem of financial inclusion is complex and affects all countries.

Attempts to resolve the problem with other solutions have failed so far.

Although financial inclusion may not be so complex, existing systems are most certainly failing. This current system of central economic control and central currency fiat currency is not helping those most in need. An admission from the horse’s mouth, then, if you will. These old and broken systems can be changed by only one thing: the continuation of economic dysfunction which created it.

There’s no denying that access to reliable financial services and sound money is an issue plaguing billions of people on this planet. Given the history of fiat currency, one can easily say that all of humanity suffers from the lack of fair and secure financial markets and access.

The simple (and sadly, still “controversial”) reason for this is that there are ultimately two classes of people: those who think violence against the non-violent is required for economic order, and those who value freedom and consent in markets. Let individuals have their money, and don’t tax or inflate them.

Pro-violent economic interference is the former group, which incessantly repeats the same line when it comes down to cryptocurrency. It’s the sort of repetitive, wide-eyed propagandizing one might expect to hear at a holy roller tent meeting, or in some fringe cult, but not from any level-headed economist:

“Bitcoin is used mainly for illicit activities and crime.” Of course this is not only statistically false, but compared to fiat currencies like the U.S. dollar, the state is by and far the winner in the “funding-crime” competition. This knowledge is now well known and one could conclude that the regulators either are ignorant or lying.

“We need to foster an atmosphere of trust.” That is, trust in the very same financial institutions and political entities that have consistently — and over decades and centuries — proven themselves to be untrustworthy and even malicious.

Then there is the blatant hypocrisy, also reminiscent of a cult, where these perceived leaders give lip service to high humanitarian values and virtues, like “financial inclusion,” but never live them out in practice, and never lift a finger to help the poor.

U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler says that Satoshi “Nakamoto’s innovation is real,” but proceeds to threaten businesses attempting to provide services via that same innovation, even breaking the SEC’s own legal protocol to do so, applying extremely antiquated laws to this brand new economic paradigm.

The same goes for financial institutions and centralized exchanges. This makes it difficult to trade and access crypto with an ID. This holds true especially for those living in poverty, as we’ll discuss below.

Even the most progressive regulators and politicians, even if they make a big deal about opposing cryptocurrency regulation, cannot compare to the elegance of peer-to–peer communication described in Bitcoin whitepaper.

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

But they don’t wish to. Even for the most progressive statists, there are a ruling and servant class. Many Indians are still waiting to see what the strangers in Parliament will decide about their use of money. It doesn’t matter if they approve of the final decision or not. They can also support the state. Under threat of violence, the law will be applied forcefully to them. The U.S. is the same. Same in Europe. Similar everywhere. It’s so inclusive and ingenious.

Buzzwords like “financial inclusion” and “banking the unbanked” are used, then, to co-opt a technology that is already functional and efficient and does not require violent interference from the state.

The bizarre recommendation from central banks is to use central bank digital currency (CBDCs), or pre-approved cryptocurrency from state-licensed exchanges. As long as it is defined, you can do what you want in total freedom.

The Biggest Cases of Financial Ineptitude and Financial Crime Ignored

The WEF report raises two key points in the section titled “Special characteristics of stablecoins for financial inclusion.” Namely, that “Stablecoins (and cryptocurrency) may side-step issues related to consumer mistrust in traditional financial services,” and that they “may uniquely provide digital financial accounts that malicious or untrustworthy actors cannot steal from.”

Evidently proponents for economic freedom and Satoshi Nagamoto have always been conscious of point two. This was what bitcoin stood for. There is no need for a trusted third party to foul things up in one’s transactions anymore. WEF makes it seem so simple by validating the safety and security crypto offers.

However, many users today are more likely to lose funds due to user error or financial problems with digital currency wallets or issuers than accounts at financial providers or regulated institutions.

It is important to note that there are many non-custodial options for backing up and storing passwords and seeds, as well as holding crypto through joint wallets and smart contracts. These can function like a bank without compromising privacy or trust. And, if the issue is a risk of losing funds, perhaps it’s good to look at the undisputed grand champions in the contest of losing money: governments. We will then return to the WEF point 1. It is not necessary to restore trust with governments who recklessly devalue assets and suppress trade. These governments should be avoided.

Donald Rumsfeld (then-U.S. secretaryof defense) admitted that the department of defence accounting systems were in place as of 2001.

Financial systems have been around for decades. Some reports claim that $2.3 trillion of transactions cannot be tracked. We cannot share information from floor to floor in this building because it’s stored on dozens of technological systems that are inaccessible or incompatible.

If one thinks this centralized ineptitude and inefficiency doesn’t apply to central banking and treasury systems as well, one would be mistaken. Obviously, printing trillions of dollars from thin air to shore up an economy destroyed by the same reckless policies is a fool’s game — and literal counterfeiting scam — but beyond that, there’s plenty of proof blind trust equates to disaster.

Mexico’s banking system, as a one-off example, “misplaced” at least $18 million in transfers back in 2018, bringing time-sensitive transactions to a standstill. What’s more, the world’s largest and most trusted names in banking like JPMorgan, Deutsche Bank, Chase, and others are frequently tied to criminal activity like money laundering, and even drug and sex trafficking.

All this in view, it is unclear why any sane market actor would trust the same institutions anymore, where there is a better solution, and where security, order, and governance are still possible, but based on verification and not trust — a level playing field created by mathematics and decentralized systems, not politicians.

Africa, a Prime Example of Crypto’s Utility

In Africa, crypto’s practical utility is on display already, as individuals in countries like Zimbabwe, Nigeria, and Kenya leverage the sound economic principles and efficiency of private digital assets to preserve value and send cross-border payments. The centralized fiat systems they have been using to fund their lives are failing them severely, and will continue to do so.

For example, in Nigeria the central bank arbitrarily gives fiat currencies unrealistic official values. It ignores crypto users and pushes an IMF-associated CBDC called the e-naira. It is important to ask why the central banks of these troubled regions do not include the crypto industry and suppress innovation if inclusion is the ultimate goal. Especially when it’s helping people in need to live and thrive, right now. As financial service Kurepay’s CEO Abikure Tega recently lamented:

Due to this recent clampdown which we find difficult to understand considering that Nigeria is not a lawless country, Kurepay, Africa’s foremost social payment app for cryptocurrency & fiat — is announcing the suspension of business operations in Nigeria.

A State Doesn’t Need Economic Governance

This article likely has some asking: “But who will make the rules?” To which I reply with the question: “Does each transaction you make in the crypto economy, or on the blockchain, require the oversight of centralized law enforcement to make it reliable?” The issue of private law societies based on objective reality and consent — and not arbitrary statist violence — is a critical one, but is somewhat beyond the scope of this writing. That said, crypto has already shown us that business can be done much easier where trust is not compulsory, and verification goes both ways — not just the serfs presenting their KYC papers to mysterious rulers in shadowy banking edifices.

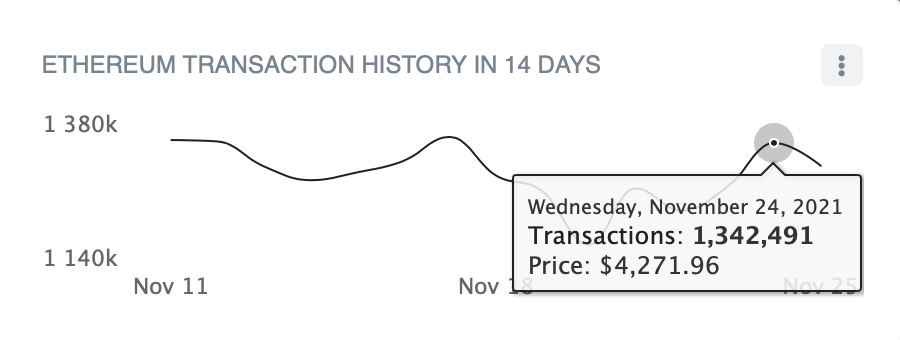

According to the Ethereum Blockchain Explorer etherscan.io on November 24, 1,342,491 ETH transactions were made. This is just the ETH network. There are high fees and it can be hard to move tokens. The staggering amount of transactions occurring across decentralized finance ecosystems (defi), every day is something you can imagine. Although there may be scams, the majority of transactions that occur are peaceful and successful, without any central oversight. Because everyone wants to be successful, trade and collaborate. The complexity of the decentralized economy can be overwhelming.

Cryptocurrency has been accused of being full of fraudmers and high risks. While that may be true, it doesn’t begin to compare to the greatest rug-pull of all time — hands-down — which is when the state took the power of money from the individual. The central banks are not held responsible for thefts, frauds, and damages. Your taxes ensure your salary. While the neighboring restaurant could be liable for poisoning others, the state makes itself the market. It is also the arbiter and enforcer of justice. However, blockchain is math and sound economics doesn’t give any quarter to bizarre religions. This is why regulators are afraid of bitcoin and resort to violence.

Around the world, central banks, financial regulators, and think tanks are aping the same mantras from their ivory towers to the struggling masses: “We are working for you.” “We want everyone to have access to these innovative financial systems and opportunities.” But what they do is make the solutions crypto provides either impossible to efficiently access, or outright illegal.

Truth is simple. Financial planners should not be attempting to promote financial inclusion. This is the complete opposite. People are becoming increasingly concerned about the self-proclaimed leaders of dinosaur institutions and systems around the globe. They are scared that crypto will open up new money options and may soon be completely out of touch with the freer, more flexible paradigm.

Your thoughts about financial inclusion Please leave your comments below.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.