Minutes from the U.S. Federal Reserve’s policy meeting on December 14-15 show that the central bank is being persistent about unwinding quantitive easing (QE) tactics and that it views ultra-low interest rates as no longer necessary. The news immediately caused global markets to drop. Crypto markets lost billions and precious metals such as gold fell a little in value.

US Central Bank Policy Meeting: QE and low-interest rate fiesta coming to an end, global markets lose billions

The Fed’s last-month meeting notes have been published. They indicate that the Fed believes the US economy is stable enough to allow major asset purchases to be refunded and the benchmark interest rate to rise. Mizuho Bank’s Vishnu Varathan wrote in a report that the minutes update from the Fed “bludgeoned the markets” after it was published. Barron’s financial author Randall W. Forsyth wrote that investors being “surprised, is somewhat surprising.”

Fed chair Jerome Powell gave no details on when the interest rate hike will begin and when it comes to QE, Powell said it was “best to take a careful, methodical approach.” Powell insisted that the cautious attitude toward tapering is because “markets can be sensitive.” Stock markets were sensitive on January 5, after the Fed minutes were published, and the crypto economy shed billions in value as well. In the 24 hours since the Fed minutes were published, gold lost 1% and silver lost 3%.

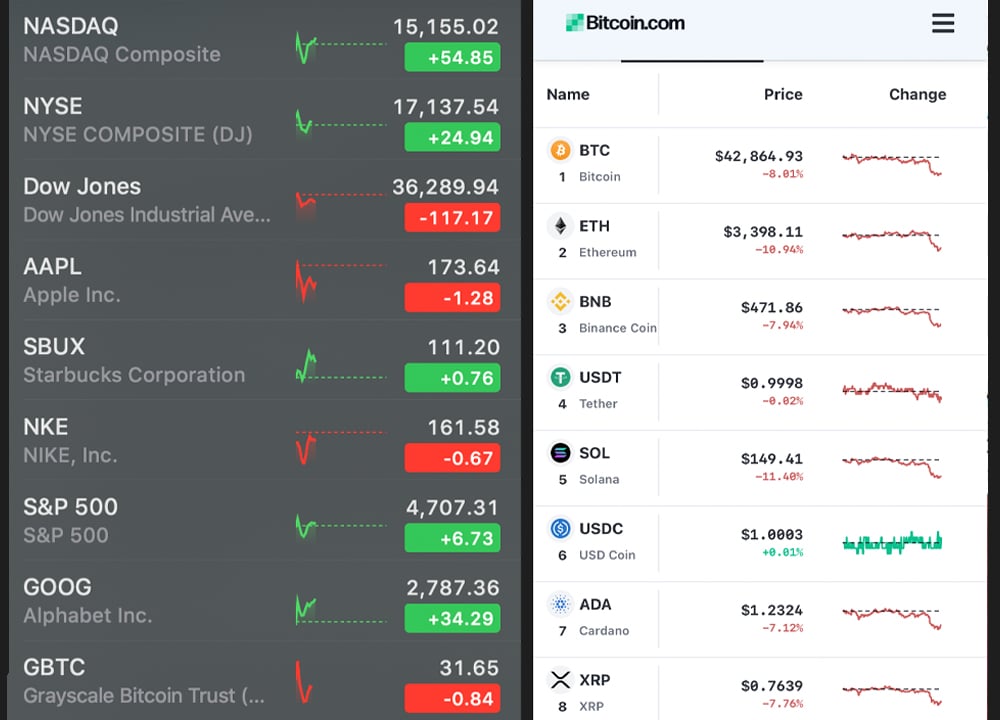

Asian stocks fell during the overnight (EST) trading sessions as well following Wall Street’s plunge. On Thursday, Wall Street’s top indexes picked up some gains as the Nasdaq and NYSE were up some percentage points in the morning, but the Dow Jones index was still down 100 points. As the cryptocurrency economy stands today at $2.17 Trillion, digital currency markets all over the world are down 8.3%.

According to the Fed’s last minutes, inflation has been rising rapidly in the U.S. but economic strength was still considered strong. Fed participants wrote that they wanted to “begin to reduce the size of the Federal Reserve’s balance sheet relatively soon after beginning to raise the federal funds rate.” The next U.S. central bank meeting is slated for January 25-26.

What do you think about the Federal Reserve’s latest minutes report and the market changes that ensued shortly after? Comment below and let us know how you feel about the subject.

Images Credits: Shutterstock. Pixabay. Wiki commons. Gold.org. Bitcoin.com. Apple Stocks.

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.