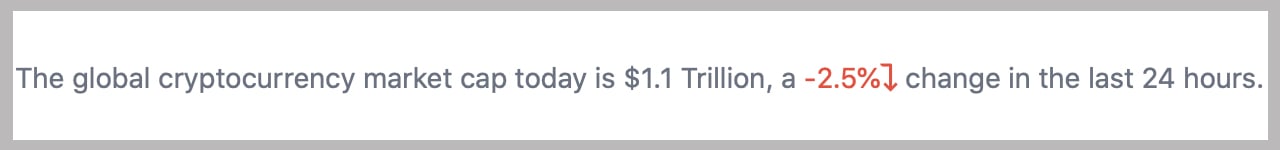

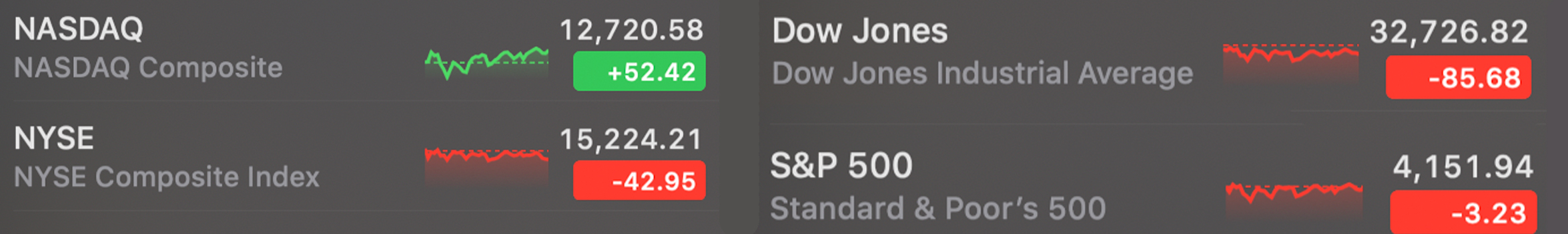

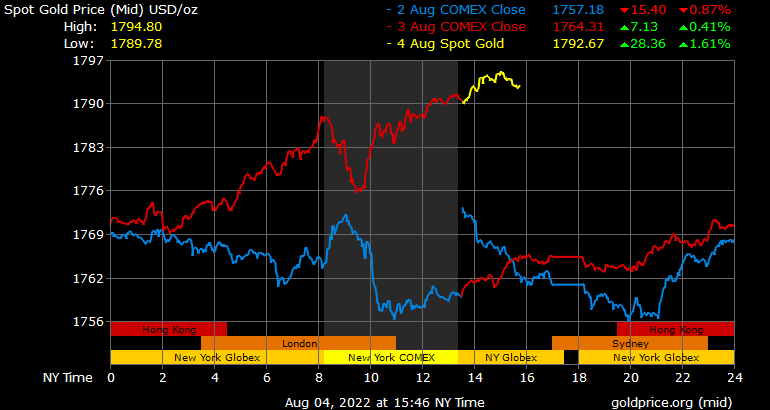

The volatility in stock and cryptocurrency markets was evident on Thursday, following fluctuations due to tensions between China (Taiwan) on Tuesday and Wednesday. Major indexes like the S&P 500, Dow Jones, and NYSE have shed a few percentages today, while the global cryptocurrency market capitalization lost 2.5% in 24 hours, dropping to just above the $1.1 trillion range. Precious metals, on the other hand, traded higher as U.S. president Joe Biden’s administration declared that the Monkeypox virus a public health emergency in the United States.

China and Taiwan Tensions and Monkeypox Reports Cause Stock and Crypto Prices to Fluctuate, Precious Metal Markets Rise Catching ‘Safe-Haven Demand’

On August 4, stock and crypto traders were facing some challenges. This was the day that Nancy Pelosi (American representative from California) visited Taiwan to talk democracy with TsaiIng-wen, Taiwan’s president. The global markets experienced some volatility before and after the U.S. diplomatic visited Taipei on Wednesday.

On August 3, Equities, precious metals and crypto markets both fell while the cryptocurrency economy held its own for another day. U.S. equity markets suffered a further dip on Thursday, with the Dow Jones dropping 85 points in the afternoon (EST), trading sessions. It was the same day that cryptocurrencies fell with the stock markets.

While Nasdaq was up, S&P 500, NYSE, and many other stocks saw losses during the course of the day. As a result, the crypto economy also suffered losses. The entire digital asset pool lost 2.5% over the past 24 hours to the U.S. Dollar.

On Thursday, the value of bitcoin (the most popular crypto asset) fell 5% to $23,548 from $22,395 Ethereum (ETH), too, lost 5% today, after hitting a 24-hour high of $1,666/unit and falling to a low point at $1.545/coin. Solana (SOL), which lost 5.6%, and polkadot(DOT) 5.5% respectively are the worst-performing crypto market caps.

Europe is still reeling from the Ukraine-Russia conflict, and tensions have escalated between China and Taiwan this week. Asia is dealing with tensions while Europe deals with an energy crisis as well as a recession. Many believe the U.S. is in recession, even though American experts and bureaucrats have said otherwise.

The U.S. Labor Department published its weekly jobless claims data. This shows claims have increased by 6,000- 260,000. As the weekend approaches, stock traders have been interested in America’s July jobs report, which is due to be published on Friday. A couple of hours before the closing bell on Thursday, a few of the top Wall Street indexes like the Dow, and the S&P 500 rebounded slightly. By the end of Wall Street’s trading day on Thursday, three out of the four major indexes were down.

As both silver and gold markets gained some strength on Thursday, there was some relief. Gold’s price per ounce jumped 1.64% while silver’s value per ounce against the U.S. dollar increased 1.04%. On August 4, Kitco’s Jim Wyckoff attributed the precious metals spike to tensions in Asia when he said that gold and silver prices were higher in the U.S. “on safe-haven demand as China-Taiwan-U.S. tensions have escalated this week.”

On Thursday reports revealed that the U.S. officially declared Monkeypox an emergency. The Washington Post (WP) reporter Dan Diamond explained that “two officials who spoke on the condition of anonymity” said that the Biden administration will declare monkeypox an outbreak and a public health emergency. Diamond stated that the White House Health and Human Services Secretary Xavier Becerra would send the message.

Becerra made the announcement that monkeypox was now a national emergency during an afternoon briefing. “We’re prepared to take our response to the next level in addressing this virus, and we urge every American to take monkeypox seriously,” the health secretary stressed to the press.

Let us know your thoughts on the crypto and stock market actions of Thursday, while silver and gold prices showed some gains. We’d love to hear your opinions on the subject below in comments.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.