Five companies including crypto-exchange FTX USA have been sent cease and desist letters by the Federal Deposit Insurance Corporation. CEO Sam Bankman-Fried explained that FTX does not have FDIC insurance, stating: “We never meant otherwise, and apologize if anyone misinterpreted it … to be clear FTX US isn’t FDIC insured.”

FDIC orders 5 firms to cease and desist

Five companies received cease-and-desist orders from the Federal Deposit Insurance Corporation on Friday. FDIC-insured community bank deposits and other financial institutions are insured by the agency.

The letters demand that the five companies and their officers “cease and desist from making false and misleading statements about FDIC deposit insurance.” They must also “take immediate corrective action to address these false or misleading statements.”

These five companies include FTX US (Cryptonews.info), Cryptosec.info and Smartasset.com.

Detail:

Each of these companies made false representations — including on their websites and social media accounts — stating or suggesting that certain crypto–related products are FDIC–insured or that stocks held in brokerage accounts are FDIC–insured.

FDIC says Cryptonews.com claims that Coinbase and Etoro are FDIC-insured. Smartasset.com provides a listing of FDIC insured crypto exchanges. This includes Crypto.com. Luno. Robinhood. Voyager. FDICCrypto.com blatantly registered a domain with FDIC while it was still being operated.

FTX US ordered to cease and desist

FTX US was one of many crypto companies that were issued cease-and-desist letters by the FDIC.

Although FTX US and FTX US may be two different trading platforms, both were founded by Sam Bankman Fried, currently serving as the CEO. U.S. citizens cannot trade on Global Exchange FTX.

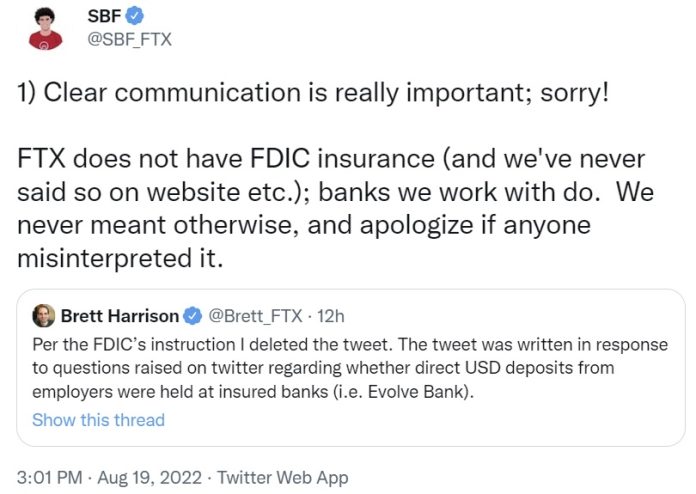

On Twitter, Bankman-Fried apologised for any confusion about FDIC insurance. “Clear communication is really important; sorry!” he tweeted. “FTX does not have FDIC insurance (and we’ve never said so on website etc.This is not true for banks that we collaborate with. We never meant otherwise, and apologize if anyone misinterpreted it.” In a follow-up tweet, he stressed: “To be clear, FTX US isn’t FDIC insured.”

It was not the first instance that the FDIC took action against crypto-related companies. Voyager Digital was notified by the Federal Reserve Board last month that it would not be able to make false statements about its deposit insurance status. Voyager requested bankruptcy protection.

How do you feel about five crypto-related cease & desist orders being issued by the FDIC to companies? Comment below.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.