On-chain data shows Bitcoin exchange reserves have now reached new 4-year lows, a sign that could prove to be bullish for the crypto’s price.

Bitcoin Exchange Reserve has Sunk down further recently

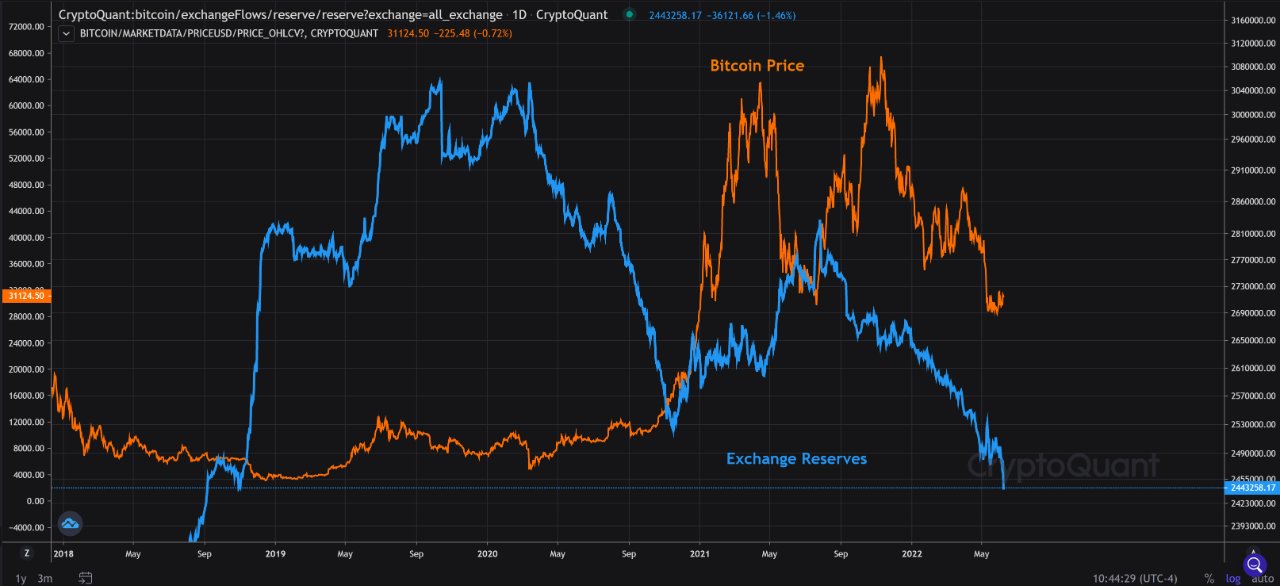

An analyst pointed out in CryptoQuant that the BTC exchange reserves have been falling, indicating that buying activity has occurred in the market.

The “all exchanges reserve” is an indicator that measures the total amount of Bitcoin currently stored in wallets of all centralized exchanges.

This metric increases in value, which means that investors deposit more coins on exchanges.

This trend can bearish on the cryptocurrency price if it continues for a long time. Cryptocurrency holders often transfer their crypto to an exchange for selling.

Related Reading| When Greed? Bitcoin Market Crashed in One Month of Fear

However, investors may be withdrawing BTC at this time due to a downward trend in the reserve. For the cryptocurrency price, this trend could be positive.

Below is a chart showing how the Bitcoin reserve has changed over time.

It seems that the value of the metric appears to have seen downwards movements over the last one year. Source: CryptoQuant| Source: CryptoQuant

You can see that Bitcoin’s exchange reserves have seen some dramatic movement in recent months, with its value falling to new lows of 4 years.

The indicator is continuing its downtrend, which has continued for nearly a year now.

U.S. Macro Pressure Responsible For Entire Bitcoin Downtrend| U.S. Macro Pressure Responsible For Entire Bitcoin Downtrend

It could indicate that there has been a steady accumulation of BTC, and this would suggest that there is a potential supply shock.

This is because of supply-demand dynamics. A shock like this can have a positive effect on the cryptocurrency’s price over the long term.

However, some data from December 2021 suggests that the growth of new investment instruments like ETFs are likely one of the reasons behind the exchange reserve’s decline.

Coins are moving simply from one source to another. Such a shift would mean that a supply shock wouldn’t take place just by declining exchange reserves.

However, the price of Bitcoin can continue to fall if there is still a lot of buying on the market.

BTC Prices

At the time of writing, Bitcoin’s price floats around $30.1k, up 1% in the past week. In the last month, crypto lost 12%.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Unsplash.com's featured image. Charts by TradingView.com. CryptoQuant.com chart.