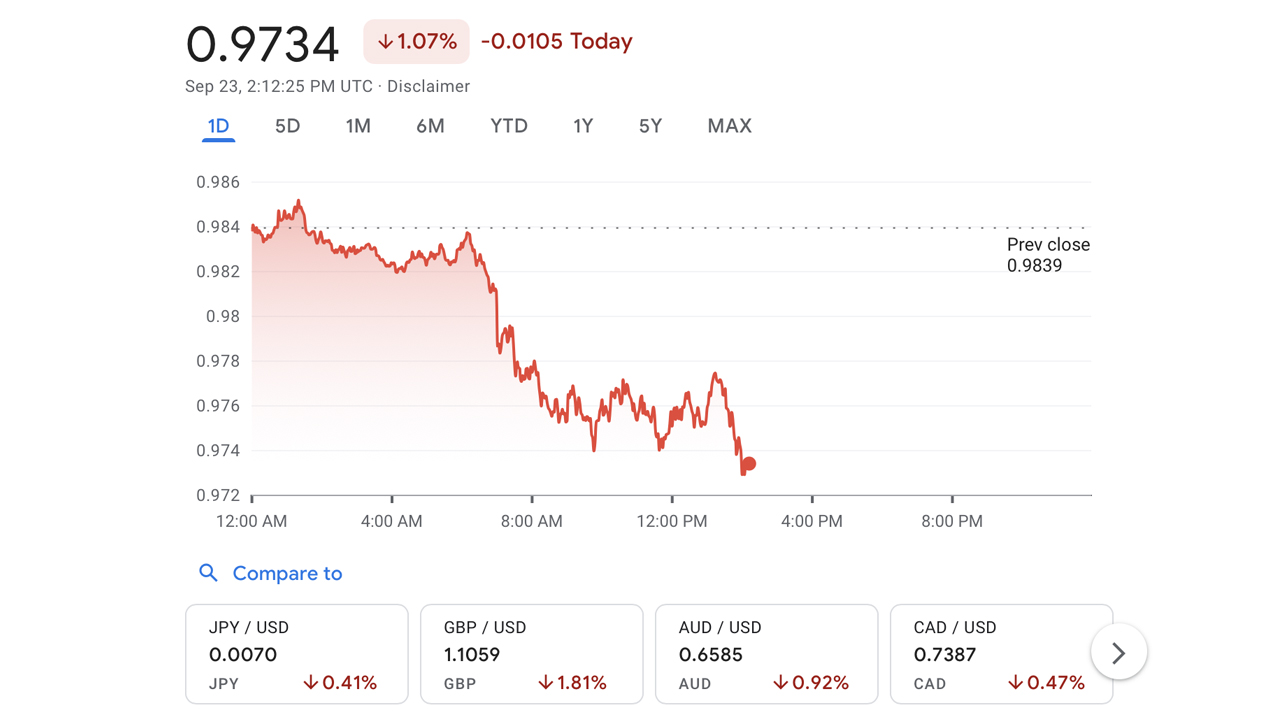

Friday’s plunge in the value of the euro (official fiat currency) of 19 member states to the European Union (EU) was a shocker. It fell as low at $0.9732 against a dollar. This drop occurs at a moment when other fiat currencies, such as the yen and yuan have been struggling against the greenback over the last six months. Analysts claim the pound and euro are trapped in a “doom loop” and it’s also been said that the U.S. dollar is “the only possible hedge” against a failing global economy.

Citigroup Analysts Declare Greenback the Only Optimist in This Macroeconomic Environment

Strange times have greeted us in finance, stocks and bonds, cryptocurrencies, and fiat currencies. On Friday, September 23, the European Union’s fiat currency the euro has been struggling against the U.S. dollar and slipped below parity as the weekend nears. The euro currently trades for $0.97 and dropped to $0.9732 at 10 a.m. during morning trading. ET). The euro has lost more than 1% against the greenback in 24 hours and it’s the lowest it’s been in 20 years.

Bloomberg’s contributors Sofia Horta e Costa, Ruth Carson, and Ruth Carson have recently referred to Citigroup Inc. analysts and views of The Canadian Imperial Bank of Commerce. “The surging dollar has caused a lot of people to believe the only safe haven asset is the U.S. currency,” the writers explained last week. Citi strategists Jamie Fahy, Adam Pickett and others provided a research note to the duo that discussed the phenomenon surrounding the U.S. Dollar.

“The only place to hide is in US dollar cash,” the Citi strategists claim. A “deep recession” will drop inflation the bank’s financial strategists add. Win Thin is the Brown Brothers Harriman currency strategist in New York. He says that the macroeconomic environment seems favorable to the dollar. “The repricing of Fed tightening risks is likely to keep the dollar bid across the board in the near term,” the Brown Brothers Harriman executive said. Brown Brothers Harriman’s currency strategy analyst continued:

We stated during the latest dollar correction lower that not much has changed. The global backdrop still favors the dollar and U.S assets overall.

TD Securities Strategists Believe Euro and Sterling Pound Are Stuck in a ‘Doom Loop’

Strategists at TD Securities believe the euro and pound are stuck in a “doom loop” and the company’s analysts think it may get worse over the next few months. TD Securities strategists and James Rossiter explained Friday that weak economic growth is behind the doom circle. They also pointed out rising energy costs.

According to TD Securities, the Sterling pound could fall another 3% from its current levels. Rossiter, TD Securities’ team and others believe that the European Central Bank and Bank of England can do only so much.

“While both the ECB and BOE want to slow and eventually reverse this loop, monetary policy can only limit the slowdown significantly ahead of the coming winter,” the currency strategists remarked. “Policymakers can’t produce the needed energy supply.”

Let us know your opinion about the euro falling to $0.9733 versus the U.S. dollars and analysts’ predictions for fiat currencies. Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerInformational only. It does not constitute an offer, solicitation, or recommendation of products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.