Since its inception, the cryptocurrency market has been closely linked to the stock markets. Ethereum, second in cryptocurrency market, rose to the same level as U.S. stocks, for the first time, in February. As a result, the token’s 40-day correlation coefficient with the S&P 500 reached 0.65.

Despite the fact that investors are still nervous about price movements over the last week, Ethereum’s (ETH) prices will rise this weekend. The trading volume increased in the past week and should have led to more constant fluctuations. However, geopolitical news and earnings as well as stock market whipsaws has affected price responsiveness.

Ethereum price witnesses Turbulence

It has been a difficult week for traders and investors in Ethereum. The price fluctuated wildly due to geopolitical events as well as earnings. Investors have also switched from taking a risk to take a risk. With volatility, comes opportunities. And as these events slow down toward the weekend, bulls have the entire market to drive the price higher to $3500 if the correct entry levels are chosen. With plenty of margin before the market moves into excessively overbought territory, expect the RSI again to climb above 50.

According to statistics from Santiment, a crypto market behavior analysis tool, Ethereum has a strong (+ve) correlation with the S&P 500 index. Following a 1.8 percent drop in the S&P 500 index’s figures, the price of ETH increased by 3%.

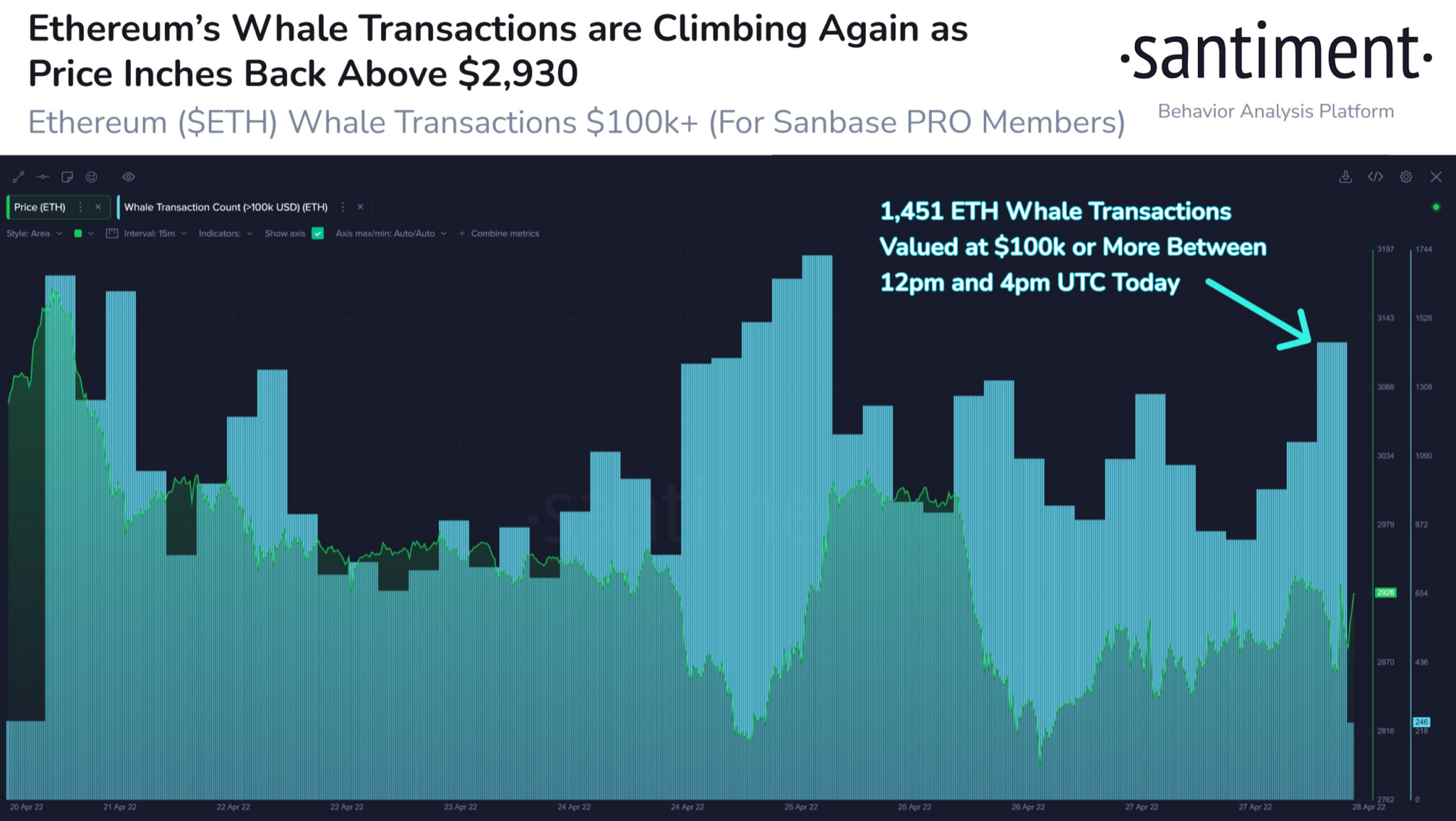

Source: Santiment

Tweet from April 29th added,

“Aided by a +1.8% day in the SP500, Ethereum has jumped back above $2,930 with its tight correlation to equities markets.”

Now, as seen in the graph above, ETH’s most powerful buyers, the whales, have retaliated by buying additional ETH. That day saw a dramatic increase in whale transactions exceeding $100,000.

14,511 transactions were made in a span of just four hours. According to Santiment this suggests that important stakeholders had been paying close attention to price increases.

Metaverse Tokens On Overdrive, Outpace Bitcoin And Ethereum| Metaverse Tokens On Overdrive, Outpace Bitcoin And Ethereum

Are Equities Market Correlations Good for ETH?

This wasn’t the first time ETH had shown signs of a developing relationship with the stock market. Three weeks prior, it was reported that the two fell together on March 31, but they began to climb again shortly after. From mid-March onwards, Ether and the SP500 surged together.

Each positive circumstance in crypto-verse comes with its negative counterpart. It is an unfortunate fact. This is not an exception. Crypto’s strong association with equities, in particular, might work wonders. However, different reputable entities have cautioned against the same.

Below $3k, ETH/USD has not changed. Source: TradingView

Arthur Hayes (ex-CEO of BitMex) raised concerns about the link. Surprisingly though, the Federal Reserve’s tightening of monetary policy is expected to cause a massive drop in stock markets through 2022.

Related Reading: Bitcoin Futures Base Nears One Year Lows. How will This Affect BTC| Bitcoin Futures Basis Nears One-Year Lows, How Will This Affect BTC?

Featured Image from Pixabay. Santiment chart from TradingView.com