According to on-chain data, the supply of Ethereum has fallen to around 14%.

Ethereum Supply Continues To Fall on Exchanges

According to a CryptoQuant analyst, the ETH supply has been declining since a while. This has reached a new low of 14%.

The “percentage supply on exchanges” is an indicator that shows the share of the total Ethereum supply stored in wallets of all exchanges.

Usually, this supply present on exchanges is said to be the selling supply of ETH, and so if the indicator’s value goes up, it means there is a higher number of coins in the available sell supply.

Due to supply-demand dynamics of the market, this kind of trend can prove to be bearish for the cryptocurrency’s price.

On the other hand, if the metric’s value moves down, it implies the available supply of Ethereum has reduced. Prolonged such trend can create a supply shock in the market, which can turn out to be bullish for the coin’s price.

Read Related Reading| Exchanges See Bitcoin Outflows For 7th Straight Day As BTC Price Begins Recovery

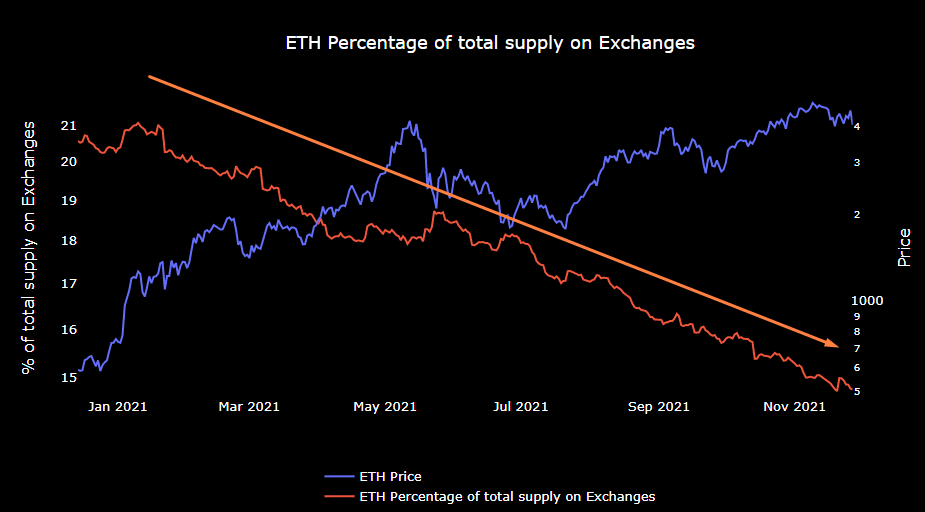

Below is a graph that illustrates the recent trend in the total ETH supply traded on the exchanges.

It appears that the value of this indicator has been slowly declining. Source: CryptoQuant| Source: CryptoQuant

You can see that there has been a consistent downtrend in percent ETH supply over the past year, as shown by the graph.

The current value of this indicator is around 14%. This marks a low. At the start of the year, the metric’s value was about 21% so that in the past year 7% of ETH supply has been taken off exchanges.

Ethereum Scarcity: After London Fork, ETH’s Supply Change Drops To Almost Zero| Ethereum Scarcity: After London Fork, ETH’s Supply Change Drops To Almost Zero

Also, back in May, when the price of Ethereum was at similar levels as now, the metric’s value was around 18%, a sizeable difference. Because of this the analyst believes that the current supply shock isn’t fully reflected in the price yet. And that it won’t be long until a difference is seen.

ETH price

At the time of writing, Ethereum’s price floats around $4.6k, up 10% in the last seven days. The crypto gained 5% over the last month.

Below is a chart showing the change in coin price over the past five days.

The crash seems to have caused a rebound in ETH's prices | Source: ETHUSD on TradingView

A few days ago, Ethereum and other markets crashed due to fud from COVID’s latest variant. However, ETH seems to have recovered.

Unsplash.com's featured image. Charts by TradingView.com. CryptoQuant.com chart.