Ethereum has surged to the top of the market for cryptocurrency, surpassing most other available assets, by 45 percent over the past week. This could have a simple explanation:

As Ethereum’s team of developers approaches the conclusion of a multiyear, extremely difficult upgrade, traders are shifting positive.

Ethereum is on the Rise

Ethereum has surged about 45% in the last week to become the second largest cryptocurrency market capital. This is more than the vast majority of top 100 crypto assets. While there are many theories surrounding ETH’s bullish trend, one of the main drivers of price movements is the impending Ethereum merger.

The trend in trading ETH is from bearish towards bullish, as developers move closer to completing a complex upgrade over the next several years. With intense social expectation for the Merge (lows of 41% in the days before the current price rise), the entire ETH profit supply has now risen by 56%.

ETH/USD trading in bullish momentum

According to statistics from Glassnode, a significant clearing out of short positions in the futures market was the reason for Ethereum’s 22 percent gain this week.

Glassnode tweeted:

“Over $98M in short futures positions were liquidated in one hour, pushing $ETH prices up by 12.5%.”

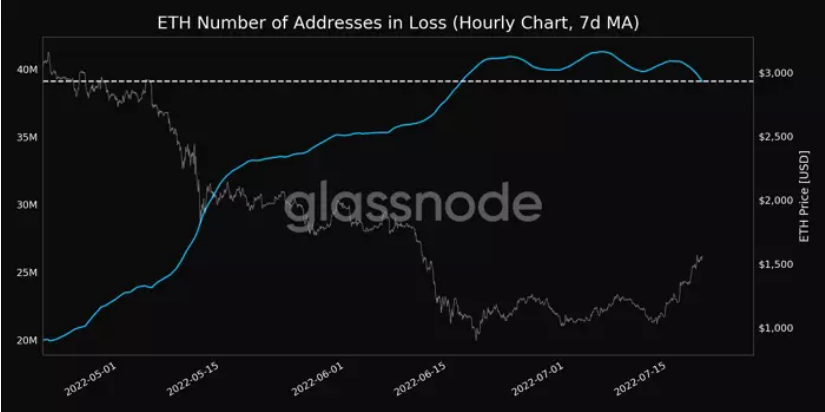

The Number of ETH Addresses in Loss (7d MA) reached a 1-month low of 39,112,029 at press time, further demonstrating ETH’s recent bullish trend.

Glassnode

The last steps that actually transfer Ethereum activity onto the Beacon Chain have been scheduled for September. There’s still plenty of time for The Merge. Superphiz.eth mentioned in a tweet that Goerli will undergo the merging transfer during the final public testnet on August 11.

If everything goes as planned with Goerli, the mainnet merger is expected to flot during week September 19.

Related Reading: Ethereum Classic, (ETC), Reclaims $3 billion Market Cap. What’s Next?| Ethereum Classic (ETC) Reclaims $3 Billion Market Cap, More Upside To Follow?

Expert Opinion

Youwei Yang, director of financial analytics at StoneX, says that two “certainties” are the cause of this upward rise for EthereumThe first is the recently announced time for the Ethereum “merge” update, which should make the network significantly more energy-efficient. Yang claims that the “calming” of macroeconomic anxieties is the second.

“Actually if you see the price movement tick by tick, this time it’s more like ETH leading BTC [or Bitcoin] instead of the other way around in usual times, so it’s a strong indication of ETH-led bear market rally with the confirmation and sentiment of ETH2.0,” said Yang, referring to post-merge Ethereum.

In his most recent episode of “The Breakdown,” famous podcaster and devoted industry watcher Nathaniel Whittemore made this assertion. There is a growing understanding that “the Merge” might influence markets on Twitter, Discord, and everywhere else people debate cryptocurrencies.

After months of low prices, the event suggests, as Whittemore put it, a “return of optimism” in the cryptocurrency markets. The Merge also fills a “narrative void,” allowing crypto enthusiasts to tell others stories about how this technology is changing the world.

Some believe the Merge may be causing ETH prices to rise due to structural factors. This upgrade will make Ethereum more useful and reward investors who have invested in it. The upgrade could even produce a Bitcoin-like inflationary force that will further benefit the holders. This scenario could lead to people who buy ETH as a preparation for a future purchase. They may see it more like an investment rather than merely completing a transaction.

Liquidations Cross $230 Million As Ethereum Barrels Past $1,400| Liquidations Cross $230 Million As Ethereum Barrels Past $1,400

Featured image taken from The Shutterstock. Chart by TradingView.com