Ethereum has experienced a mild setback after breaking the important barrier at $2,000 and continues to trade in the green over today’s trading session. It is the leader in crypto market relief right now and has potential for more gains.

Ethereum (ETH), trades at $1.980, with a 6% profit and 15% respectively over the past 24 hours and seven days. Only Solana (SOL), and Cardano (ADA) come close to ETH’s price gains with double digits profits over the same period.

QCP Capital is a trading company that believes bullish sentiment will increase due to the positive macro-economic conditions. After publishing the July Consumer Price Index (CPI), a measure of inflation, in the United States last week, crypto relief rallies took root.

The metric stood at around 8.5% and, as QCP Capital said, “confirms the peak inflation narrative”. As inflation seems to be declining, the market expects a lower-intensity Federal Reserve (Fed). The trading desk said:

Markets have been pricing in a Fed that’s more dovish, creating bullish momentum which will likely continue up to the 22 September FOMC meeting.

In the coming weeks, there are other macro-economic events that could negatively impact market participants’ perceptions about the Fed. However, QCP Capital believes the market will “remain supported regardless”.

For the price of Ethereum, the bullish narrative is double as there is a tentative date for the mainnet implementation of “The Merge”, the event that will complete ETH transition to a Proof-of-Stake (PoS) consensus. This event is scheduled to occur between September 15 and 16.

This has led to an “unprecedented” shift in the crypto options markets, the total open interest (OI) for ETH contracts has overshadowed Bitcoin (BTC) open interest. Both the former is $8 billion, and the latter $5 billion.

What Could Become An Obstacle For Ethereum’s Bullish Momentum

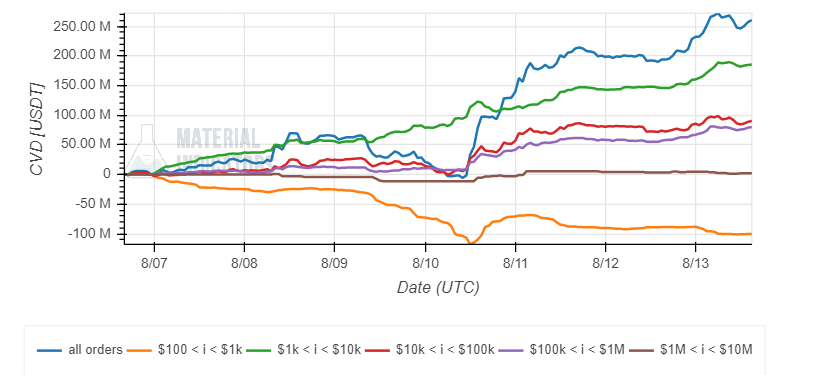

The above might suggest market participants are buying call (buy) options for Ethereum heading into “The Merge”, counting on the event to be successful. In the spot market, data from Material Indicators shows that investors with bid orders from $1,000 to $100,000 have been buying into ETH’s price action over the last week.

QCP Capital anticipates that Ethereum will see continued support from large investors, which could help sustain the bullish momentum. NewsBTC has previously reported that Bitcoin needs to see increased upward pressure to maintain any bullish, long-term price movement.

Additional data provided by Material Indicators records thin resistance for ETH’s price, on low timeframes, north of $2,050. If the bulls are able to push the price above those levels, ETH may regain its prior highs and transform critical resistance into support.