After a week of positive momentum, Ethereum (ETH), is now losing momentum. ETH trades 9 percent less at $1032 and has a market capitalization of $125billion as of press time.

This is the most important economy worldwide, but it’s losing momentum. It may drop as low as $1,000 or lower.

Ethereum drops below $1k

The price of ethereum fell below $1,000 over the last few hours as it moved from the support level. More selling pressure could lead to a decline below $900, or possibly even lower.

If you want to disprove the dismal view, then the second-largest crypto by market cap must retake $1100 as support.

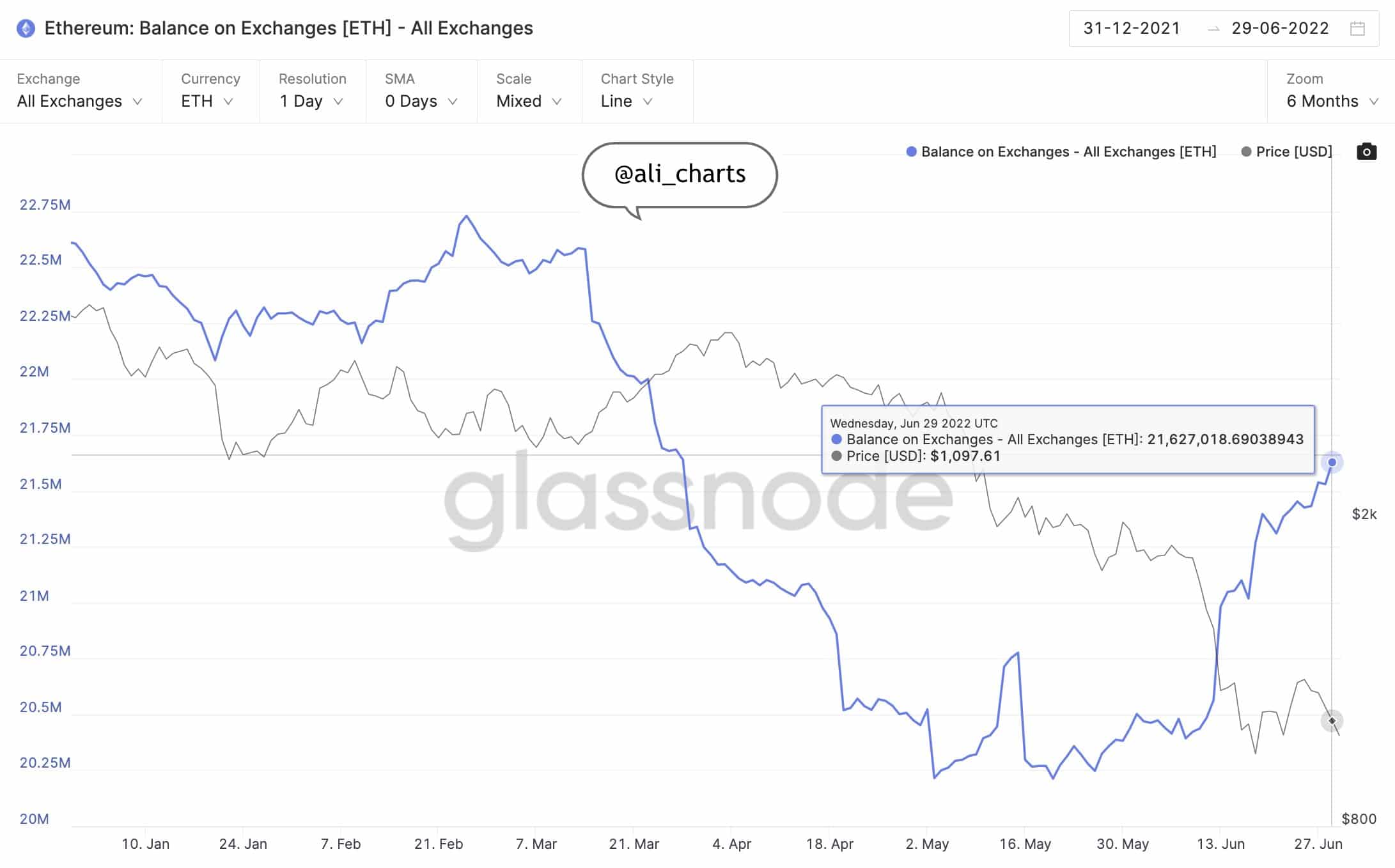

Ali Martinez is a market analyst and shares some key statistics on the chain. Martinez stated, citing Glassnode statistics that there was a recent increase in the supply ETH on exchanges. He said:

“More than 200,000 $ETH. worth over $200 million, have been sent to known cryptocurrency exchange wallets over the past five days.”

Source: Ali Martinez

A significant increase in the number of ETH addresses which have suffered losses due to this correction also occurred. It could lead to another sale. Ali Martinez said:

“Ethereum Recognizes the need for rapid correction. A transaction history has shown that almost 468,000 addresses have more than 7,000,000. #ETHThey are currently underwater and may soon be forced to exit their positions. A spike in selling pressure could trigger a downswing to $700 or even $600.”

Above $1k, ETH/USD trading. TradingView

TA: Ethereum Key Indicators Suggest A Sharp Drop Below $1K| TA: Ethereum Key Indicators Suggest A Sharp Drop Below $1K

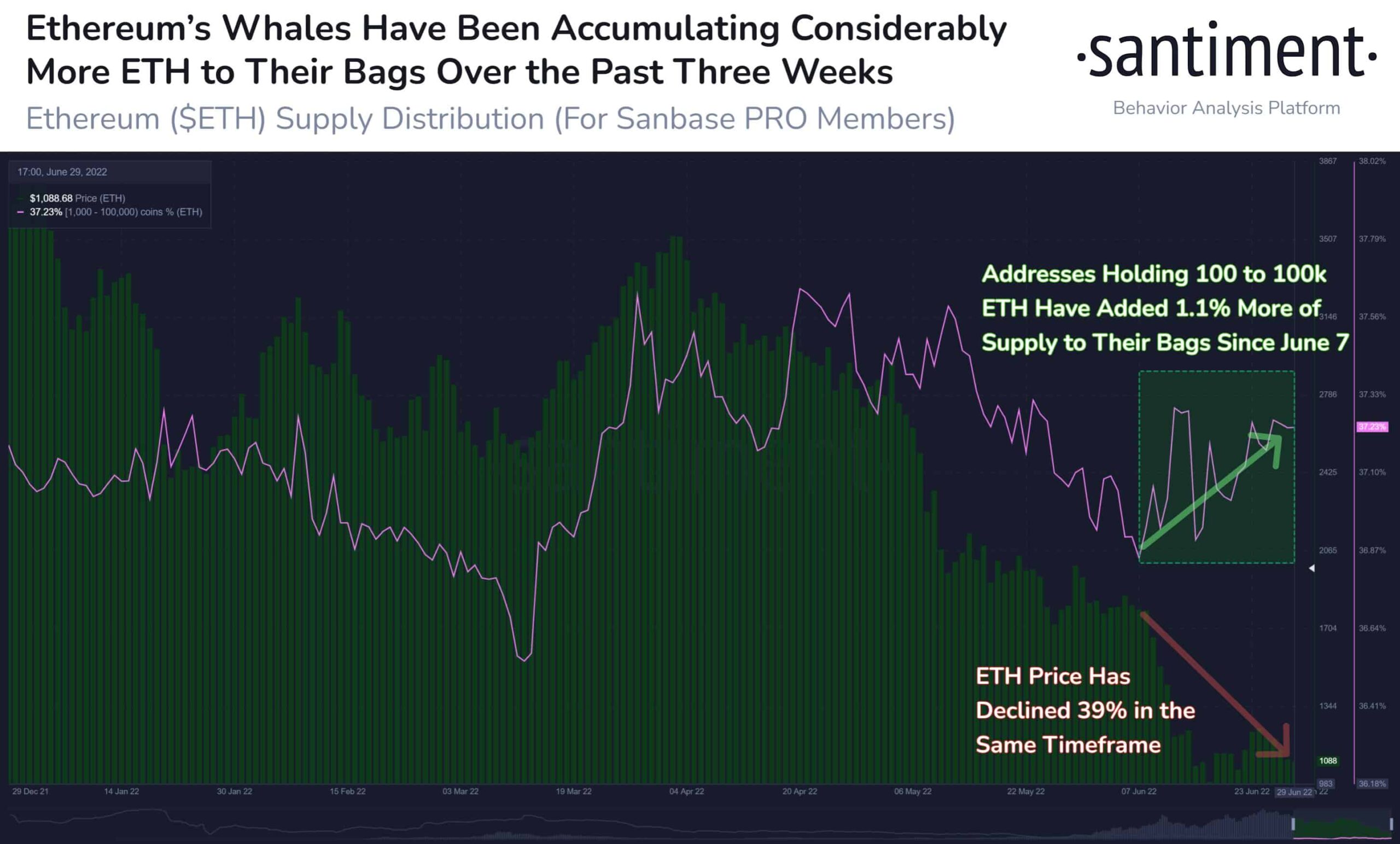

Ethereum Whales Keep Increasing

Despite current turmoil in the price of ETH the whales continue to demonstrate their power with sporadic accumulations. Santiment, on-chain data source, noted:

“Ethereum Shark and Whale Addresses (holding between 100 and 100k $ETH) have collectively added 1.1% more of the coin’s supply to their bags on this -39% dip. Historical evidence points to this tier group having alpha on future price movement”

Source: Santiment

The current state of market conditions and the global economy is dire. Recent statistics show that there has been a decline in confidence among consumers in the markets, and this could lead to increased selling pressure of American equity.

These ripple effects may continue to exist as the cryptocurrency market is currently experiencing a much more severe correction.

Similar Reading: Why Ethereum could trade at $500 if these conditions are met| Why Ethereum Could Trade At $500 If These Conditions Are Met

Pixabay's Featured Images and Charts from Tradingview.com, Santiment and Glassnode