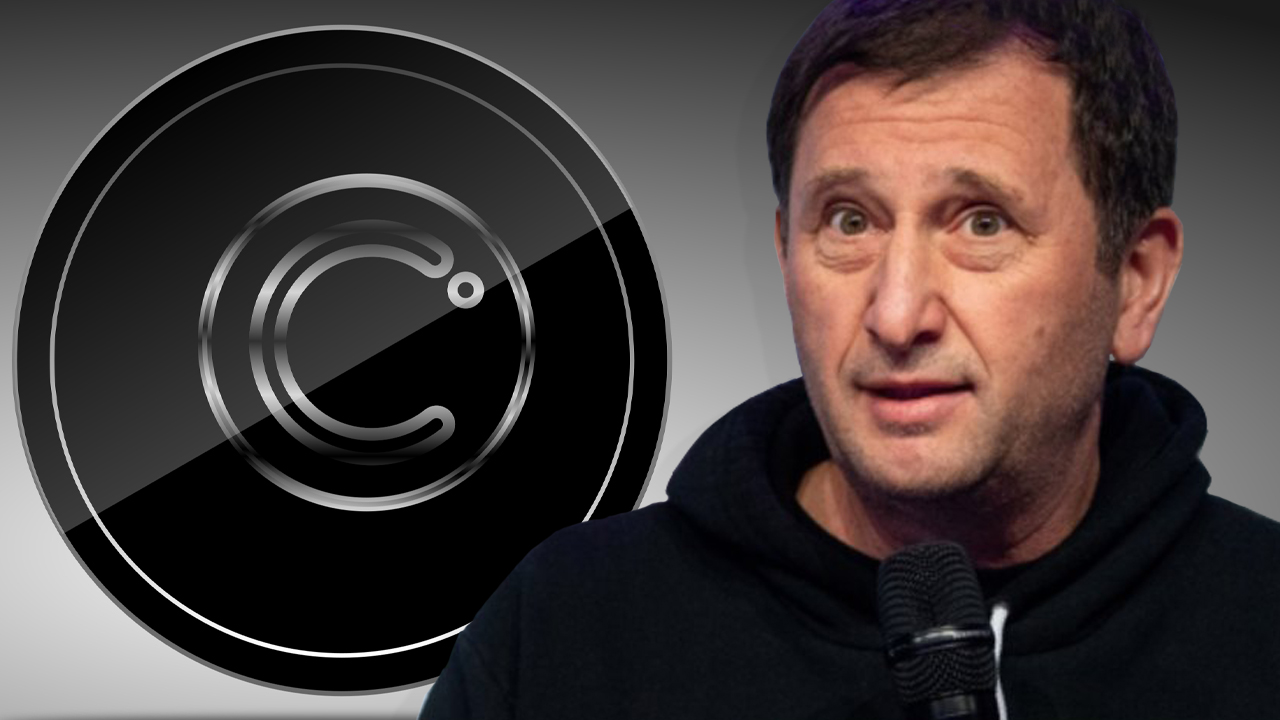

Ever since Celsius paused withdrawals on June 12, the company has been the focus of attention due to the lender’s financial hardships. Celsius applied for bankruptcy protection in the U.S. using Chapter 11 to resolve its financial problems a month later. A report revealed that Equitiesfirst, the private lending platform that Celsius owes $439 million to, was filed two days following the bankruptcy filing.

FT Sources: Private lending platform that is owed Celsius $439M, according to Equitiesfirst

Insolvencies, liquidations and bankruptcies have been hot topics in the cryptocurrency world over the last week. Three very well-known crypto companies filed for bankruptcy protection. These include Voyager Digital (digital currency exchange), Celsius (crypto lender), and Three Arrows Capital (3AC). Celsius filed for bankruptcy in July 2022. That’s 31 days after company withdrawals were frozen.

There was no bankruptcy before July’s filing. speculationCelsius claimed that it had money in specific decentralized financing (defi), protocols. This protocol required immediate adjustment, or that significant collateral was needed to liquidate the funds. A few days before Celsius filed for bankruptcy, the company’s wallets reportedly transferredMillions of USDC (United States Dollar Coin) available at different timesTo pay off loans in Compound or Aave.

The filing that was filed by Celsius for bankruptcy protection stated that he was owed large amounts of money. The Financial Times (FT), published a July 15th filing. reported that “Equitiesfirst [has been]Retrieved as [the] mysterious debtor to troubled crypto firm Celsius.” The report claims two people familiar with the matter disclosed that Equitiesfirst is the ostensible borrower that owes the crypto lender $439 million.

Founded in 2002, Equitiesfirst is an investment firm that “specializes in long-term asset-backed financing,” according to the company’s website. Equitiesfirst has been involved in the trading of select cryptocurrency since 2016, but manages stocks. Johnny Heng (Managing Director and Head of Equitiesfirst Singapore) spoke out about cryptocurrency in April 2022.

“We used to be pure equities, until some six years ago, we started to offer loans against cryptocurrency as well, and that activity has really taken off [in] the past year or two,” Heng told hubbis.comInterview. Speaking with FT, an Equitiesfirst spokesperson said: “Equitiesfirst is in [an] ongoing conversation with our client and both parties have agreed to extend our obligations.”

Meanwhile, celsius network (CEL) token investors Tried to squeeze the air out the company’s native token well before the company filed bankruptcy. CEL fell by 58% to the U.S. Dollar after bankruptcy filings, but it recovered. On July 16, 2022 statistics showed that CEL had fallen by 58% to the dollar. CEL’s market volatilityOver the last thirty days, crypto assets have gained more than 30%

How do you feel about Equitiesfirst being named as the mysterious debtor that owes Celsius million? Comment below and let us know how you feel about the subject.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.