Dogecoin struggled to maintain its resistance level over the last 72 hours. The charts showed the meme coin consolidating.

Dogecoin’s price action has been very limited in the last 24 hour. Bitcoin traded above $40,000, which showed signs of strength. Altcoins have yet to show the same price action. Doge’s current price movements have wiped out its rally.

Trading can take a breather if the coin breaks the $0.151 threshold. Dogecoin currently trades between the $0.130-$0.1150 levels.

Global cryptocurrency market capitalisation stood at $1.93 Trillion, an increase of 2.2% in the past 24 hours.

Dogecoin Analysis: A One-Week Chart

Dogecoin fell almost 90% from $0.737, its record high, to $0.109 in 2018. DOGE’s charts still show bullish prices sentiments despite all this. A falling wedge has been formed by the price correction caused by meme-coin.

This pattern can be considered bullish and occurs following a bearish price movement. The asset consolidates right before breaking off from the upper trendline during a falling wedge.

Dogecoin’s price is at the extreme end of its trendline. This could indicate that Dogecoin will finally show signs of recovery. It was $0.150 at first and $0.190 later.

A falling wedge pattern is when bears temporarily overtake the market while buyers are unable to cope with an abrupt increase in price. Dogecoin’s current position is in the consolidation phase. Dogecoin is expected to rally after the above phase.

Dogecoin Plummets As Investors’ Doubts After Musk Twitter Takeover Unfold| Dogecoin Plummets As Investors’ Doubts After Musk Twitter Takeover Unfold

Dogecoin Technical Analysis – Short Term

Dogecoin technicals indicate that Dogecoin will experience lateral price movement, which is consistent with the falling wedge trend. The coin was spotted parked below 20-SMA because buyers were less than sellers. This indicates that the current price momentum is being driven by sellers.

Relative Strength Index: The coin saw an increase, which indicates that buyers wanted to reenter the market. As of press time, the consolidation phase meant that buying strength was still lower. The uptick could lead to buying strength returning and Dogecoin may aim at breaking its closest price resistance points.

Another Metric that Supports the Bullish Outlook

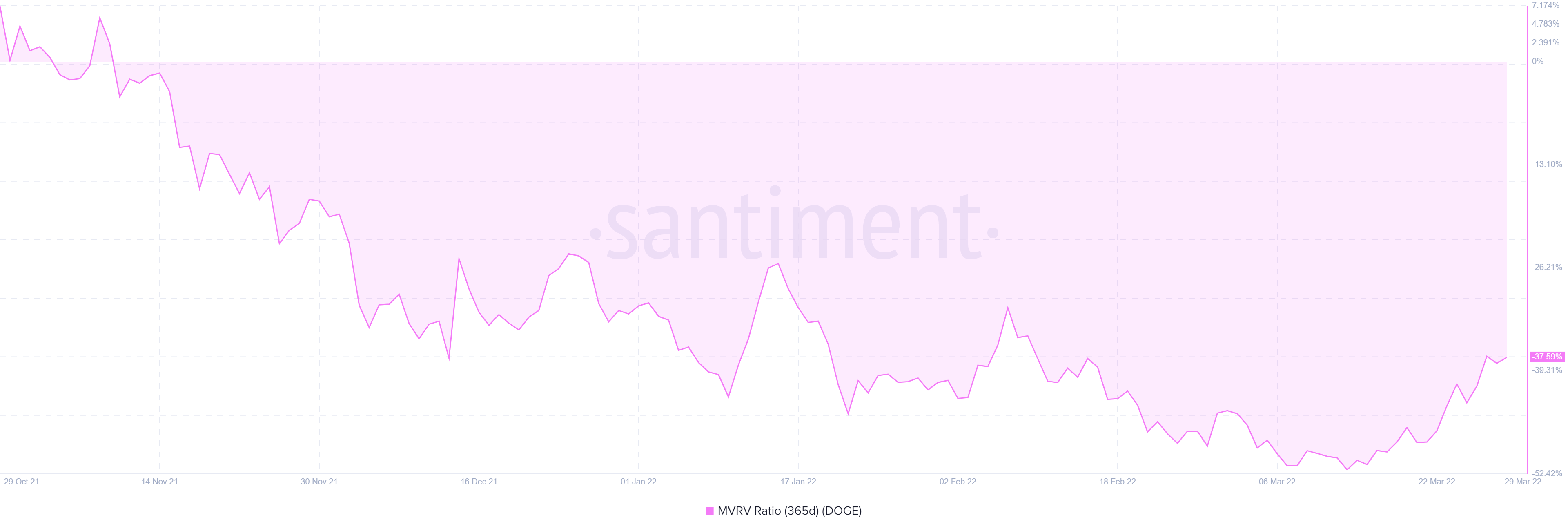

Market Value To Realised Value is the ratio of an asset’s market capitalization to its realized capitalization. This indicator can be used to determine the average profit/loss for investors who have bought the asset over time.

The value of short-term holders is considered to be at risk if it hovers between -10% & -15%. If the metric crosses the above-mentioned threshold, then long-term traders will enter an accumulation area.

The indicator was at -37% in the diagram above, which indicates that the price is likely to reverse. This reading corresponds to the long-term, as well as the short-term technical outlook.

If the wider market shows weakness, it is possible for the entire narrative to become invalid.

Recommended Reading: Dogecoin drops 9% after Elon Musk’s Twitter buyout| Dogecoin (DOGE) Struggles, Drops 9% After Elon Musk Twitter Buyout