Non-fungible token (NFT), collectibles, have been a popular commodity in the past 12 months. However, many NFT owners now take loans to cover their NFTs. Nftfi, an NFT loan marketplace, has already facilitated nearly $50 million worth of NFT loans this month.

NFT Borrowing and Lending Continues to Grow

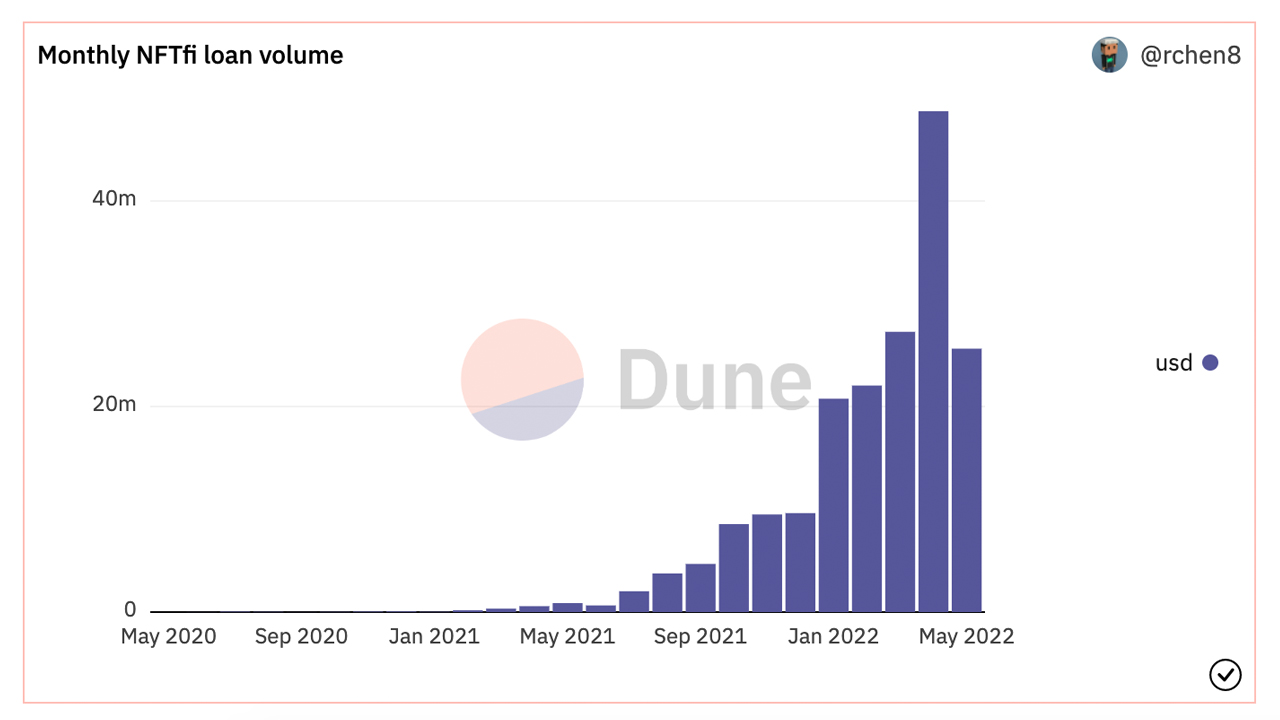

The NFT industry has grown to a $1 billion market in the last year. It is also a well-known use case of blockchain technology. NFTs still sell for thousands to even millions of dollars each digital collectible, despite a decline in sales due to the cryptocurrency market crash. NFT buyers are lending their digital collectibles to other NFT owners for liquidity access. For instance, a decentralized finance (defi) platform called Nftfi has seen $185.4 million in cumulative loan volume since the market’s inception.

Four loans exceeding $100K were recorded in the peer-to–peer NFT collateralized loans marketplace. Bored Ape Yacht Club (7813) was utilized for a $100K loan and Autoglyph (231) was leveraged to secure a $200K loan. BAYC 627 was used to secure a $150K loan, and BAYC 371’s owner obtained a $115K NFT loan the previous day. According to Dune Analytics statistics, Nftfi has assisted $25.6 million in NFT loans so far this month. Nftfi partners also with the Blockchain firms Flow and Animoca Brands.

NFT Lending Competition

Nftfi does not represent the only NFT platform available. Drops and Nexo.io are also options. According to statistics, Drops has helped facilitate $6,746,515 worth of lending. Pantera Capital and Franklin Templeton Investments have invested $17.8 Million in Arcade. Peer-to-peer NFT lending platform Flowty is another competitor, and it is built on the Flow Blockchain network. Flowty raised $4.5 million in the company’s first investment round from two lead investors and 23 total.

Nftfi offers a large selection of NFTs as well as a variety of digital collectibles from blue-chip companies. There are ENS domains, unstoppable domains, Axies and Doodles. Sanbox land is also available. On April 4, 2022 the platform ceased using its smart contract NftfiV1. It launched NftfiV2. According to the web portal, Chainsecurity and Halborn audited the platform’s V2 smart contract.

Do you have any thoughts about loan sharks using their NFTs as collateral? Please comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.