The digital currency markets were turbulent in the last month with bitcoin falling 15.43% against the U.S. Dollar and ethereum dropping 17.49%. Additionally, the crypto spot volume is 18.95% less than in the previous month, while futures volumes and options volumes also fell in April. Lower than average trade volumes usually indicate that investors are waiting for lower prices.

April’s Crypto Market Spot Volumes Slip Close to 19% Lower Than Last Month

Due to losses in digital assets over the past few weeks, the crypto economy finished April in red. All ten top cryptocurrency assets were down by a significant amount during the last 30 days. They lost anywhere from 10.39% to 31.43%. Metrics further indicate that April’s cryptocurrency exchange volumes dropped 18.95% lower than in March.

Bitcoin lost 15.43% as of May 1, 2022. ethereum fell 17.49%. BNB dropped by 10.39%. Solana lost 31.43%. XRP has lost 25.27% in the past 30 days. The trailing data for 30 days shows that Terra is below 27.66% and cardano fell 31.39%. However, dogecoin has only lost 3.46% over the past month.

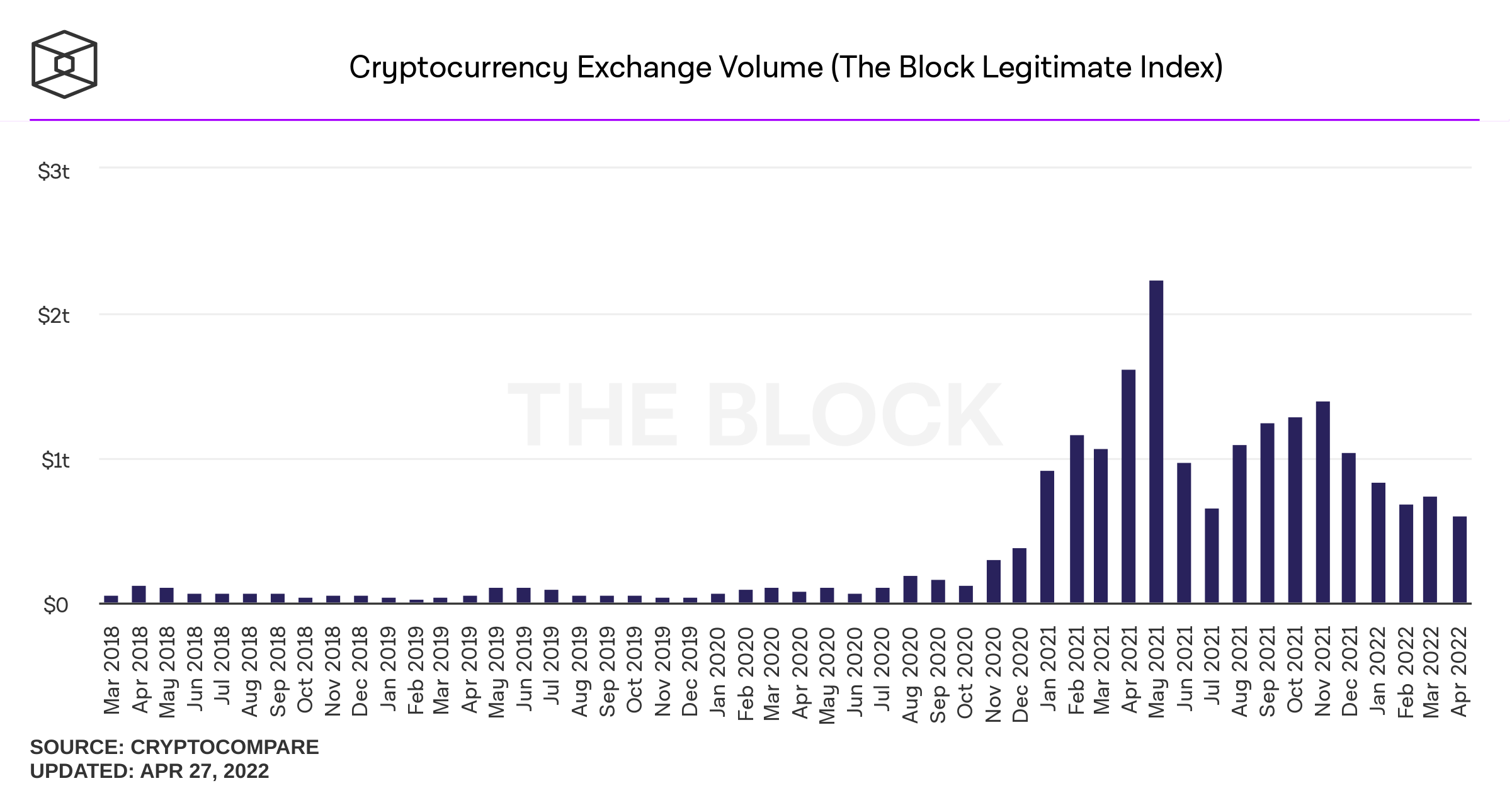

According to statistics, the total trade volume for crypto spot market volume in March was $739.4 Billion. April’s spot volume, according to the Block’s Legitimate Index and Crypto Compare metrics, came in at $599.22 billion.

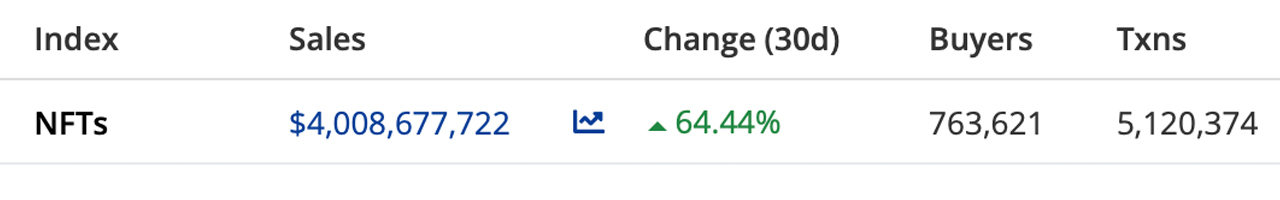

60 Day Crypto Derivatives Volume Slide and Dex Volumes Slip. NFT Sales increased by 64%

This is also true for cryptocurrency derivatives markets. Data indicates that there was $1.06 Trillion in April bitcoin futures volume. In March, $1.32 Trillion was reported. April’s statistics, in terms of bitcoin futures open interest, are lower during the past 30 days as well.

Today’s bitcoin futures open rate is $16.9 billion, compared to $14.58 billion a month earlier. The April bitcoin options volume of CME, Okex and Bit.com was less than in the previous month. In March, there was $20.77 billion in bitcoin options volume, while April’s bitcoin options volume saw $15.81 billion.

Furthermore, the recent defi report covered by Bitcoin.com News indicates that April’s decentralized exchange (dex) trade volumes were 21% less than in March. In March dex trade volume was $117 billion, while April’s dex trade volume recorded $92.18 billion.

The non-fungible token sales (NFT), however, experienced a 39.25% rise in the past seven days which pushed NFT sales up 64.44% over the previous month. Moonbirds, which had $492 million of global sales this month, was the best-selling NFT collection.

Let us know your thoughts on the cryptocurrency market’s performance over the last 30 day. Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.