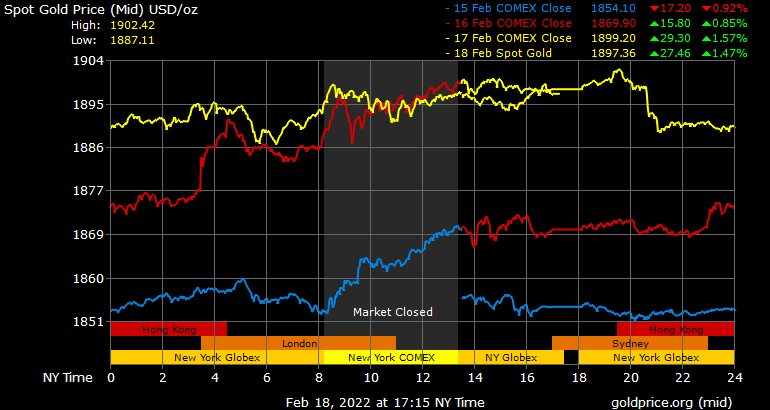

The price of precious metal gold rose by 3.85% in seven days, despite the fact that stocks and cryptocurrency markets are struggling over the past week. One ounce fine gold went up from $1.826.92 to $1.897.36 an ounce on Feb. 10. Additionally, top crypto-coins that have been backed by gold are seeing a substantial increase in demand and premiums over the spot gold price.

Gold shines in times of economic uncertainty

The world’s economy has been shaky and many are blaming the turmoil between Russia and Ukraine, and the possibility of war. The equities market has been in decline this week, and all the major indexes were still down at Friday’s closing bell. Closed at -168 by the Nasdaq, -232 by the Dow Jones, and -99 respectively at Friday’s close. In addition, the cryptocurrency markets followed their lead as billions have fled the crypto economy. It fell below $2 trillion last week and dropped to $1.88 Trillion.

The crypto economy lost 3.1% USD in the past 24 hours, while bitcoin (BTC), has fallen below $40K. Contrary to crypto and equities, precious metals like gold have done very well, gaining 3.85% USD over the past seven days. One troy ounce of.999 pure gold, which is currently trading at $1,897.36 an ounce, has traded just under the $1900 mark. Since January 28, a.999 ounce has seen a significant increase in its value. On that day, an ounce of silver traded for $22.47 per ounce, and today it’s changing hands for $23.94.

The Tokenized Gold Market is expanding, and specific Gold Tokens see premiums over spot.

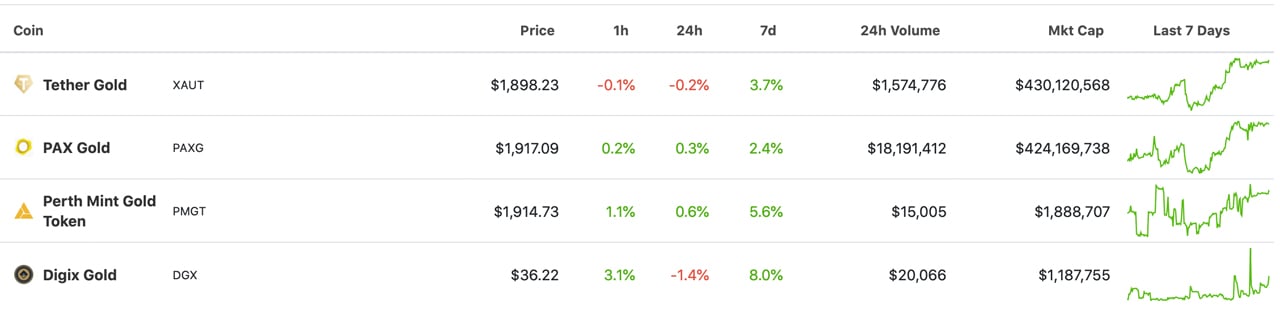

The market for precious metals has seen markets rise in value but the demand is growing for tokenized crypto gold coins. The market cap for tokenized coins of gold has increased by 2.4% to 8% in the past week, with XAUT (tether), PAXG (PAXG), digix (DGX), and perth mint token (PMGT). XAUT (or PAXG) and PAXG, which are both gold-backed crypto currencies in market value, are the largest. XAUT has an overall market cap of $430 million and PAXG’s valuation is $424 million.

All of them fluctuated between spot market gold prices and an acceptable premium. Pax Gold (PAXG), for instance, is trading at $1,917.09 per token, which is 1.039% more than the spot market. Also, the Perth mint-gold token (PMGT), is trading at higher prices than its spot value for an ounce. Currently, PMGT’s premium is 0.915% above the current $1,897.36 per ounce recorded on February 19.

Bitcoin.com News covered 25 days back the incredible growth in pax and tether gold, and the value has risen since. On January 25, XAUT’s market cap was $410 million and over $20 million in value has been added. PAXG’s market cap was $332.7 million and $92 million in USD value has been added over the last 25 days. XAUT’s market valuation has swelled by close to 20,000% in two years while PAXG has seen a 16,000% increase during that time frame.

Like stablecoins and crypto currency participants found their value in gold-backed digital currencies. The trend is a stronghold in the industry. Digital gold tokens are a way to hedge against market declines just like their counterparts in physical form. The current premiums allow arbitrage opportunities to occur, much like in fiat pegged stablecoin markets.

Do you have any thoughts about how gold-backed tokens, such as XAUT or PAXG, PMGT and DGX, are growing in popularity? Do you feel these tokens are getting market premiums, or not? Comment below and let us know how you feel about the subject.

Image credit: Shutterstock, Pixabay, Wiki Commons, coin gecko.com,

DisclaimerThis article serves informational purposes. This is not an invitation to purchase or sell directly, nor a suggestion or endorsement of products, services or companies. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.