Sponsored

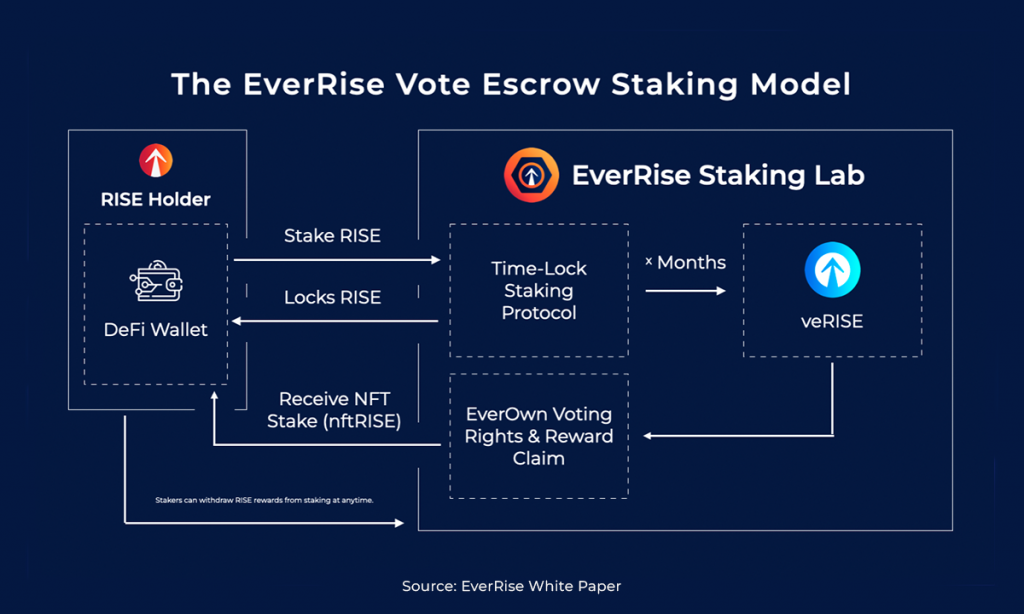

EverRise (the blockchain company responsible for the buyback in crypto) has updated to a new smart-contract that supports VeNomics (vote token model with escrowed tokens) and NFTs. EverRise has a revised protocol that offers enhanced security features as well as an innovative staking system built using on-chain utility NFTs. The RISE token is available on Ethereum, BNB Chain, Polygon, Fantom, and Avalanche with one shared supply, made possible with EverRise’s bridging solution, EverBridge.

On-chain NFTs make it possible to secure staking contracts on the Blockchain. These NFTs can be stored offline on a server that has only a serial and a link to the blockchain. The contract administrator can change these NFTs on-server in the future. EverRise uses the full potential of smart contracts and the public ledger to secure all necessary information for NFT Stakes.

The EverRise NFT Stakes metadata and image are both stored on the blockchain. They do not require any external data sources other than the blockchain. Each stake’s data is used to generate the attributes and the image for the NFT.

NFT Stake houses the RISE tokens as well as the governance tokens. Tokens can move when the NFT is moved. If the NFT is transferred from one blockchain into another, its metadata, and all contained tokens, move to the second chain. The NFT Stake becomes the new NFT.

NFT Stake houses the RISE tokens as well as the governance tokens. Tokens can move when the NFT is moved. If the NFT is transferred from one blockchain into another, its metadata, and all contained tokens, move to the second chain. The NFT Stake becomes the new NFT.

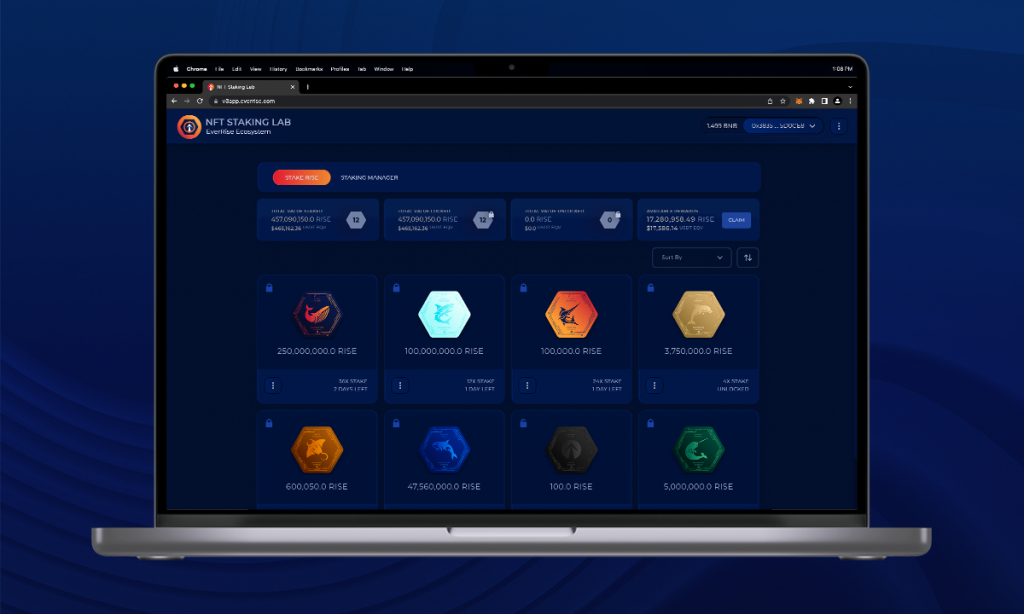

EverRise uses an automated buyback-and stake model to strengthen EverRise’s liquidity pools and reward stakers. Automatically purchased tokens called RISE are distributed to the rewards pool. EverRise NFT Stakes are available to holders when they stake their tokens. Holders have access to a variety of features in EverRise NFT Staking Lab. In addition to on-chain NFTs, those who stake RISE receive vote escrowed RISE (“veRISE”) which gives them governance votes for the EverRise protocol.

This smart contract offers unprecedented flexibility for staking. Every staking contract is an NFT on-chain tethered with locked RISE tokens. The key innovation with EverRise’s new staking protocol is that the NFT Stake itself, which holds the staked RISE tokens, is transferable, tradable, and bridgeable to BNB Chain, Ethereum, Polygon, Fantom, and Avalanche. Holders have the flexibility to do more than lock RISE tokens, even though each stake has a time limit. EverRise NFT Stakeholders can transfer, trade, and bridge their assets using the NFT Staking Lab distributed application. EverRise now has more than 70% staked, as per Monday, April 4th, 2022.

This smart contract offers unprecedented flexibility for staking. Every staking contract is an NFT on-chain tethered with locked RISE tokens. The key innovation with EverRise’s new staking protocol is that the NFT Stake itself, which holds the staked RISE tokens, is transferable, tradable, and bridgeable to BNB Chain, Ethereum, Polygon, Fantom, and Avalanche. Holders have the flexibility to do more than lock RISE tokens, even though each stake has a time limit. EverRise NFT Stakeholders can transfer, trade, and bridge their assets using the NFT Staking Lab distributed application. EverRise now has more than 70% staked, as per Monday, April 4th, 2022.

EverRise also provides protection for the RISE tokens and RISE assets with key features such as time-locks and bounded permit approvals. They can be used to mass-revoke operators approvals and have auto-timeout. These security measures protect against the common exploits found in DeFi and NFT.

The upgraded RISE token is available through EverSwap, EverRise’s multi-chain swap interface that allows projects to collect transaction tax in native cryptocurrencies rather than project tokens, eliminating sell pressure caused by the common “swap and liquify” function.

EverRise

EverRise, a blockchain technology company, aims to increase access to decentralized finance and bring security solutions into the market. EverRise offers developers and investors the opportunity to gain access to the largest market possible with maximum security through an ecosystem of decentralized apps. The company is working to spread safety protocols across Ethereum and Binance Smart Chains, Polygon and Avalanche networks, Fantom networks, Polygon and Avalanche, and offers five security dApps currently: EverBridge (EverOwn), EverMigrate (5, 6, 7, 8, and 9), EverStake (4, 5, and 6). More are on the way.

| Discord Twitter | Telegram | Discord | Reddit | Facebook | Instagram | YouTube

This is an affiliate post. How to reach your audience? Read disclaimer below.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.