The actualization blockchains, smart contracts, cryptocurrency, DeFi and cryptocurrencies has radically changed everything about finance. This sector is experiencing a decentralization epidemic that has created concepts even dreamers wouldn’t have imagined ten years ago.

Decentralized finance makes it possible to do many things that were impossible in traditional banking. Traditional finance is limited to borrowing and lending. To be eligible for a TradFi loan, you will need to have collateral such as assets and liabilities. On the other hand decentralized finance has virtually eliminated all third-parties. Access to uncollateralized or collateralized loans is now possible for anyone with an internet connection, a smartphone, and some crypto.

This article will discuss Compound Finance, one of the most important players in DeFi borrowing and lending.

What exactly is compound finance?

Compound Finance works in a similar way to savings accounts. There is a major difference. The bank has control over your savings account and promises you ridiculous annual returns. Compound Finance on the contrary is a decentralized, holding account which allows you to earn interest from your crypto assets with no third-party interference.

Compound Finance makes it even more interesting because you can borrow your crypto savings. You can earn some interest by lending. However, you can borrow up to 80% of the total amount that your crypto savings have been locked up in the protocol.

The Ethereum blockchain has been the first to introduce smart contracts. This ecosystem facilitates decentralized application development. Therefore, it is logical to search for the Compound protocol. This implies that Compound Finance’s governance token will be an ERC-20 token.

Compound Finance allows for trades, transfers, utility, as well as the facilitation of multiple DeFi application applications. A DeFi lending protocol that uses compound finance, it is an algorithmic currency market protocol. You can compare it to an open crypto market. It allows you to borrow money and earn interest as well as deposit cryptocurrency. It uses smart contracts to automate the management and storage of the platform’s capital.

Compound Finance does not require lenders or borrowers to bargain over terms in the same way they might in a traditional setting. The Compound protocol manages interest rates and collateral. Both sides only have to communicate directly with it. Compound Finance doesn’t need third parties. Crypto assets can be held with liquidity pools (also known as smart contract protocols) and not an intermediary.

Lenders and borrowers can adjust the interest rates for Compound Finance based on demand and supply. In other words, higher interest rates are associated with more demand than a limited supply. Compound, which is an open protocol, allows anyone to connect and receive interest using a web3 wallet.

Compound was founded by who?

Compound was established by Robert Leshner (serial business owner) and Geoffrey Hayes.

The renowned venture capital firms Andreessen Horowitz and Bain Capital Ventures, the venture capital division of the consulting firm Bain, contributed $8.2 million to Compound’s investment round in 2018.

Compound has raised $25 million more from the same investors as in 2018, including new investors, such as Paradigm Capital (a fund founded by Coinbase’s co-founder).

What is compound finance?

We’ve extensively touched on the initial question of “What is Compound Finance?” Let’s further consider how Compound DeFi protocol works.

Connecting your Metamask-enabled web3 wallet to Compound Finance is the first step in lending and borrowing cryptocurrency with Compound Finance. All crypto funds that are deposited into the protocol (or any ERC-20 tokens supported by Compound) will be locked automatically. You will have to unlock your crypto asset in order to perform any activity. A user may deposit multiple ERC-20 tokens and choose the one he would like to interact. Then, the user proceeds.

It is important to note that every deposit into the Compound protocol is tracked in the form of cTokens, which is Compound’s native ERC-20 token. Your stake in the liquidity pool is represented or equivalent by cTokens.

To illustrate, when you deposit ETH in Compound, cETH will be created. After deposit, the Basic Attention Token is converted into cBAT. You can deposit several coins and each will be charged interest at the appropriate rate. In other words, the interest rates for cBAT are the same as those for cETH.

You can redeem cTokens. You can use them to withdraw your tokens or convert them back into the original token that you have deposited. The liquidity pool stake you have is the same as your stake. The value of cTokens increases as the amount is borrowed from the open market. To earn compound interest, all you need is an ERC-20 token.

Compound Finance for Lending

As your first major Compound action, you must loan some cryptocurrency to Compound protocol. You can use the other functions of the platform such as borrowing by this action. Like other popular lending and borrowing platforms, compound requires collateral to allow you to borrow from this protocol. Supplied assets will accrue interest per the protocol, but you won’t be able to redeem the crypto asset while borrowing.

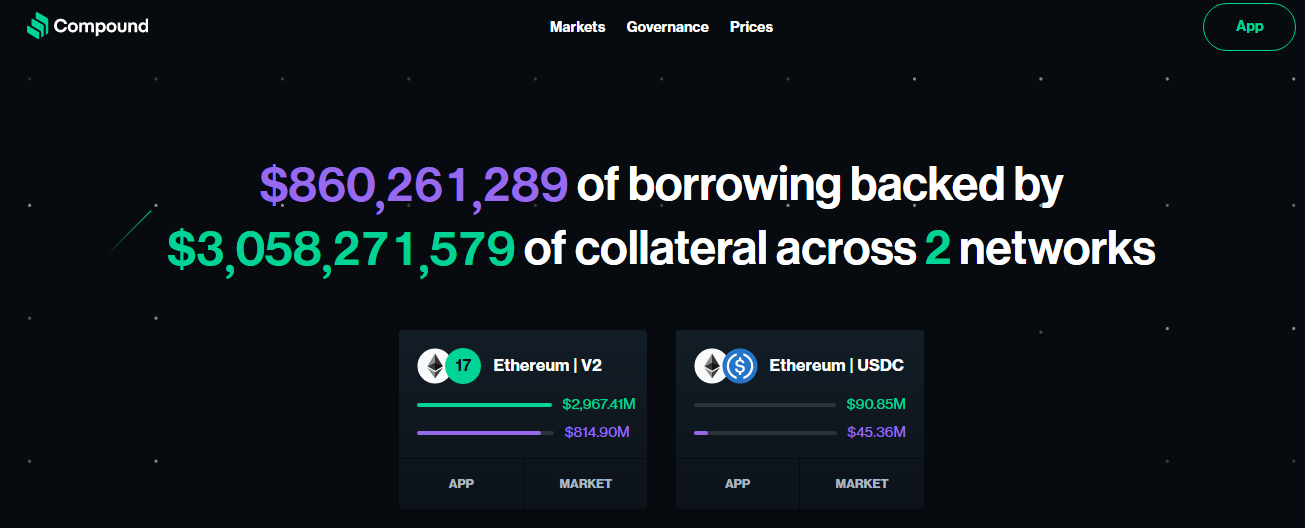

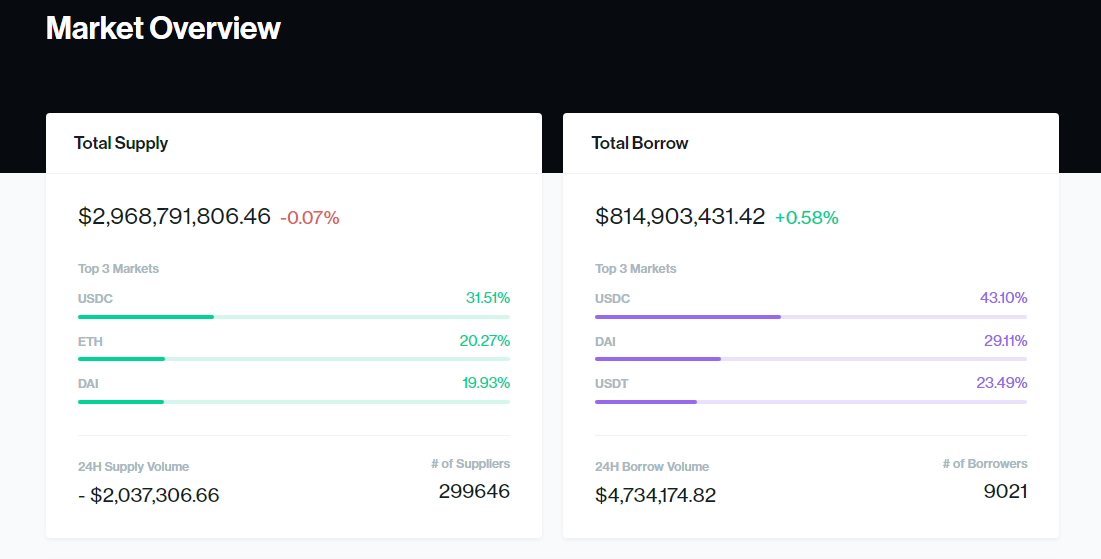

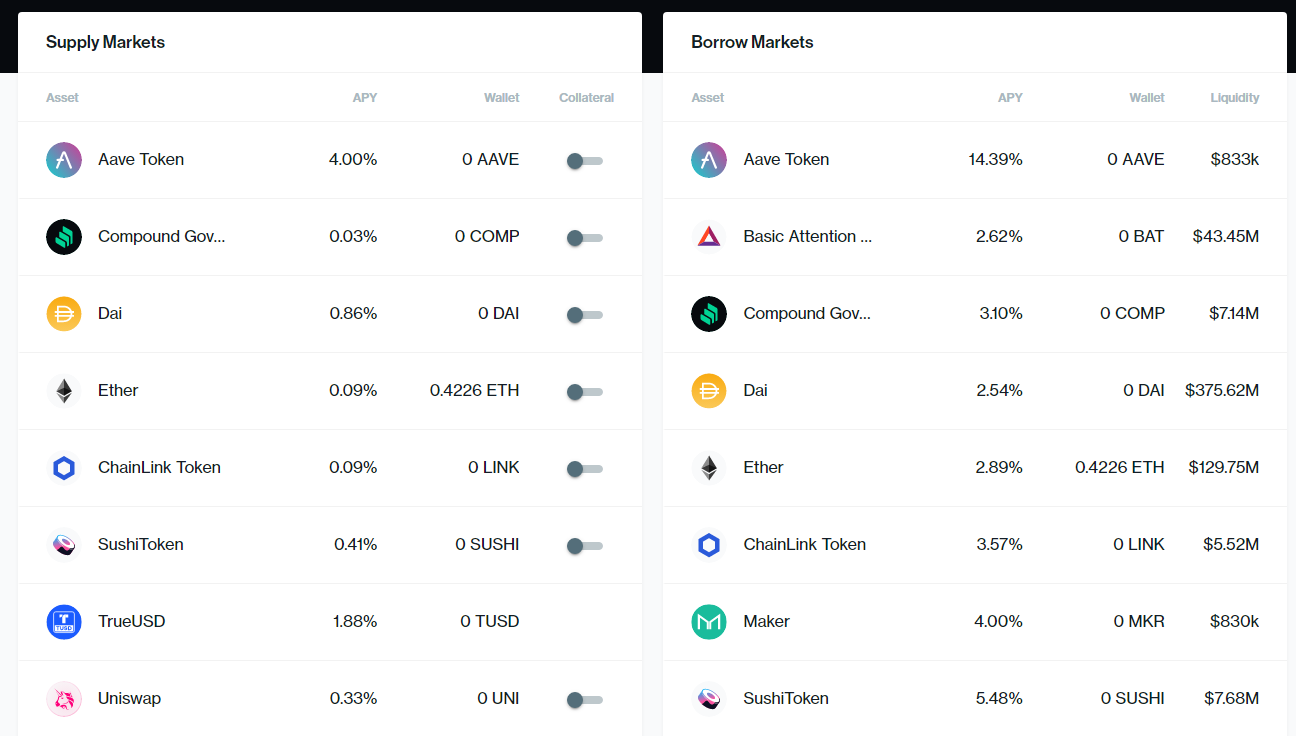

Compound’s V2, the most popular version as of right now, offers a selection of about 20 different altcoins, among which the top five are USD Coin (USDC), DAI, Ether (ETH), Wrapped Bitcoin (WBTC), and Tether (USDT). Most popular pools are those that use Ether (ETH), as well as stablecoins such DAI, USDC and USDT.

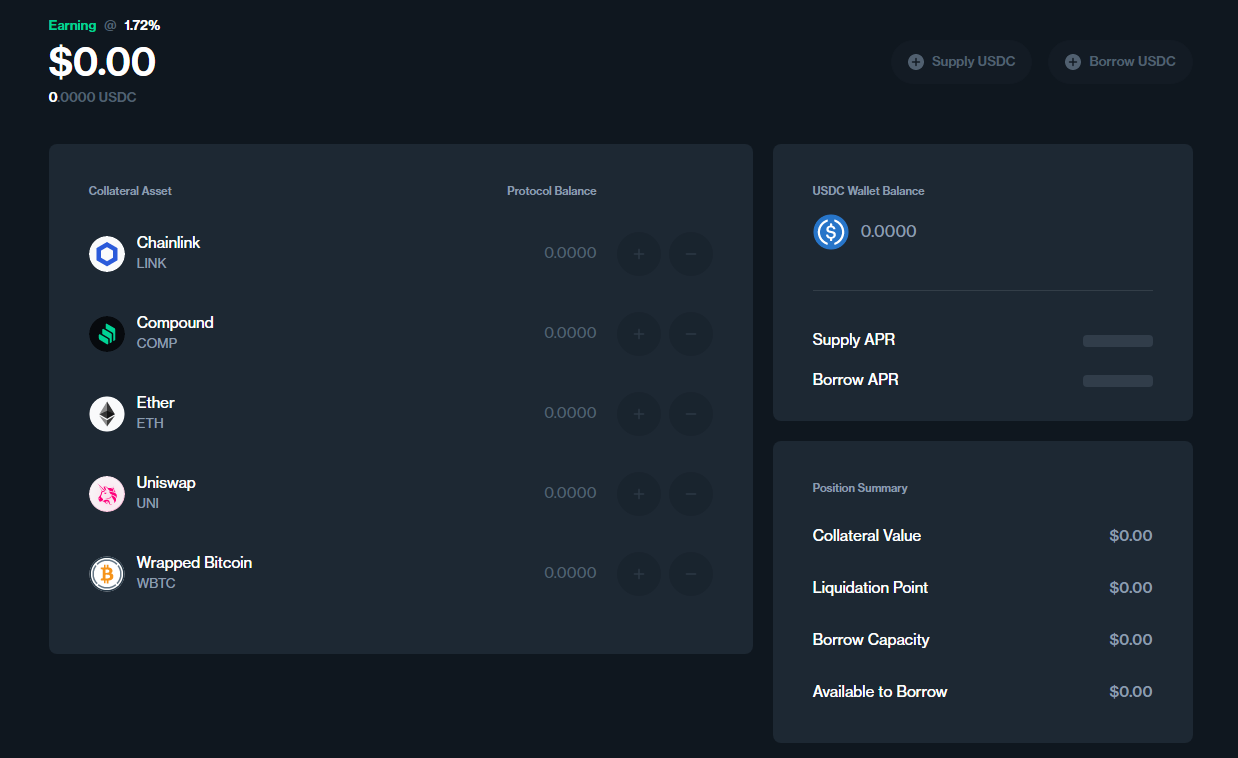

Compound’s V3 offers a limited amount of crypto assets you can supply. Five are included: Ethereum (ETH), Wrapped Crypto Bitcoin (WBTC), Compound [COMP], Chainlink (LINK), Uniswap(UNI), and Compound (COMP).

The process of lending is simple. First, you must unlock the asset that you want to lend capital. Next, use your wallet to sign the transaction. Once the asset is added, it immediately begins to accrue interest. These assets then become cTokens.

You can Borrow with compound finance

You’ll have an approximated borrowing capacity as soon as you’ve lent some money to the Compound protocol. This allows Compound to allow you to borrow cryptocurrency for a set amount. The USD equivalent of your available credit will be used to calculate the amount.

Multiple deposits will result in your total borrowing ability being calculated. This is based upon all the cryptos you’ve lent to the protocol.

Pay attention to your collateral ratio when you borrow funds. Based on your deposit crypto assets, the collateral rate will show you what percentage you can borrow. If the collateral ratio is for Ether (ETH), you are allowed to borrow 75% of what you deposit in ETH. For most altcoins, the collateral ratio ranges between 60% to 85%.

This means that, similar to other DeFi lending protocols, Compound’s protocol works on the principle of over-collateralization – where a borrower has to supply more crypto than the amount he borrows from the pool to avoid liquidation. The platform can continue to retain its tried-and-true stability thanks to this meticulously maintained over-collateralization.

Inflation Rates for Compound Finance

Market liquidity directly affects interest rates. How these rates are affected in real time will depend on the supply and need. Interest rates will be lower if there’s a lot liquidity. As demand rises, interest rates increase. This encourages new production as well as debt repayment.

An annual interest is paid to Compound for each block of Ethereum that is mined. Each 15 second, the value in cTokens goes up by a factor equal 1/2102400 of its annual interest rate.

Compound Tokens – COMP and cTokens

cTokens

Compound tokens can be used as a utility tool. The tokens are your proof of deposit and you receive them when you add capital to the pool.

Instead of being applied to the initial cryptocurrency you invested, all interest earned on the money you’ve lent is added to your cTokens. These tokens can be considered artificial assets that increase in value over time.

Because cTokens come from the Compound protocol they are not available for use outside of that ecosystem. It is not possible to use them in any other context than Compound.

COMP

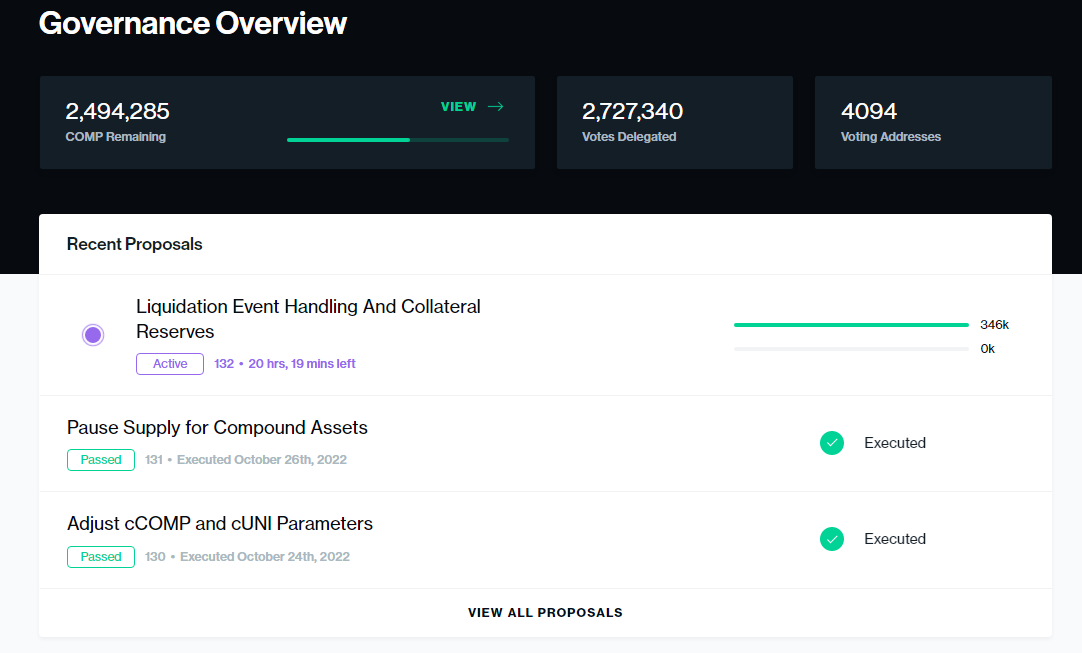

Compound’s native and primary cryptocurrency is COMP. Compound’s primary cryptocurrency is COMP. It is an ERC-20-standard coin. The COMP token’s owners have the ability to vote for or delegate votes on significant protocol updates. According to market cap, native COMP governance token now ranks ninth in governance crypto.

COMP Token – Circulating Supply

A total supply limit is set at 10 million COMP. Currently, less than one third of the total supply is being used.

In four years time, Compound Protocol users will get 4.2 millions tokens. About 2.4 Million COMP will be awarded to Compound Labs. Inc. stockholders. With a four-year vesting period, the Compound founders and existing team members will each receive an additional 2.2 million Comp tokens.

The pros and cons of compound finance

The pros

Diverse earning possibilities

Compound allows users to borrow different types of cryptocurrency. You can earn interest for all the cryptocurrencies that you provide to the pool. Lenders have many liquidity options, each with different rates of return. This platform allows lenders to receive an average of 15 second interest. You can earn more interest by compounding, which increases your rate of return.

On Compound’s platform, yield farming is another alternative, implying a chance to profit from a high annual percentage yield. Compound has many investors who act both as lenders and borrowers to help them obtain more COMP tokens.

Proven Security

Security is a key element in the cryptocurrency ecosystem. Compound puts a high priority on security. Well-known auditors, including Trail of Bits and Open Zeppelin, have conducted numerous security audits on the platform and found the platform’s coding to be dependable and capable of securing network demands.

No Trading or Slippage Fees

Compound’s platform has another advantage: there is no slippage and trading costs. This saves traders from exorbitant fees. This is in contrast to other platforms that charge different fees for cryptocurrency trading or performing transactions.

There is no limit on supply or borrowing

Compound doesn’t have any minimum borrowing requirements or supply criteria like other platforms. This allows greater participation by users in the loan marketplace and permits lenders to make interest on token investments.

Cons

It’s Not User-Friendly

Compound requires some learning and may not be as intuitive as other platforms. For new users, it can be complicated to navigate and will require at least an understanding of the cryptocurrency field. It is restricted to experienced cryptocurrency enthusiasts who are more adept at navigating the domain.

Limited Tokens

Compound’s platform, which is built on Ethereum has a restricted selection of tokens. Compound has less than 10 tokens. This is much lower than the number on other competing platforms. The platform is only available to individuals interested in those alternatives due to the tokens’ shared Ethereum blockchain foundation.

Conclusion

Compound Finance, one of the most popular DeFi lending methods on Ethereum. Anyone looking to make interest on their cryptocurrency assets by borrowing and lending is well-suited for this platform. You can borrow up to 15% of your crypto assets by using collateral.

It is possible to eliminate third-parties from the financial sector, which opens up new possibilities for financial inclusion. These are the benefits of the Internet. Decentralized finance has enabled an ecosystem of financial services that is decentralized. Projects like Compound Protocol allow us to participate in and benefit from this ecosystem.

Find out more about cryptocurrency, keep up to date with markets and manage your portfolio seamlessly on CoinStats.