The Decentralized Finance (DeFi), has been a key feature of the cryptocurrency industry. As more funds, people and projects enter the space, it is only becoming more evident.

It’s clear that DeFi has grown exponentially in almost all of its metrics in the past couple of years, from the number of protocols that operate in the space, through the total value locked (TVL), and all the way to the number of users benefiting from various platforms.

This report will discuss the performance of DeFi during the bearish 2022 year, and what it has in store for future months and years. Let’s get into it!

The Rise of DeFi

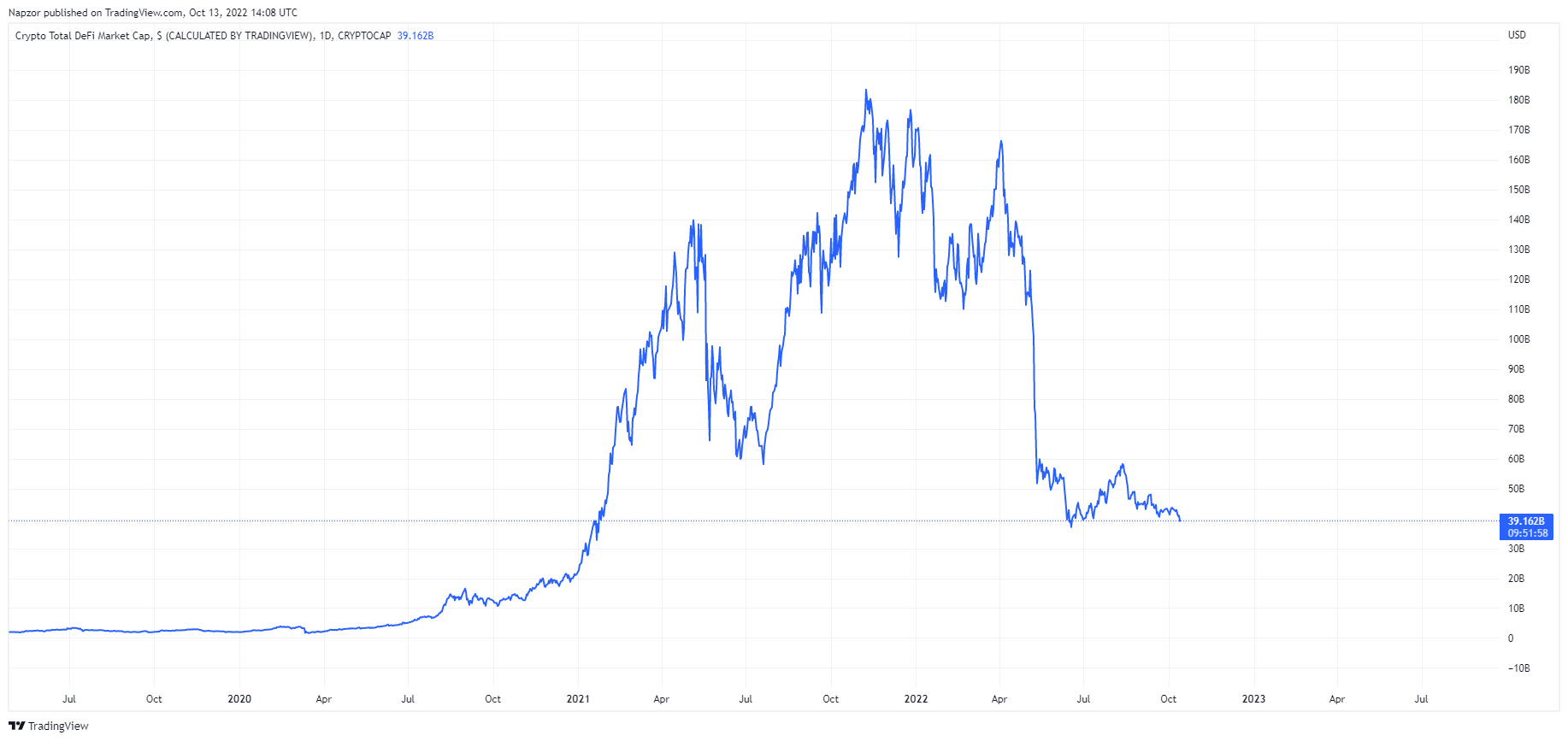

Market Capitalization

DeFi has seen a rapid growth rate since 2020. The market cap for the DeFi ecosystem is now over $1 trillion. More than $26 billion The end of 2020 will see this growth. This rate of growth continued into 2021 with the highest point at as high to be reached in 2021. $199 billion.

DeFi, however, has retreated towards the $40 Billion mark due to economic uncertainty and a bear crypto market in 2022.

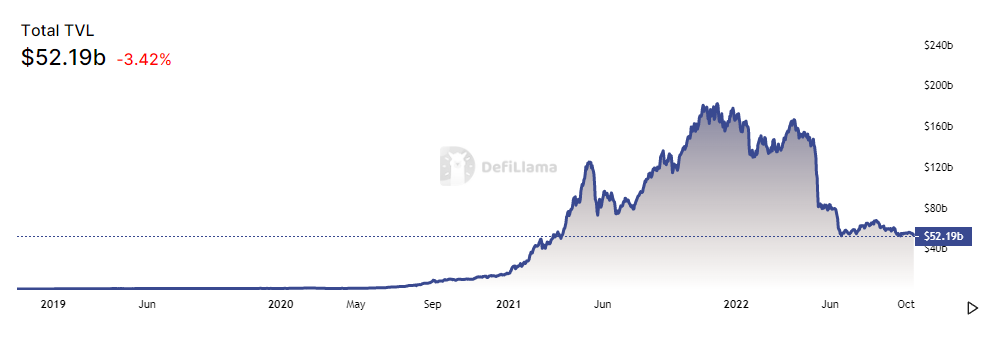

Total Value Locked

When we look at the total value locked in various protocols, we may see nearly the same image as before – but the chart may fool you!

DeFi protocol tokens have been increasing in value as a result of the DeFi ecosystem price cap. However, when we take out fluctuations and adjust for them, it is possible to see that actual cryptocurrency locked has remained almost the same. The dollar value of DeFi TVL in TVL has increased to a much higher per-dollar level than ever before. This means that, during the bear market, people were still locking their assets in DeFi protocols – they were just doing so with less expensive cryptocurrencies.

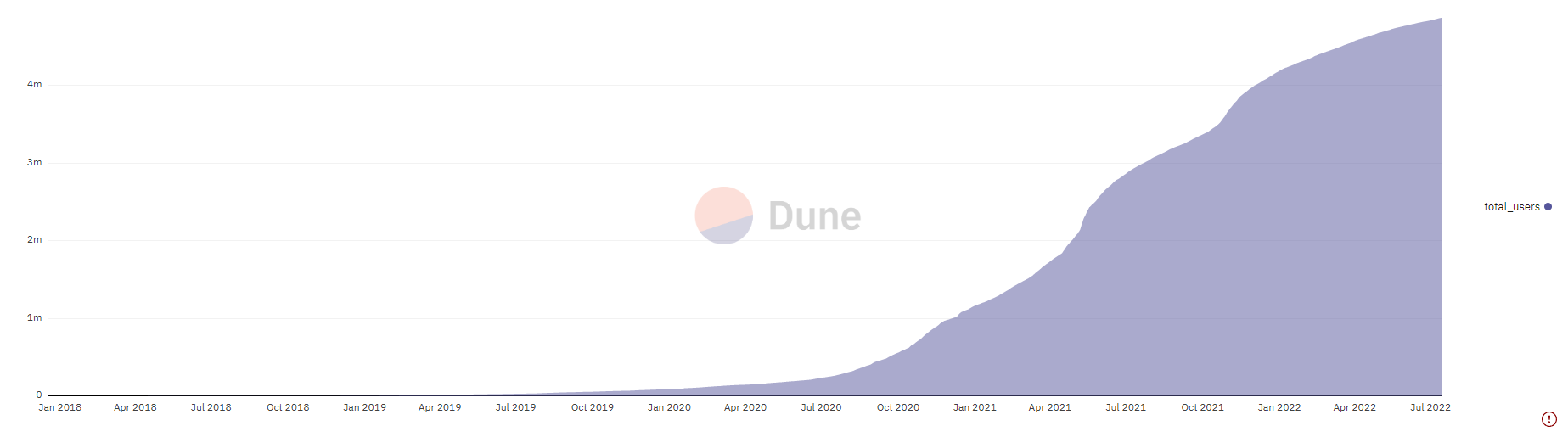

DeFi Participating Addresses

The number of addresses involved in different protocols may tell a very different story. This data again confirms that there has been a steady rise in the number of addresses involved in different protocols through 2020, early 2021 and even 2022, despite the bearish market.

This trend is likely to continue as many early users and powerful users of DeFi protocols remain active. As the market stabilizes, new users will gradually return.

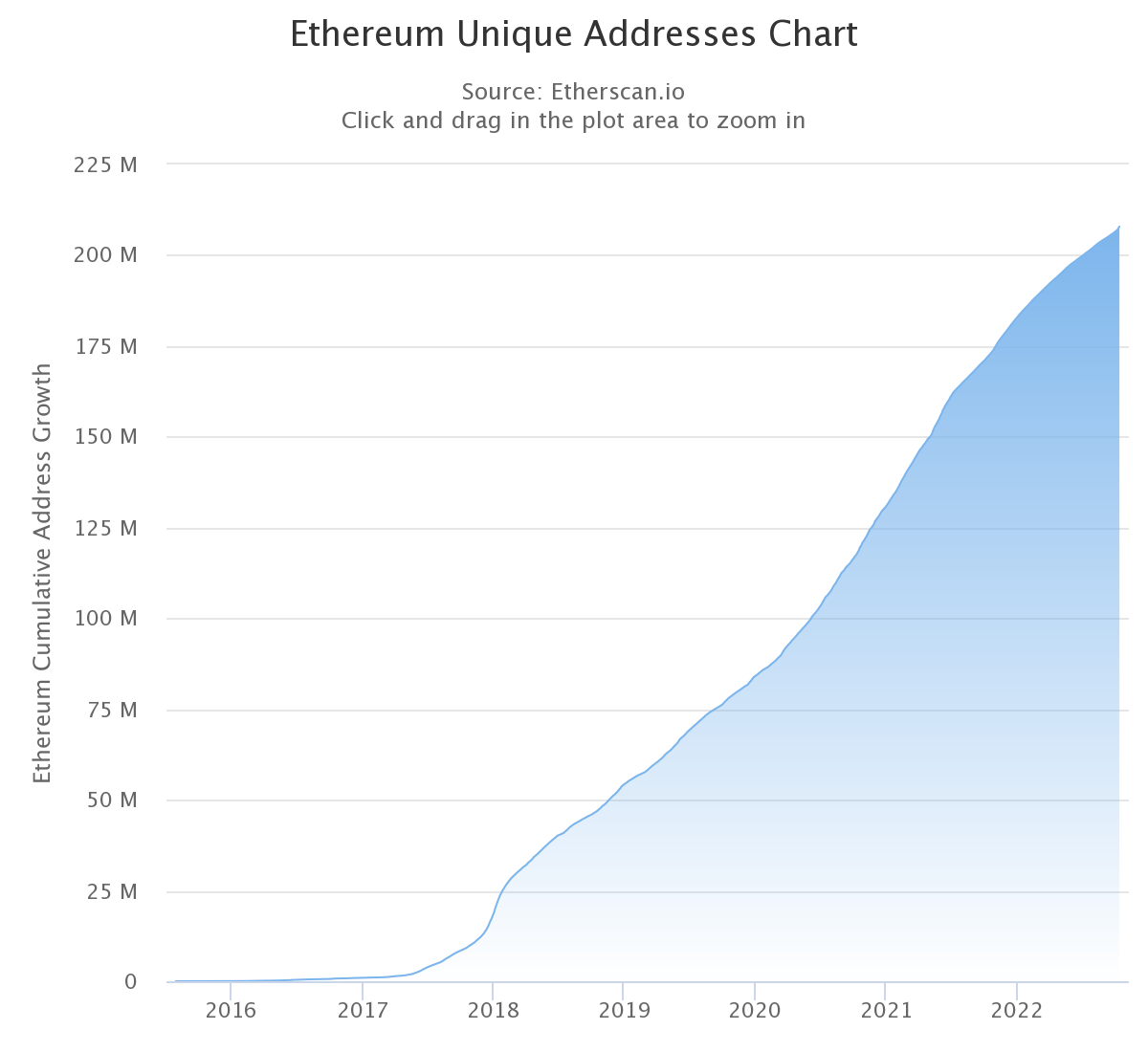

Unique Ethereum Addresses

Since most of the DeFi protocols are currently built on Ethereum, it’s also important to look at the number of unique addresses interacting with Ethereum.

The data show a steady rise over time, which indicates that humans still operate in the ecosystem despite the negative outlook.

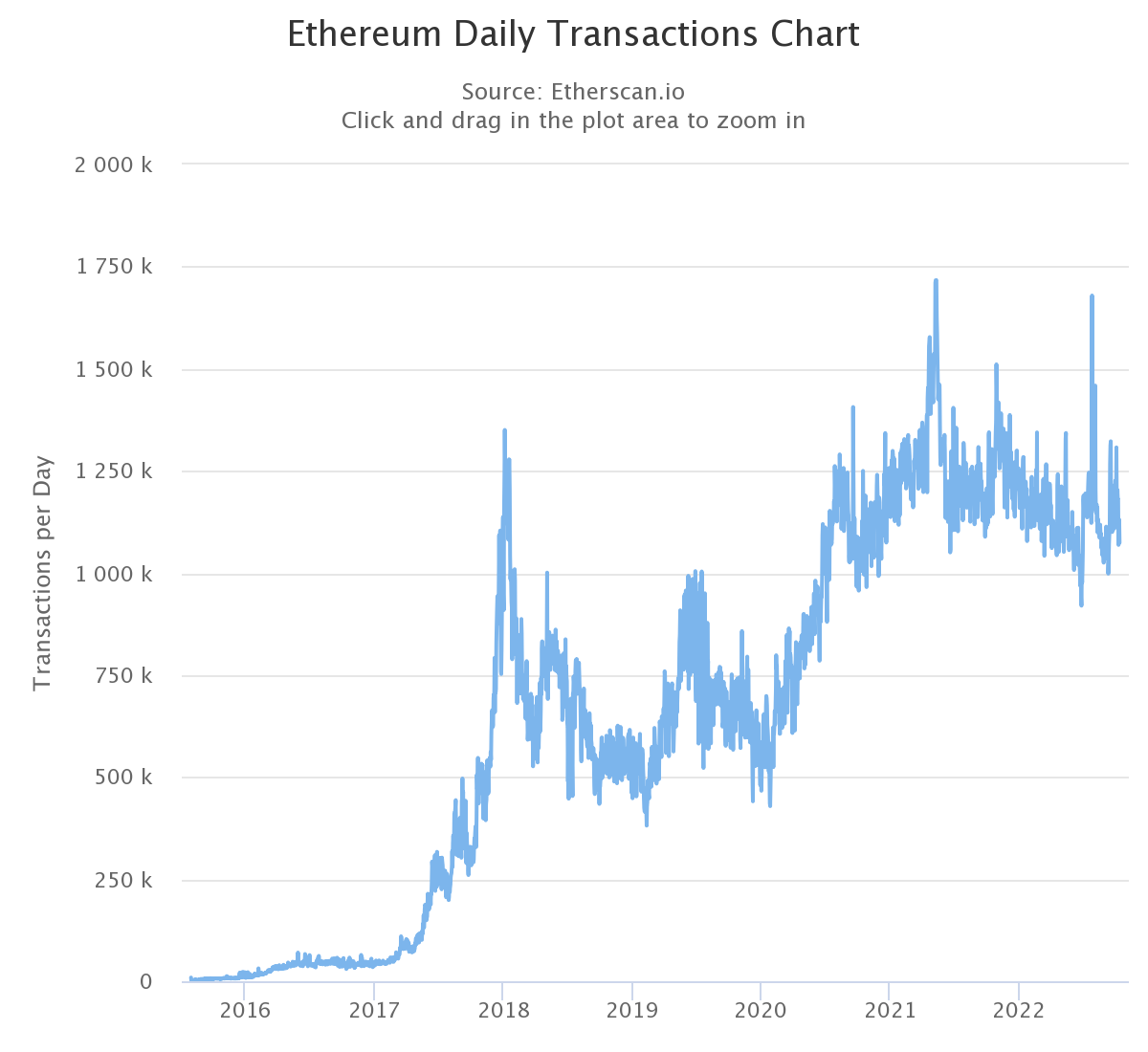

Ethereum Transactions per Day

We can clearly see the trend in Ethereum’s daily transactions, which is positively shifting despite fluctuations.

This is another great indicator that people are actually using the blockchain despite its uptrends and downtrends – and a large percentage of transactions are most likely connected to the DeFi ecosystem.

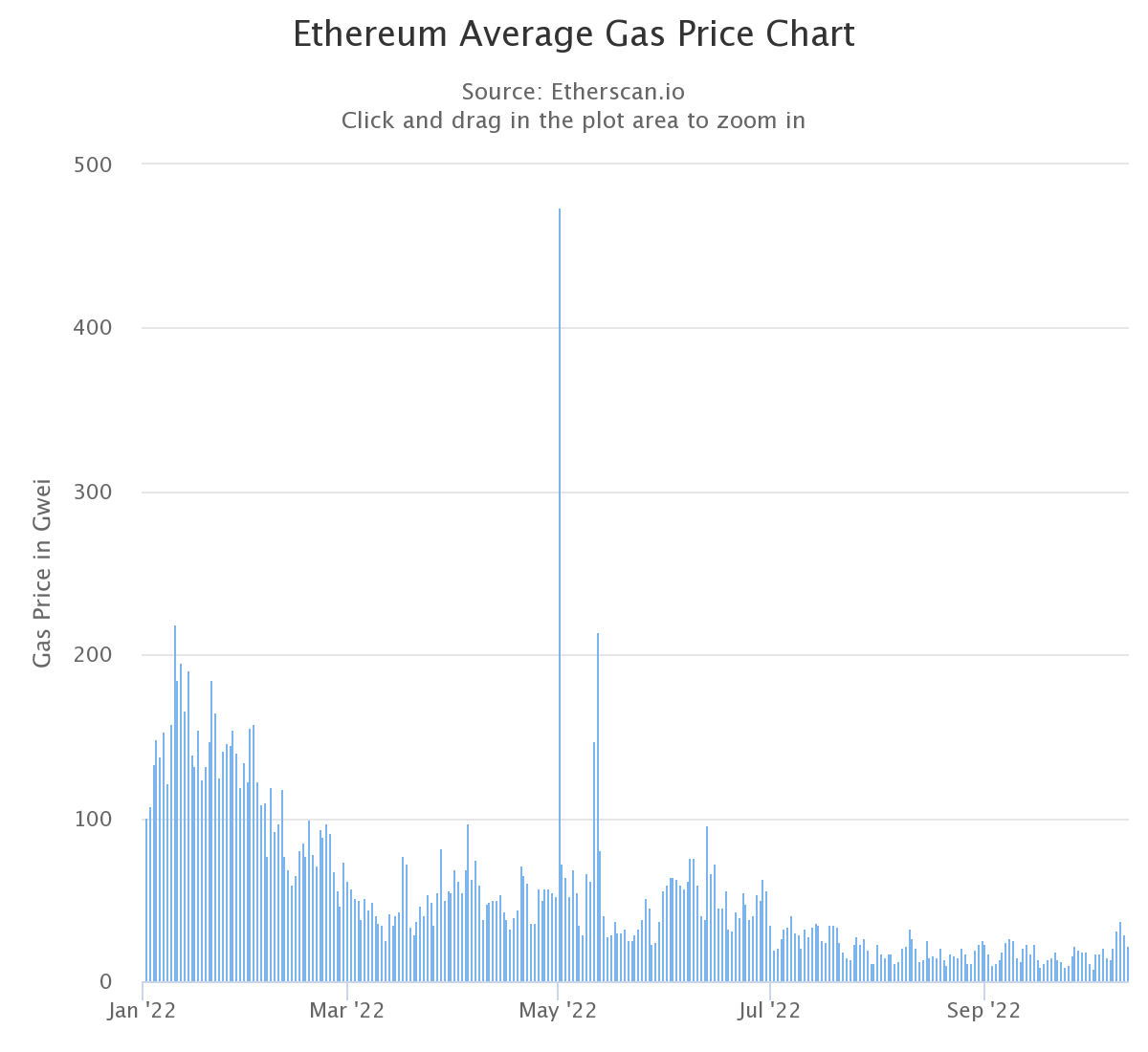

Ethereum Gas Fees

When it comes to Ethereum’s gas fees, we can see a steady descent in average gas prices in 2022. Many reasons can explain this. There are many reasons for this, including the ETH price fall that saw less ETH move around and people shifting more to other cryptocurrencies as a way of transacting daily.

DeFi was also affected by the bear market, which resulted in a decrease in gas prices for Ethereum.

The average current gas price is 22 Gwei. In 2022, it will reach close to 500 Gwei.

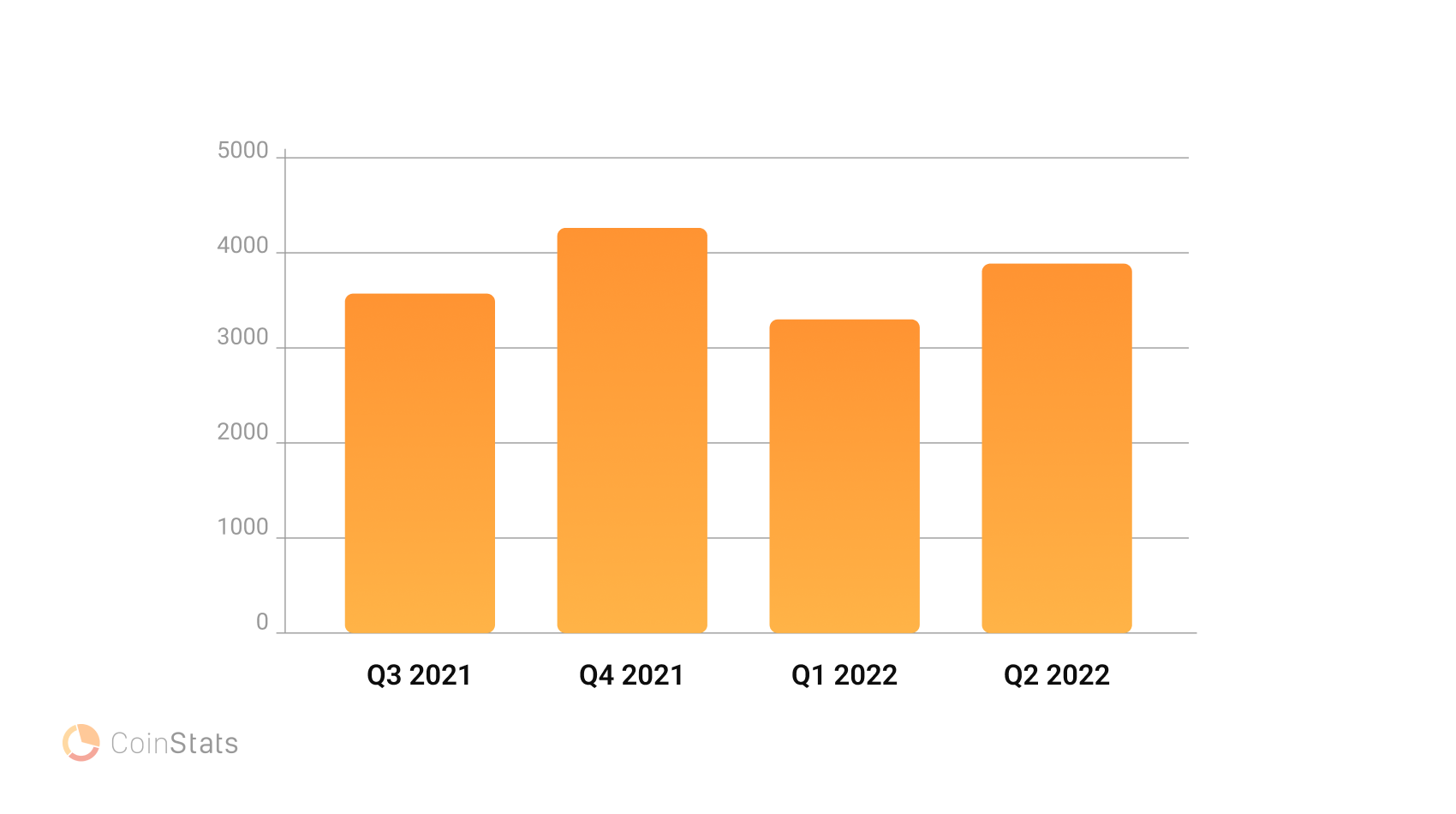

Larger Ethereum Users

If we take a look at the number of Ethereum whales on CoinStats, we can see that the numbers between Q3 2021 and Q1 2022 don’t differ too much – and the same goes for Q4 2021 and Q2 2022.

This indicates that, despite Ethereum losing more value in the markets, there was still a lot of whales. It is even better when we consider the fact that Ethereum holders now need to hold more ETH for whales to be valued at dollar value.

Ethereum Transferring to Proof of-Stake

Ethereum’s proof-ofwork consensus algorithm has been replaced by a proof-of stake. While the process was slow and difficult, it was quite seamless.

While this event may not have had a direct impact on DeFi protocols and platforms, it’s worth noting that it could potentially lead to increased interest in Ethereum and, as a result, DeFi protocols built on top of it.

The reason is that Ethereum 2.0 (and its transition to PoS consensus algorithms is only one part) will make the blockchain fully functional. It will also support more transactions. Vitalik Yeterin, the creator of the cryptocurrency, mentioned a throughput capacity of 100,000 transactions per second.We may be able to see DeFi adoption increase if Ethereum is even remotely close.

Additionally, the barrier to entry for Ethereum’s blockchain validation’s “passive income” will be much lower as users won’t be needing to expensive mining equipment, but rather simply stake their ETH and participate in the network’s consensus. This could result in a surge in users and an increase of the price of ETH, which would in turn cause a decrease in DeFi protocol’s value.

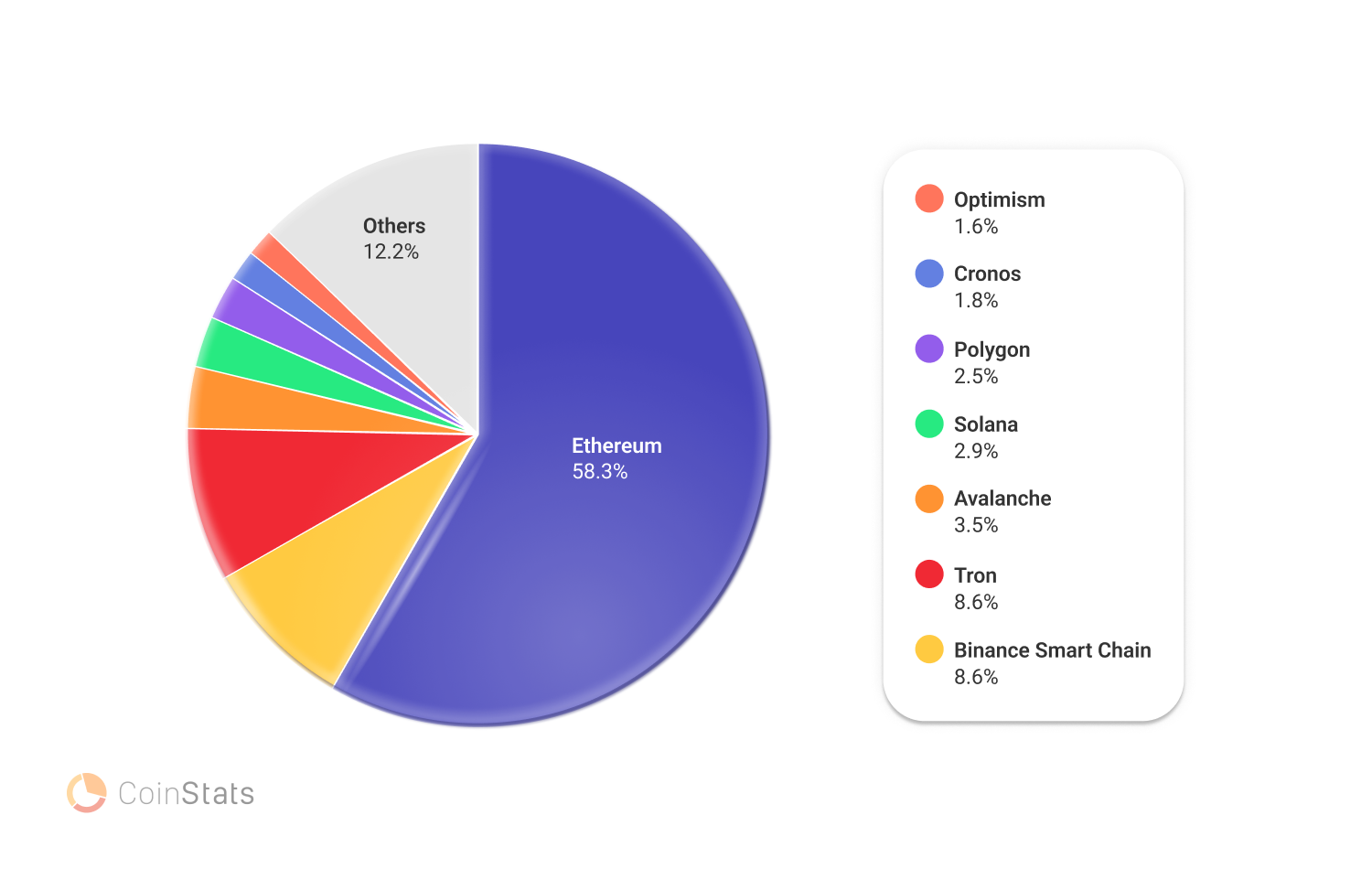

Other Blockchains Expanded

DeFi Protocols have seen a tremendous growth, and it is now necessary for other blockchains that offer comparable services. Ethereum remains the most popular blockchain, but other chains are slowly but steadily catching up.

Avalanche and Binance Smart Chain are some of the most prominent. Layer 2 solutions such as Polygon and non-EVM Blockchains like Cosmos also exist, although the market is still waiting on Polkadot or Cardano. These protocols provide similar services as Ethereum with substantially lower fees. They use a different consensus process (PoS instead of PoW), and thus require less computing power. It is therefore cheaper to run.

This protocol is also more efficient than Ethereum in handling transactions, which is critical for scaling DeFi protocols.

DeFi Protocols may shift to alternative blockchains, as users look more closely at Ethereum.

Looking at blockchain’s total value, it is clear that Tron and Binance Smart Chain are both getting closer to 10%. It is not an insignificant amount, and it indicates that users are considering non-Ethereum Blockchains.

Blockchain-related Projects

Let’s explore some of the different types of blockchains, and what they have to offer to the market.

Other EVM Blockchains

Interoperability of blockchains is a major hurdle that industry has to overcome. Ethereum virtual machine (EVM), compatibility with other blockchains is an excellent starting point to solve this issue. Some of the most prominent blockchains are Avalanche Smart Chain, Fantom Smart Chain and Polygon.

Avalanche

Avalanche is an EVM compatible blockchain which aims to enhance scalability while preserving speed and decentralization.

It consists of 3 blockchains:

- The Exchange Chain (X-Chain) – used for creating and trading assets.

- The Contract Chain (C-Chain) – used for smart contract creation.

- For coordinating Validators and Subnets, the Platform Chain (PChain), is used.

Avalanche uses a Directed Acyclic graph (DAG), an optimized consensus protocol, instead of traditional PoW and PoS mechanisms.

Avalanche’s main value proposition is the ability to optimize and improve existing principles. It also allows users to create custom-designed blockchains known as Subnets.

Avalanche’s most popular DeFi platforms are Aave (a multi-chain lending platform), followed by Benqi, and Trader Joe.

Binance Smart chain

Binance Smart Chain is Binance Exchange’s version of Ethereum. You will not notice any differences in its functionality. The Proof of Stake Authority (PoSA) is used to run the system. This makes it slightly more centralized, yet also allows for more stability in gas prices.

BSC became popular during the Ethereum gas fee hike, but has maintained relative popularity even though Ethereum’s gas fees have been on the decline.

Binance Smart Chain’s most popular DeFi platforms are Pancake Swap, followed by Venus and Alpaca Finance.

Fantom

Fantom, like other Ethereum alternatives and guarantees lower cost per transaction. However, Fantom comes with one unique functionality: users can create and deploy their own independent networks instead of relying only on Fantom’s main consensus layer. Fantom’s blockchain allows each application to function as its own blockchain while still enjoying all the benefits of the parent Fantom.

Fantom is based on an Asynchronous Byzantine Fail Tolerant (aBFT), Proof of Stake(PoS) consensus mechanism that maintains operational efficiency of the network.

Fantom’s most popular DeFi platforms are SpookySwap, followed by Beefy and Beethoven X.

Polygon

Polygon, a layer-2 network which adds to Ethereum’s blockchain, is called Polygon. Polygon is a layer-2 network that aims at increasing Ethereum’s throughput without changing its original blockchain layer.

Polygon has been announcing many amazing partnerships and has continued to develop.

Polygon’s most popular DeFi platforms are Aave, followed by Quickswap and Curve.

Polkadot

Polkadot is an open-source blockchain network which provides interoperability and security through shared state.

It is clear that developers will experience a very different layer of abstraction when they use Polkadot and Ethereum.

Developers create smart contracts in Ethereum that execute on one virtual machine called the Ethereum Virtual Machine. Polkadot allows developers to create their logic on individual blockchains. This interface forms part of the state transformation function for the blockchain.

However, there shouldn’t be any major differences from the user perspective, as Polkadot could be considered an augmentation and scaling solution for Ethereum, rather than its competition.

Polkadot, even though it will not be able to use smart contracts in its core chain, will still support EVM smart contractual blockchains that will allow compatibility between existing contracts.

Alternate non-EVM Blockchains

There are also blockchains which are not compatible with Ethereum, since they do not use the same programming language. Because they are more functionally different than Ethereum, these blockchains may be slightly different.

Cosmos

While Ethereum has a rollup-centric roadmap, aiming to scale a single, highly-decentralized settlement layer via numerous of Layer 2’s, Cosmos aims to create an “internet of blockchains,” or an interoperable network of sovereign, application-specific blockchains.

Cosmos can be used to build application-specific blockchains, which are optimised for one purpose. Osmosis Chain, the largest Cosmos blockchain, and dYdX chain are just a few examples.

Cardano

Cardano, a PoS decentralized blockchain that is designed to replace PoW networks, can be used to make payments. Created by Charles Hoskinson, one of Ethereum’s co-founders, Cardano aims to improve scalability, interoperability, sustainability, growing costs, energy use, and slow transaction times of current blockchains.

Cardano has been able to introduce smart contracts functionality in its Alonso update 2021. However, the existing infrastructure and unpopular programming languages are keeping Cardano off the front foot at the moment, at least for future updates.

DeFi Hacks and Security Breaches

Hacks of DeFi protocols have become a major problem within the cryptocurrency industry over the past several years. Many hacks are carried out via centralized exchanges. However, DeFi protocols can also be used to target malicious actors.

Many hacks took place in 2022. Hackers stole $615.5 Million from Ronin and $602.2 from Poly Network. $362,000,000 from Wormhole. $181million from Beanstalk. $140 Million from Vulcan Forged. $570,000 was stolen from Curve. $100 million has been taken from BNB Chain. $100 million is from Mango Markets.

This brings the sum total of DeFi Protocols funds stolen to $3Billion in 2022.

While decentralized financing as a whole can be a viable alternative to traditional, centralized finance it is still not perfect in terms of security and safety.

How will DeFi bring the future?

The traditional financial system has been in existence for hundreds of years and is unlikely to disappear anytime soon. But, decentralized finance protocols built upon blockchains represent a paradigm shift in our interaction with financial services.

We will see increased growth in DeFi over the years as new protocols are developed and more people flock to this space for better rates, lower fees and greater security.

Let’s check out the biggest contributors to the recent expansion of DeFi!

Traditional finance is entering deFi

With the recent boom in DeFi protocols, it’s no surprise that traditional finance is starting to take notice.

One notable example is the entrance of major banks to the sector. JPMorgan is one example. It has actively participated in Quorum’s development, which uses Ethereum to build a blockchain-based platform for enterprise business. JPMorgan is also part of Enterprise Ethereum Alliance which works on standardizations for Ethereum-based businesses.

Similar to HSBC, ING is involved in several blockchain-based supply chain finance projects.

Traditional finance is entering the DeFi market is an indication that it is mature and is beginning to recognize the benefits of blockchain-based financial protocol.

It’s also worth noting that, as traditional finance enters the space, we are likely to see an influx of new users and an increase in the amount of assets being locked into DeFi protocols.

One thing to watch out for is Traditional Finance moving into the DeFi area in the next months and years.

The rise of decentralized exchanges

Decentralized exchanges are an important component of DeFi’s ecosystem. They allow people to trade cryptocurrency directly without the use of a central intermediary.

Uniswap and Kyber Network, which are the top protocols in this area, have played a crucial role in DeFi’s recent expansion. Because they allow you to trade crypto assets easily without needing to go through an exchange,

What’s more, these protocols are also integrated with many DeFi protocols, which allows users to trade between different assets easily.

Kyber Network integrates with MakerDAO to allow users to easily convert DAI into Ethereum. Because it allows traders to exchange between assets within the MakerDAO ecosystem, this is crucial.

Uniswap also integrates with a range of protocols including Compound and Balancer. This allows you to easily trade among different assets, and without ever leaving the DeFi ecosystem.

Decentralized exchanges have been rising in popularity as a signal that DeFi is maturing and users are more comfortable trading in a distributed environment.

What’s more, it’s likely that we’ll see even more growth in this space in the coming months and years, as more protocols are built, and more users flock to the space.

The Growth Of Governance Tokens

The rise in governance tokens is another sign that the DeFi ecosystem has matured. The tokens allow holders to control how the protocol runs and are an essential part of DeFi.

MakerDAO is one example. It has MKR tokens that allow holders to vote for things such as the interest rates for DAI stablecoin. The protocol can be audited by them. Comppound uses the COMP token which works very similarly.

Governance tokens are a signal that people are more comfortable using decentralized protocols and are ready to trust them. What’s more, it’s likely that we’ll see even more growth in this space in the coming months and years, as more protocols launch their own governance tokens, and try to push away from centralized governance.

DeFi Gaming and Blockchain Gaming

More than 2Billion gamers spend over $159 Billion annually. That number is projected to rise to approximately $256 billion in 2025. As more people spend their time on this entertainment medium, creators and players will naturally seek to further monetize it.

Blockchain gaming is one way game developers and studios are trying to make the sector more profitable. In the case of blockchain gaming, the video games are connected to a blockchain, not a central server, with players “mining” tokens by performing certain tasks in the game.

To allow in-game transfers, popular DeFi protocols are required. Game-based cryptocurrency holders would likely want to make a profit on their investments.

Toptal conducted a survey and found that 62% and 82% respectively of gamers and developers were open to investing in digital assets, which can be transferred between different games. They have been fulfilled by the cryptocurrency world ever since.

Ubisoft released HashCraft in 2019, the first major studio to publish a blockchain-based video game. Multiple titles are now available.

Decentraland and Sandbox have been leading the metaverse space since then. Additionally, as NFTs have presented themselves as the backbone of the Metaverse space, we could see countless large companies creating their own NFT projects, including Coca-Cola, Pepsi, Adidas, McDonald’s, Nike, Disney, and many more.

While it is often seen as oddly bizarre, we must keep an eye on the future of blockchain gaming. This includes the Metaverse and NFTs.

Last Word

DeFi will grow both in complexity and size, making it easier for users to choose from a variety of products. We expect that the DeFi space will mature and there will be a few protocols who are leaders in their fields. Others may have to adapt, or go out of business.

DeFi remains in its early stages and we will continue to see what happens with this new sector. However, one thing is for sure – decentralized finance is here to stay.

For more information, visit our blog and sign up to our newsletter.

We appreciate your time!