According to a report, cryptocurrencies could offer an alternative to standard settlement procedures. This is because the blockchain technology that underpins them enables instant transactions to be completed without any intermediaries. The blockchain and cryptocurrencies are seen as technologies that will improve the remittance process by many players in cross-border transfer.

Cryptocurrencies eliminate Expensive Practices For Remittance providers

Using cryptocurrencies for the settlement of transactions can be a useful “alternative to traditional settlement processes,” the latest report by the International Association of Money Transfer Networks (IAMTN) has said. According to the report, this is due to the fact that on the blockchain — the technology that underpins cryptocurrencies — transactions are settled instantly without the need to go through intermediaries like correspondent banks.

A combination of decreasing correspondent bank relationships and an increasing volume of cross border transactions highlights the importance blockchain. The blockchain can not only lower the costs of sending funds, but also makes it much easier to transfer money between countries.

“Cross-border transactions can be settled almost instantly, thus obviating the need for pre-funding accounts in receiving countries, which is an expensive practice for remittance providers. A number of businesses, ranging from traditional remittance services providers to cryptocurrency fintechs are using blockchain technology to improve remittance processes,” explains the report.

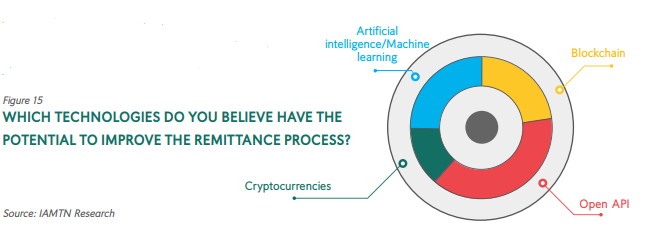

To buttress this assertion, the report includes the findings of a study by IAMTN which sought industry players’ views on innovative technologies which can improve the process of sending funds across borders. As suggested by the findings, both the blockchain and cryptocurrencies are seen as innovations that “bring [an] infinite number of possibilities in the realm of cross-border payments.”

According to the IAMTN study, open application programming interfaces (API) as well artificial intelligence (AI), were the two other technologies that could help improve the remittance process. Besides disrupting the financial industry, many of these new technologies can “permanently improve the infrastructure behind cross-border payments, in the interest of end-users.”

Adoption of new technologies is slowed by regulatory uncertainty

However, IAMTN found that remittance service providers who are eager to integrate new technologies into their business often face challenges due to rigid national regulations and the lack of laws that regulate such technologies. According to IAMTN, the fact that only a few countries regulate the use of blockchain creates “some level of uncertainty for businesses that use, or would like to use, this technology.”

It was also stated that barriers like accessibility, insufficient literacy and lack of trust are often obstacles to new technology adoption, even when they can lead to significant savings. To overcome these barriers, IAMTN calls on policymakers to make sure that their policies are tailored to the realities.

Your thoughts? Please comment below to let us know your thoughts.

Image creditShutterstock. Pixabay. Wiki Commons