From 2008, when it was first imagined by Satoshi Nagamoto (paper for Bitcoin), the cryptocurrency world has made great strides. This has led to cryptocurrencies allowing people across the globe financial freedom. With thousands of projects and technologies available, cryptocurrencies have seen a significant increase in adoption over the last five years. Market entry. With each year it innovates the financial market. Crypto Loans are one example of this innovation. Users can access loans against crypto assets, known as Crypto Backed Loans and Crypto Loans Without Collateral (Flash Loans), among others.

Here, we bring you all there is to know about cryptocurrency-backed loans and how you can get loans against crypto, and the advantages and risks associated with them.

What are Crypto Loans?

Understanding what a cryptocurrency loan is is crucial. It’s also important to know what a conventional loan looks like and how it operates. Two types of traditional loans are available: secured or unsecure. As a security measure, secured loans have collateral or security to protect the borrower from default. Unsecured loans do not require security or collateral, rather they are given out on the basis of the loanee’s CIBIL or credit scores.

A crypto loan, while similar to a conventional loan, is different in that the collateral or security needed to protect the loan isn’t a tangible asset. Instead it is a crypto asset. Another type of crypto loan is the Flash Loan. This is not secured by an asset but is managed on smart contracts. However, crypto secured loans can also be called crypto loan.

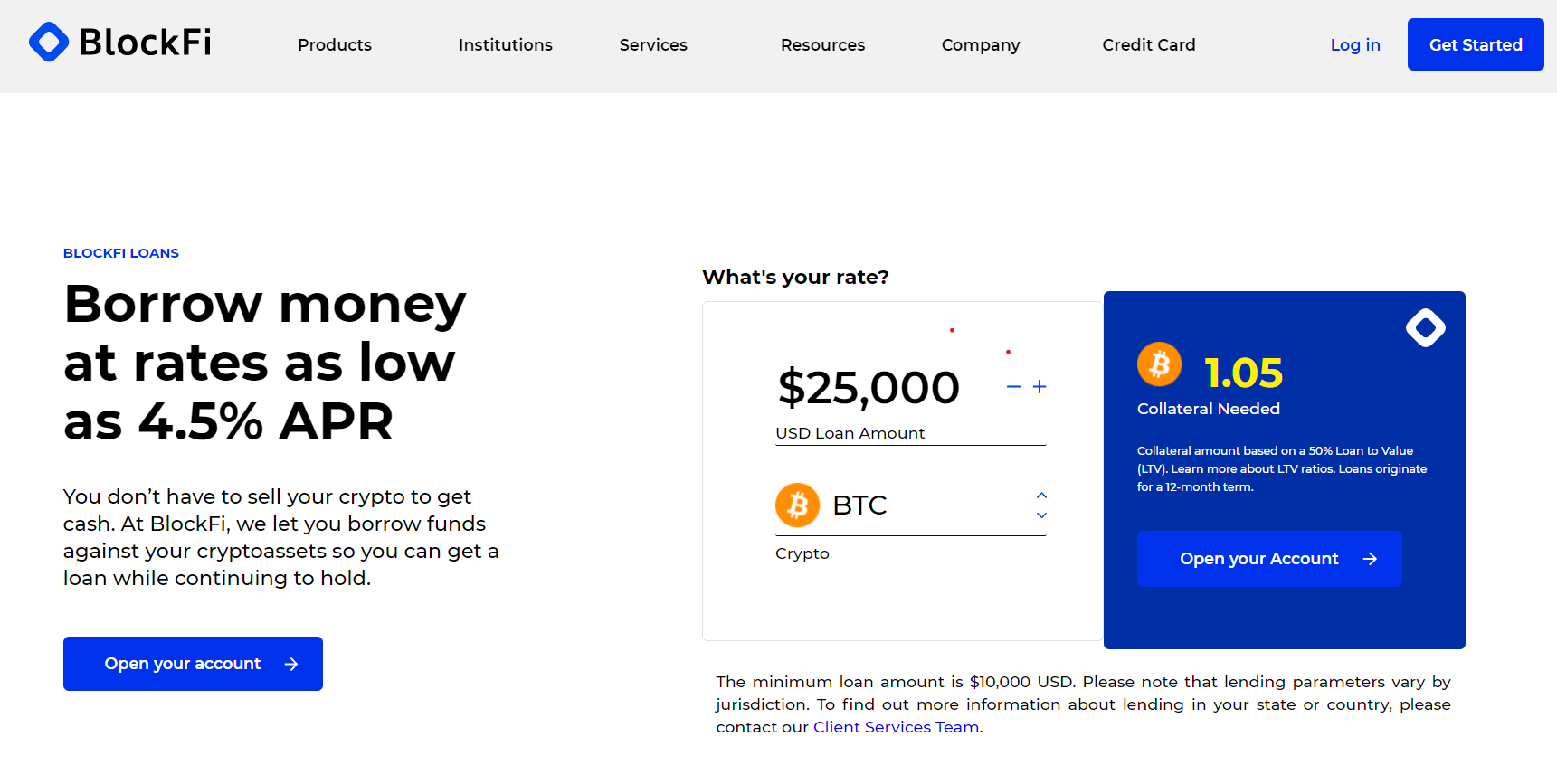

Many platforms can be used to secure crypto loans such as BlockFi and Celsius.

Benefits of Crypto-Loan

It is important to consider whether or not obtaining a loan in crypto currency is an option. Any user has many choices when it comes cryptocurrency loans. You can be the borrower, or you can be the lender. Each one of these roles comes with its own advantages and disadvantages.

Get Interest

Lenders have the opportunity to make interest on loans that they provide. You can easily make a passive income from lending out crypto assets such as USDT or cash.

Low Interest Rate

Borrowers find crypto collateral loans very attractive because the interest rates can be very low. As an example, BlockFi provides a loan at a rate of 4.5 percent annual percentage rate. Other platforms have very low rates for cryptocurrency loans if the loans are long-term secured.

Banks are not necessary

In a way that takes control of loan approval and denial from banks and other financial institutions, cryptocurrency loans give people the ability to access funds. However, the average amount of the crypto-asset backed loan is over $10000. This is still a very lucrative option that allows people to access funds they would not be able to get through other methods.

Quick and secure

Conventional loans are slow and difficult to obtain. Not everyone is able to get a loan. Cryptocurrency loans are quick and easy to apply for.

Crypto assets owned

You don’t have to dispose of your crypto assets if you own a significant amount of them. Instead, they can use their crypto assets to secure loans and then get the money back once they have repaid the loan.

The disadvantages of crypto loans

Cryptocurrency loans can be very attractive, and it is the smart thing to do when you need loans for crypto-themed people. They have some inherent disadvantages. Some of these drawbacks include:

Minimum loan amount required

The loan amount for cryptocurrency loans is often high. This makes it more risky for individuals to consider getting one. Platforms like BlockFi require that you have a minimum amount of $20000 to be eligible for a $10000 cryptocurrency loan.

A Short Period of Repayment

A majority of cryptocurrency loans come with a very short repayment time, ranging from 12 months to three years. Comparable to traditional loans, the repayment term for cryptocurrency loans is significantly shorter than conventional loans and puts more strain on the borrower.

Crypto-Price Volatility

A loan secured against a crypto asset can experience extreme volatility over the loan term. A Margin call is when the value of the crypto asset falls below the limit set by the lender. A margin call means that the borrower will need to make additional deposits to satisfy the loan terms. Platforms can sell assets if the borrower does not comply with the loan requirements.

Crypto assets are secure

A loan secured by a crypto asset is locked for the duration of the loan. The borrower cannot access or trade their crypto assets during this period. In case the price of your asset goes to the moon, you won’t be able to sell them. Likewise, if the price drops substantially, you won’t be able to sell them to cut short your losses.

Conclusion

Although cryptocurrency loans are easy to get, they can also be difficult to repay. They offer financial liberty to anyone around the world and many inherent benefits. Although the mechanism is in its early stages, it and the platform offering it are not yet fully developed. It is also risky because of the volatility of the crypto assets used to back cryptocurrency loans. It is a better option to keep your crypto assets in CoinStats Wallet, even if your lender wants to make interest from lending them their assets. And you can manage all of your crypto assets across multiple platforms via the CoinStats Wallet & App.