The crypto market was a good deal better than Netflix (NFLX) on Tuesday. The shares of the world’s leading streaming company fell 27% to $256 in after-hours trading reaching 2019 levels after announcing a massive loss of 200,000 subscribers in the first quarter of 2022. It was a roughly $40 billion loss within half an hour.

The company has lost customers for the first time since 2011, and expects to lose another 2 million in the second quarter. NFLX has already fallen 63% from its All-Time high and is down over 40% for this year.

“If you are wondering about how painful a missed opportunity can be, here is a reminder. $FB is still down ~33% since it disclosed Facebook’s user growth hit a ceiling,” Bloomberg’s Brian Chappatta noted.

Analyst Michael Nathanson of MoffettNathanson LLC told Bloomberg that “It’s just shocking,” adding, “Everything they’ve tried to convince me of over the last five years was given up in one quarter. It’s such an about-face.”

Crypto will follow?

The news site further reported that “Disney fell as much as 5.2% in extended trading after Netflix reported its outlook, while Warner Bros. Discovery Inc., which owns HBO Max, saw shares fall by as high as 2.8%. Shares of Roku Inc., the maker of set-top boxes for streaming, dropped as much as 8.3%.”

It has been speculated that this may also cause a decline in the cryptocurrency market. An economist noted that the last time a sharp shed like this happened for Netflix (Jan 22, 2022), “it triggered [an over] 30% 4-day crash across crypto.” However, he added that he doesn’t think this will be an issue this time. “It’s now an idiosyncratic event.”

The reason why many do not think this scenario will repeat is that the previous case was highly related to the macroeconomics –the general stock market sell-off over fear related to interest rate hikes in the U.S.–, while this time the indicator seems to be specific to the company’s declining demand.

Bitcoin Nosedives Below $38k As Tech Stocks Take A Beating, Pandemic Gains Disappears| Bitcoin Nosedives Below $38k As Tech Stocks Take A Beating, Pandemic Gains Disappears

Back in January, the company admitted that the competition is “affecting marginal growth some.” Now, besides the increasing competition, they stated that the bad performance in Q1 was partly due to a large amount of customers who share their passwords, estimating 100 million households that use the service technically for free.

They also pointed out macro factors, ” including sluggish economic growth, increasing inflation, geopolitical events such as Russia’s invasion of Ukraine, and some continued disruption from COVID are likely having an impact as well.”

Netflix completely missed their forecast for a 2.5 million growth in subscribes as well as Wall Street’s estimate, which also expected them to add that many users in the first quarter of 2022.

In contrast, the anti-crypto propaganda that calls it “too volatile” and “too risky”, claiming that investors need protection from it, is looking weak and pale today.

BREAKING NEWS

Tech can plummet as quickly as stock traders realize #Crypto can.

Netflix investors, I offer my condolences. $NFLX

— Michaël van de Poppe (@CryptoMichNL) April 19, 2022

Bill Ackman, who reported about his hedge-fund’s purchase of more than 3 million shares of Netflix on January 27, the day after the big Netflix plunge. His plethora is now.Current osition 387.5M lower

Similar Reading: New Survey shows that Majority of Crypto-Holders Will Survive An 80% Crash| Majority Of Crypto Holders Will Hold Through An 80% Crash, New Survey Shows

“Somebody Always Knows”

A second major difference between crypto and cryptocurrency is the fact that it is commonly called a fraud scheme. However, some analysts believe that this NFLX scenario may be exhibiting signs of insider trading.

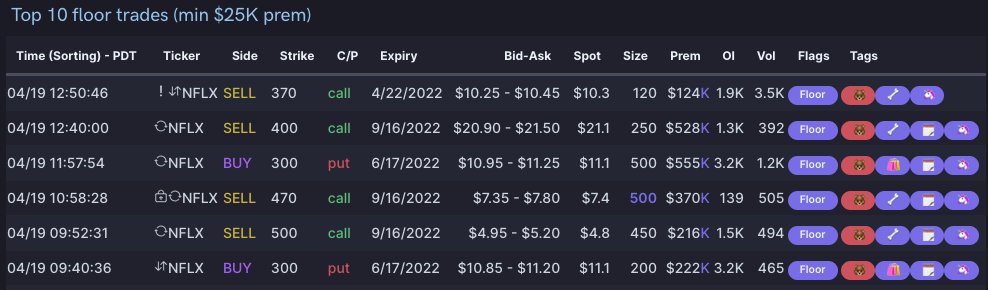

Unusual whales is a Twitter account noticed that “the most active hot chain before close” was $NFLXWith $300 put. “And the top floor trades were all bearish.” This means that traders with put options probably made a lot of money. It sounds as if they were aware that something was coming.

Similarly, the account also noted that “The trader made a massive profit. $NFLXPlaced position. Buy +100k @ $2 Ask 7 Days Ago. This position was worth 4500 volumes on the same day as 41 volume one day earlier, and expires in one month. Likely made 1000%.”