Core Scientific is one of the most prominent publicly traded bitcoin miners. A recent filing to the U.S Securities and Exchange Commission raises concerns that the company might file for bankruptcy protection. Core Scientific has stated in the filing that it will not be able to repay its debts due Oct. or early Nov. 2022.

SEC Filing Threatens Core Scientific Investors. CORZ slides 97% within 12 Months

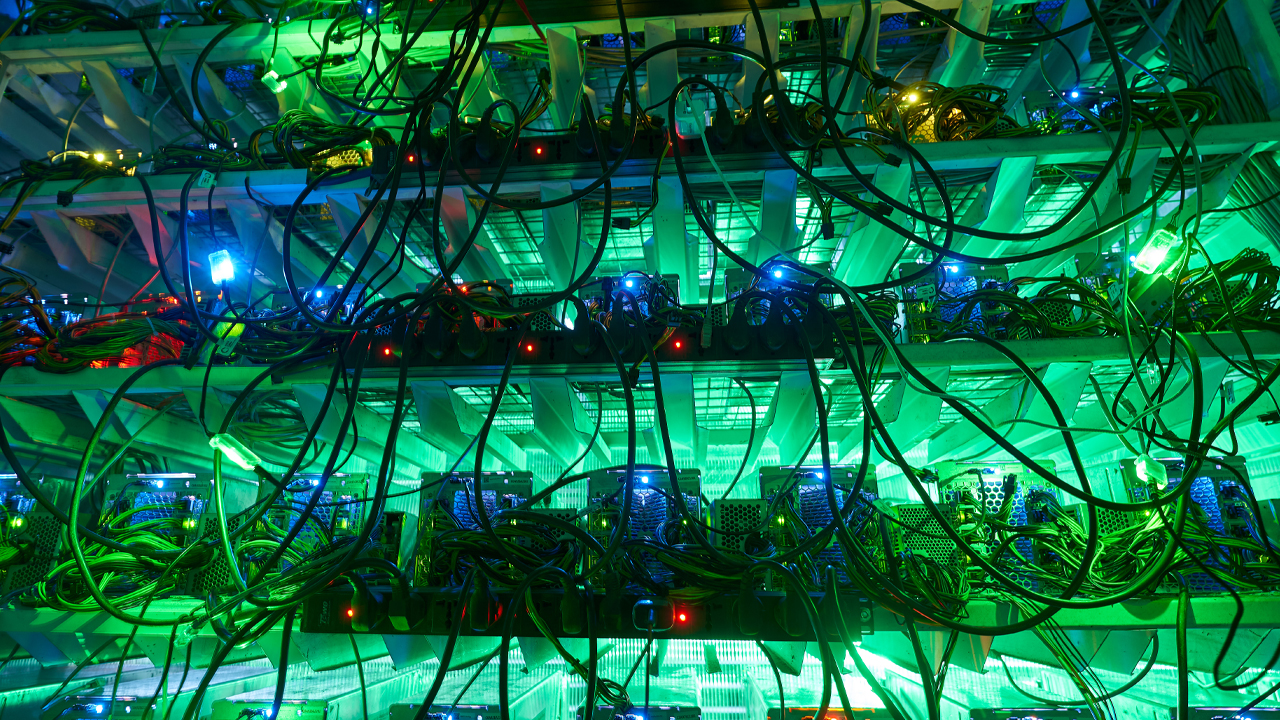

The price of Bitcoin (BTC), which has fallen 70% against the U.S.dollar since Nov. 10, 2020, is causing problems for bitcoin miners. Moreover, the network’s mining difficulty is currently at an all-time high, making it harder than ever before to find a block subsidy. At the end of September, Bitcoin.com News reported on Compute North filing for bankruptcy and how it led to Marathon Digital’s shares getting downgraded. Core Scientific (Nasdaq : CORZ), seems to lean in favor of either filing for bankruptcy protection, or some form of restructuring.

According to a U.S. Securities and Exchange Commission filed Core Scientific on October 26, 2022, the news is based upon that filing. Core Scientific states that it won’t be able make October and November loan payments. The team is currently in contact with legal firms to talk about a restructuring or bankruptcy protection. It claims that it has lost its funds and is blaming the bitcoin price (BTC) as well other forms of exposure.

“As previously disclosed, the Company’s operating performance and liquidity have been severely impacted by the prolonged decrease in the price of bitcoin, the increase in electricity costs, the increase in the global bitcoin network hash rate and the litigation with Celsius Networks LLC and its affiliates,” Core Scientific’s filing notes. As of Oct. 26, Core Scientific has roughly 24 BTC in reserves which equates to $497,901, using today’s BTC exchange rates.

Since the SEC filing, Core Scientific’s stock CORZ is down 97% year-to-date. On Oct. 28, Lucas Pipes, a B. Riley analyst downgraded CORZ from neutral to negative. “While Core has prioritized liquidity since the start of the crypto winter, we believe negative hosting margins (during 2Q) and compressed self-mining margins have exerted extra pressure on the company’s ability to meet its financial obligations,” the analyst noted on Friday.

What do you think about Core Scientific’s SEC filing? Comment below and let us know how you feel about the subject.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.