Sponsored

Many crypto exchanges send tax forms to the IRS, each with their own list of supported tokens and info that doesn’t necessarily match up. For U.S taxpayers, this can cause a lot confusion. Luckily, CointelliYou can create an unified tax report quickly and efficiently by pressing a button

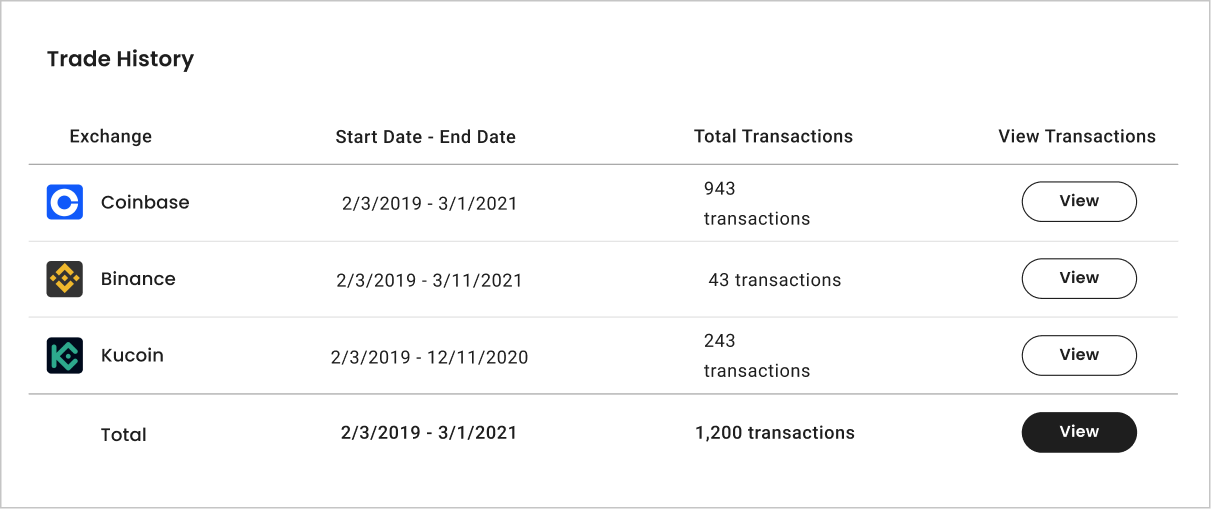

Cointelli also offers an error correction tool that allows users to easily modify data if they find inconsistencies between platforms. Cointelli’s algorithms make it easy to compile all of the data from Coinbase, Binance, Kraken, and many others into one tax report. All this for a very low price of $49

Is there a better software for cryptocurrency taxes?

American crypto investors and traders need to be able to navigate the tax system efficiently. Cryptocurrency has made things complicated for many people, as the IRS classifies it as ‘property’ for taxation purposes — dismantling a common misconception that there is no tax on crypto. U.S. investor are particularly required to be more attentive to cryptocurrency taxes reporting. The U.S. government is attempting to increase its share of cryptocurrency investments, which are experiencing a bullish trend. Since 2014, IRS has been drafting its crypto tax rules. Washington gave the IRS $80 billion in recent months to help catch tax evaders.

Crypto taxes aren’t easy to wrap your head around. Correctly reporting complicated transactions across multiple crypto platforms is often required in order to do them right. The right software is crucial for getting the job done quickly and accurately. Cointelli, a cloud-based cryptocurrency tax preparation software system that makes use of its unique technology to assist taxpayers, is available online. Individuals, CPAs, and businesses can save more crypto taxes. Cointelli is a specialist in helping crypto tax users to reap the maximum crypto tax benefits and accurately report their crypto taxes.

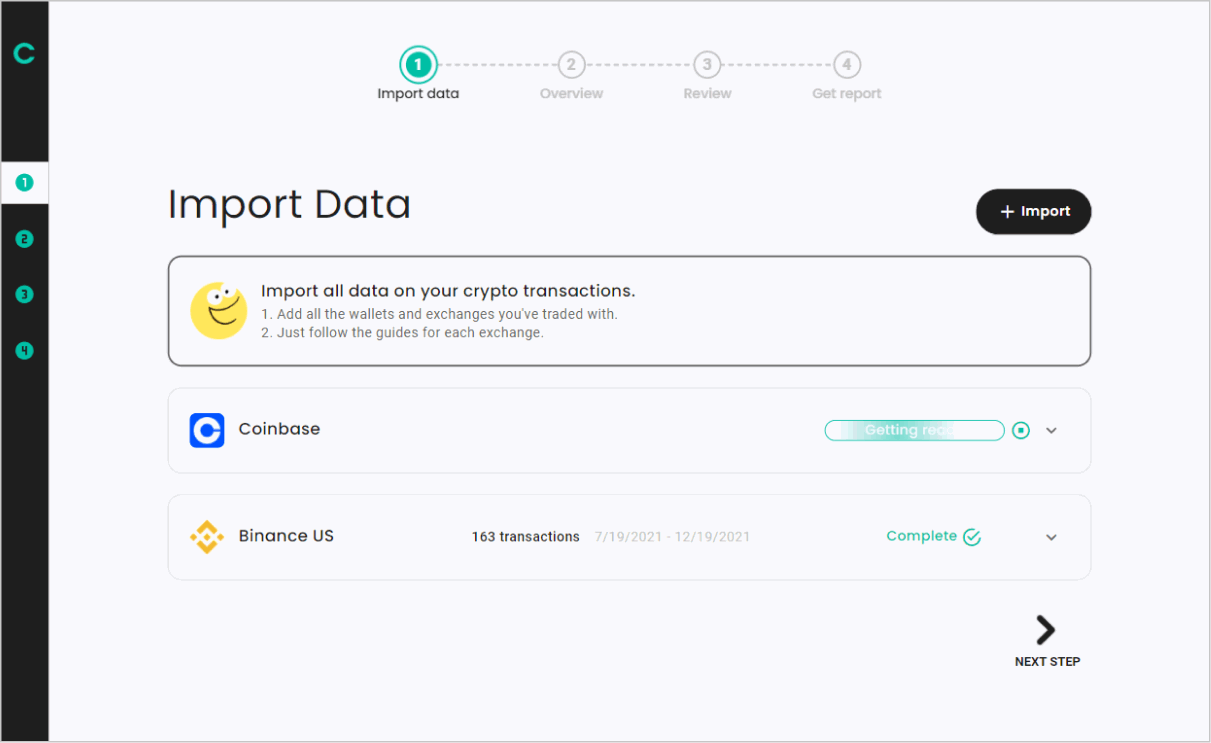

What is the other thing that sets Cointelli apart from others? The first and most important step to calculate your cryptocurrency taxes using tax software is to collect and import your transactions data across multiple wallets and exchanges. While this process might seem straightforward, you should be aware of the essential steps to assure accuracy.

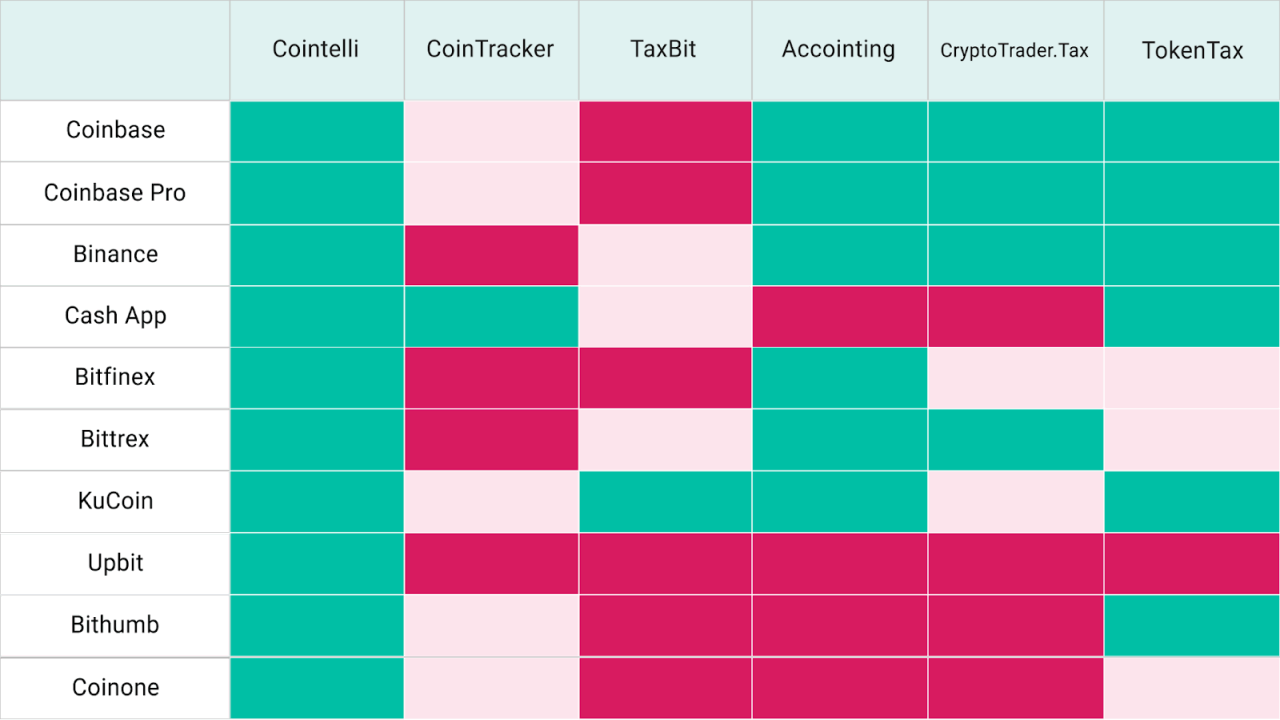

You must first check the number of crypto wallets and exchanges that this software supports. Cointelli, for example, supports a considerably larger number of major crypto exchanges than many competitors — and with full import capabilities. Cointelli also supports many smaller exchanges such as Binance and KuCoin. Cointelli offers support for 15 additional blockchains in addition to the popular Bitcoin, Ethereum and Dogecoin.

Cointelli supports more exchanges and wallets, and offers the easiest way to import transaction data across all platforms. Cointelli is an ideal choice for anyone looking to get crypto tax software.

The IRS: Reporting taxes

Important exchanges such as Binance, Kraken and Coinbase send IRS different forms (for example, Coinbase reports 1099 MiSCs while Kraken reports more types of 1099 Forms). But these exchanges can only see the transactions which occur in their system. Each significant exchange also has its own list of supported cryptocurrencies, which won’t necessarily match up with other lists. This is why it’s so important to have a crypto tax software solution that quickly and accurately aggregates all of this information in one place and processes it for you.

Cointelli offers these services but also makes them accessible to all for a flat fee of $49 per annum and with no hidden charges. In addition, users can run the program for free to see how much they will be paying in crypto taxes, and won’t pay anything until they decide to download the completed Form 8949. It is easy to download and fill out the reports. Cointelli has an intuitive interface, is easy to use and offers 24 hour customer service.

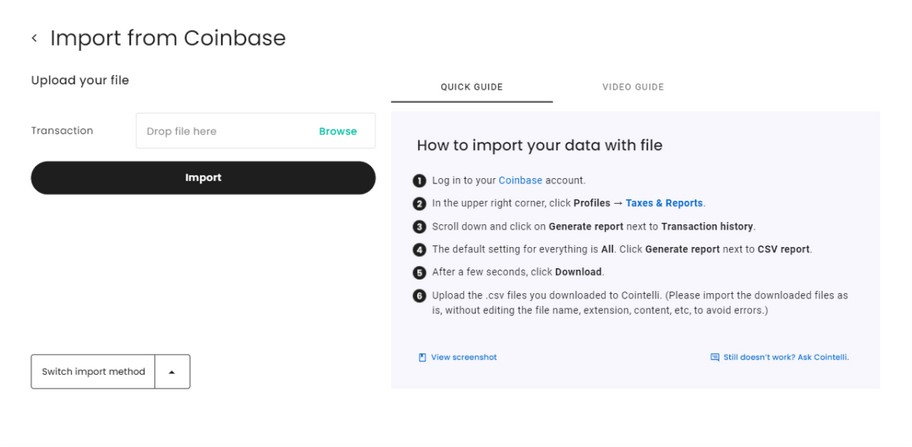

The import of transaction data to Cointelli is simple from exchanges like Coinbase and Kraken. But for anyone having trouble, Cointelli provides detailed and instructive guides and walkthroughs to show you exactly how it’s done.

You can import Binance.US data by following the steps below.

How to Import Currency Data From Binance.US

- Below, copy and paste the API key.

You will then be able confirm your transactions once the import process is completed. Once that’s done, Cointelli will then prepare your Form 8949.

You will then be able confirm your transactions once the import process is completed. Once that’s done, Cointelli will then prepare your Form 8949.

But what if you’ve traded somewhere else, like on Kraken or Coinbase? It’s no problem. Just follow Cointelli’s instructions for each exchange, and soon you’ll have your tax forms in hand.

More information is available by clicking here

- The purpose of this article is to give general information about financial matters that can be used to inform a large audience. It does not offer personalized advice on tax, investments, legal or any other professional areas. You should consult your professional tax advisor before taking any actions. They can advise you on your taxes, investments, and the law.

- Cointelli can currently be purchased only in the US. This information relates to the US.

This is an affiliate post. How to reach your audience? Read disclaimer below.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.