Since crypto prices have fallen to their lowest point, now is the ideal time to “Buy-the-Dip.” But during these brief price declines, traders appear to be shorting cryptocurrency more than they are buying it.

“Buy-the-Dip” Sentiments Does Not Stop Crypto Shorting

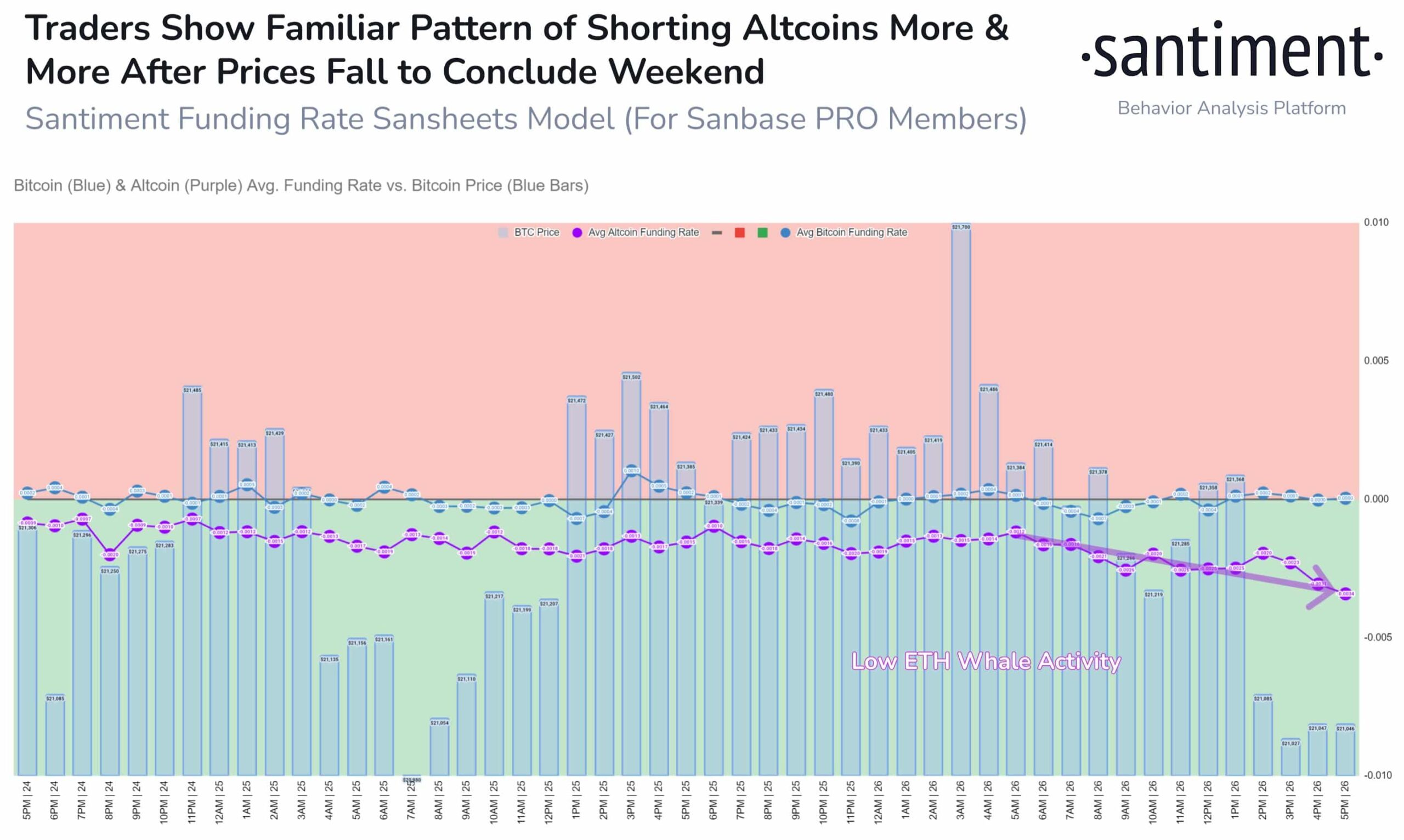

Altcoins are more popular for short sales and shorting than bitcoin. Over the last day, Bitcoin’s short position averaged 51% on all exchanges. Altcoin short positions averaged 55%.

BTC/USD is hovering around $20k. Source: TradingView

SantimentAccording to a tool for on-chain analysis, if you look at data regarding the average financing rate for Bitcoin or altcoins relative the bitcoin price, it is clear that traders are still trading altcoins even if the price falls. In contrast, the Bitcoin long/short ratio is unaffected by price swings.

“As prices gradually fell on Sunday, traders have shown that though they may proclaim to be BuythedipThese are The practice of shorteningThese mini drops are more. This applies only to AltcoinsIt is now that we are indicating Bitcoin is being flocked to as the safe haven.”

Coinglass data shows that traders continued to short crypto Monday. A $25 million liquidation in Ethereum (ETH), saw 56 percent of the market shorted. Polkadot DOT, Solana OL, XRP Cardano ADA, and BNB saw 55 percent to 59 percent as well as 63 percent, 67 per cent and 53 percentage shorts, respectively.

Similar reading: Bitcoin Perpetual OPEN Interest Suggestions Short Squeeze To Crash| Bitcoin Perpetual Open Interest Suggests Short Squeeze Led To Crash

Bitcoin and Altcoin Shortselling Source: Santiment

It’s interesting to note that in the past 24 hours, short positions in Tether (USDT) have increased by 85% across exchanges. Some short sellers think that Chinese real estate brokers back the majority of Tether’s assets in commercial paper. USDT saw significant redemptions in the past month which has caused its market cap to plummet to around $66 billion.

In spite of the dim market outlook hedge funds are gradually shorting Tether (USDT), a U.S.-dollar-pegged stablecoin.

Liquidation OF Altcoins Rises Amid Short Selling

As traders short altcoins, liquidity is also rising. Altcoins which were active traded early in the morning are now in negative. The price of Ethereum (ETH), due to a recent rise in liquidity, has fallen by approximately 4% over the last 24 hours. Others altcoins also lost gains and are now falling.

Similar reading: Doom to Fail: As Crypto Winter Gains, Tether Shorts Become More Common.| Doom To Fail: Tether Shorts Pile In As Hedge Funds Seek To Profit From Crypto Winter