As bears continued their rampant activity in the crypto markets, Bitcoin fell below $30,000 for its first time in 11 months. Luna Foundation Guard had been liquidating nearly $1.5 billion of BTC. Ethereum prices also dropped to near multimonth lows as they hovered around $2,200.

Bitcoin

Bitcoin dropped for the seventh session in a row as the markets reacted the Luna Foundation Guard’s announcement that it was going to deploy $1.5 BTC to help recover its $1 UST peg.

The latest decline in BTC/USD saw prices hit an intraday low of $29,944.80 earlier in today’s session, following a peak of $33,312.81 on Monday.

Today’s bottom is the lowest level prices have traded since June 2021, and comes as an increase of bearish pressure led to the $31,625 support point being broken.

BTC trades around 55% less than November’s record-breaking high. Some believe the worst has ended.

The chart shows that the 14-day RSI has been tracking at 32 on the charts, close to the lowest point since February.

The floor is not yet established, but $29,000.500 could be a candidate for price support due to the recent fall in value.

If this is the case, then we may see some consolidation before any bullish rebounds.

Ethereum

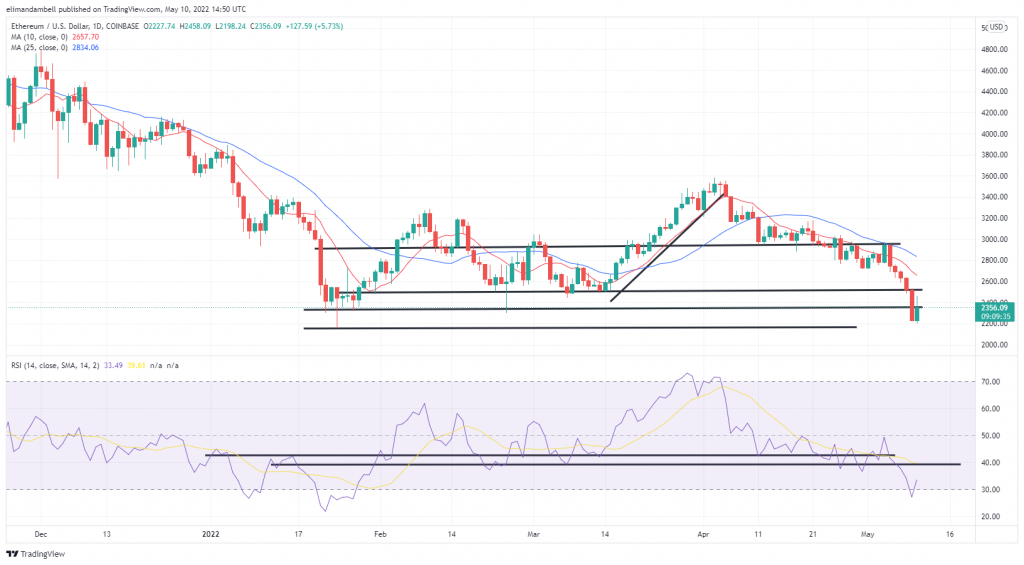

The world’s second-largest cryptocurrency also fell during today’s session, dropping below $2,300 for the first time since January.

The intraday lowest price for Ethereum/USD on Tuesday was $2206.76. That’s its lowest point since January 24, when it hit a $2,150 floor.

This latest drop comes as yesterday’s support point of $2,350 gave way, following a six-day losing streak.

At the time of writing, Relative Strength Index 14 days is at the top, just a few months from its three-month lowest.

Typically, with prices so oversold, traders would likely look at this as an opportunity to buy the dip, however as markets continue to reassess risk assets following the Fed’s rate decision, this may not be the case immediately.

As of this writing, overall crypto markets have fallen by 2.7%.

Is it possible that ETH might fall to $2,000 next week? Please leave your comments.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThe information contained in this article is intended to be informative. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.