Bitcoin has outperformed all crypto Market Cap-Weighted Indexes in January as merchants flip to much less dangerous property amidst worry over the Federal Reserve tightening, thus the king of digital property claims its place as crypto’s secure heaven.

Associated Studying | Bitcoin Begins To Kind A Backside? Why $40K Is The Subsequent Goal

Bitcoin As a Crypto Protected Haven

The considered Bitcoin (BTC) being a secure haven asset is kind of widespread, however it opposes the critics who declare BTC –and all crypto property– is just too dangerous, risky, and speculative to develop into a secure haven. Nevertheless, contained in the crypto promote it stays the much less dangerous asset.

January was a really risky month for the crypto market amidst the traders worry over The Federal Reserve (FED) hawkish strikes, however an Arcane Analysis report make clear how Bitcoin outperformed the opposite crypto indexes available in the market through the bloodshed, thus sustaining its picture because the much less dangerous crypto asset to traders, particularly throughout instances of excessive volatility and uncertainty.

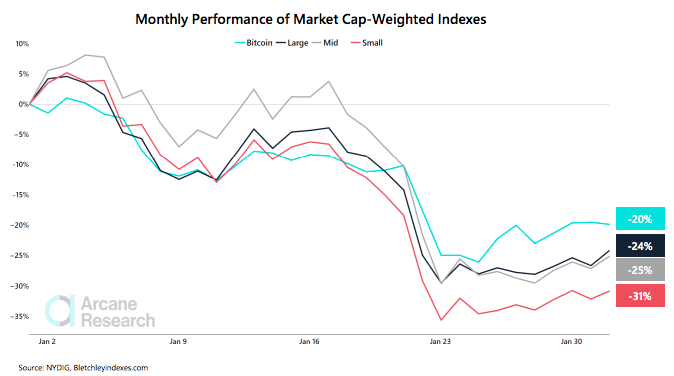

As merchants take a extra conservative place and look away from essentially the most speculative property, the Arcane report highlights how all crypto indexes noticed losses between 20% and 31% this previous month.

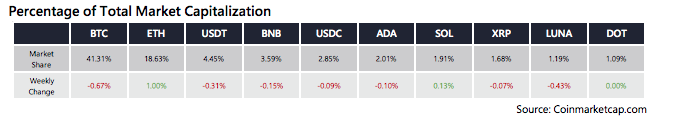

Nevertheless, like the next charts present, BTC outperformed all altcoins conserving the very best crypto market cap and counting much less losses. In the meantime, the Small Cap Index fell the toughest, displaying how the crypto market shifted amidst the merchants’ conservatory tendency.

This will get us again to the “BTC as a crypto secure haven” perception, because the digital coin stays the least dangerous crypto asset to traders, who lean on it in instances of turmoil.

Then again, the market sentiment is rigorously bettering “with the Worry and Greed Index now ‘solely’ signaling ‘worry’ after a sustained interval of ‘excessive worry’”. This might imply a greater panorama for altcoins as merchants’ place would possibly flip round to the much less “boring” property.

In the intervening time of writing, Bitcoin trades at $38,545, up 0.98% within the final 24 hours.

What Research Have Stated Over The Years

Past the crypto market, some research had predicted that “Traders within the US might cautiously use bitcoin as a hedge towards uncertainties.”

A examine from 2019 that assessed whether or not Bitcoin could possibly be a hedge on the intraday degree gave outcomes that indicated that “Bitcoin might be deemed a hedge at varied intervals of time” in addition to a “diversifier for forex traders.”

Moreover, their outcomes from a non-temporal threshold evaluation revealed that “Bitcoin is a secure haven throughout excessive and excessive intervals of market turmoil for the CAD, CHF and GBP, however fails to behave as a secure haven for the opposite currencies.”

Then in 2020, different consultants concluded the next:

Primarily based on the WHO COVID-19 pandemic proclamation on March 11, 2020, we check the Bitcoin and Ethereum as safe-havens for shares. Our dynamic correlations and regressions outcomes present that Bitcoin and Ethereum, as the 2 main cryptocurrencies, show short-term safe-haven traits for shares.

Nevertheless, different analysis carried out in the identical yr had opposing conclusions, coming to disclaim the digital coin as a secure haven:

“Throughout the interval into account, we discover that the S&P 500 and Bitcoin transfer in lockstep, leading to elevated draw back danger for an investor with an allocation to Bitcoin.”

Because the worldwide political and financial panorama evolves with excessive uncertainties this yr, new information to come back will most probably be related when making a case about how the crypto market reacts and which digital cash can develop into essentially the most helpful instruments.

Associated Studying | TA: Bitcoin Close to Essential Juncture: Why BTC Might Surge Additional