In accordance with the chief government officer (CEO) of the United Arab Emirates-based monetary establishment, Financial institution of Sharjah, blockchain and cryptocurrencies will not be solely troublesome to control however are additionally right here to remain. Regardless of this prediction, the CEO admits that many within the banking business nonetheless don’t totally perceive this know-how.

A Revolutionary Expertise

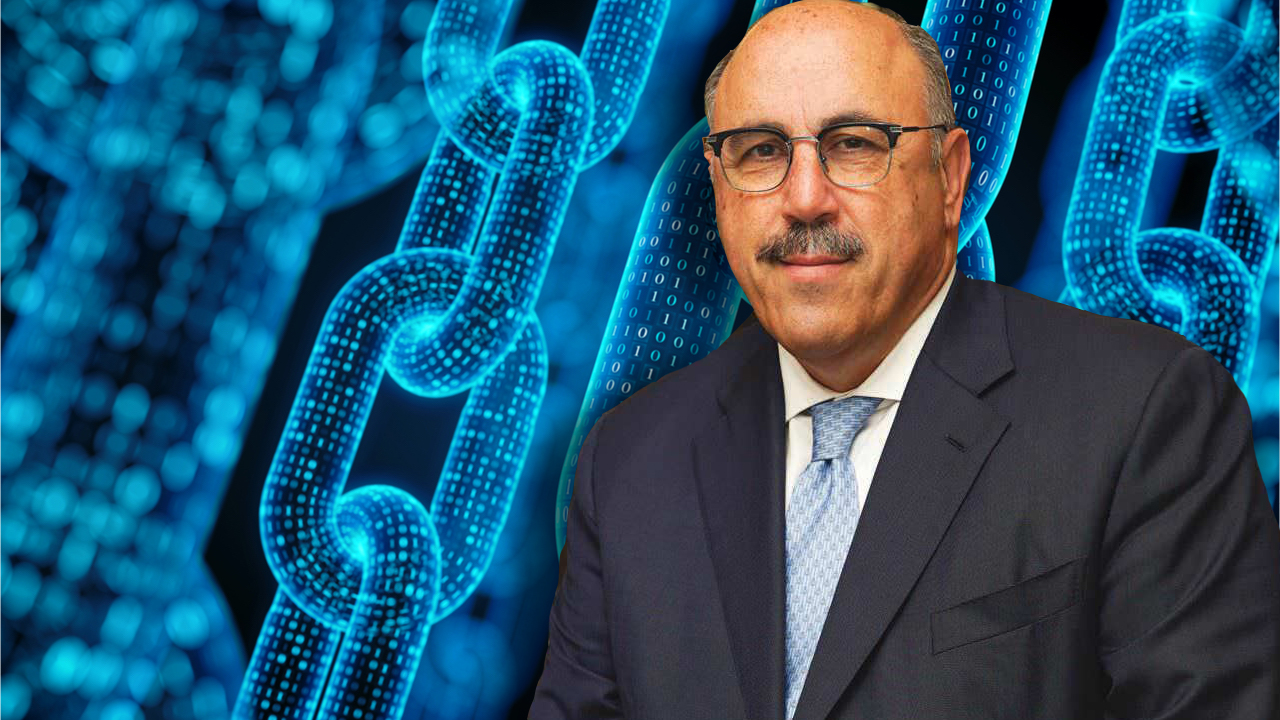

The CEO of Financial institution of Sharjah, Varouj Nerguizian, has stated the blockchain and cryptocurrencies will not be going away however are prone to change into a big a part of the banking system. Nerguizian, nevertheless, stated banks can solely totally profit from know-how after they deploy personal or enterprise blockchains.

In feedback made throughout an interview with Emirates Information, the CEO additionally defined how the blockchain can doubtlessly be a double-edged sword to monetary establishments which are trying to adapt to the post-pandemic panorama. He stated:

Blockchain is a revolutionary know-how that’s not but totally understood by the banking business at massive. Whereas its software is straightforward to understand in sure areas like Know Your Buyer [KYC] or the true property title deed verification, blockchain supposedly permits events to transact with one another with out the necessity for an middleman. This raises the considerations of the authorities that want to monitor the exercise.

Regarding the way forward for blockchain and cryptocurrencies, particularly within the wake of elevated stress from regulators and governments around the globe, Nerguizian is quoted asserting that the know-how just isn’t going away.

“I personally imagine blockchain know-how and by extension, cryptocurrency is right here to remain and [are] unattainable to control at massive. Nevertheless, in UAE, jurisdictions like Abu Dhabi International Market [ADGM] and Dubai Worldwide Monetary Centre [DIFC] have provide you with crypto laws and would possibly in time be a big a part of the banking panorama as we transfer ahead,” Nerguizian is quoted explaining.

Digital Transformation

In the meantime, the CEO is also quoted within the report expressing his perception that the banking business had been headed for a digital transformation even earlier than the pandemic struck. Because the pandemic unfold globally, extra firms together with banks shifted to a observe the place workers labored remotely.

In accordance with Nerguizian, when banks exploit their workers’ skill to work remotely they may seemingly “reap future good points and profitability.”

Do you agree with Nerguizian’s view that cryptocurrencies are right here to remain? Inform us what you assume within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss induced or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.