Bank of America Securities market strategists have explained this week in a note that bitcoin, the most popular crypto-asset, has been closely associated with gold. Bank of America analysts Alkesh Shah and Andrew Moss noted “that investors may view bitcoin as a relative safe haven as macro uncertainty continues.”

Bank of America’s Market Strategists Say Bitcoin’s Rising Correlation With Gold Indicates ‘Investors May View Bitcoin as a Relative Safe Haven’

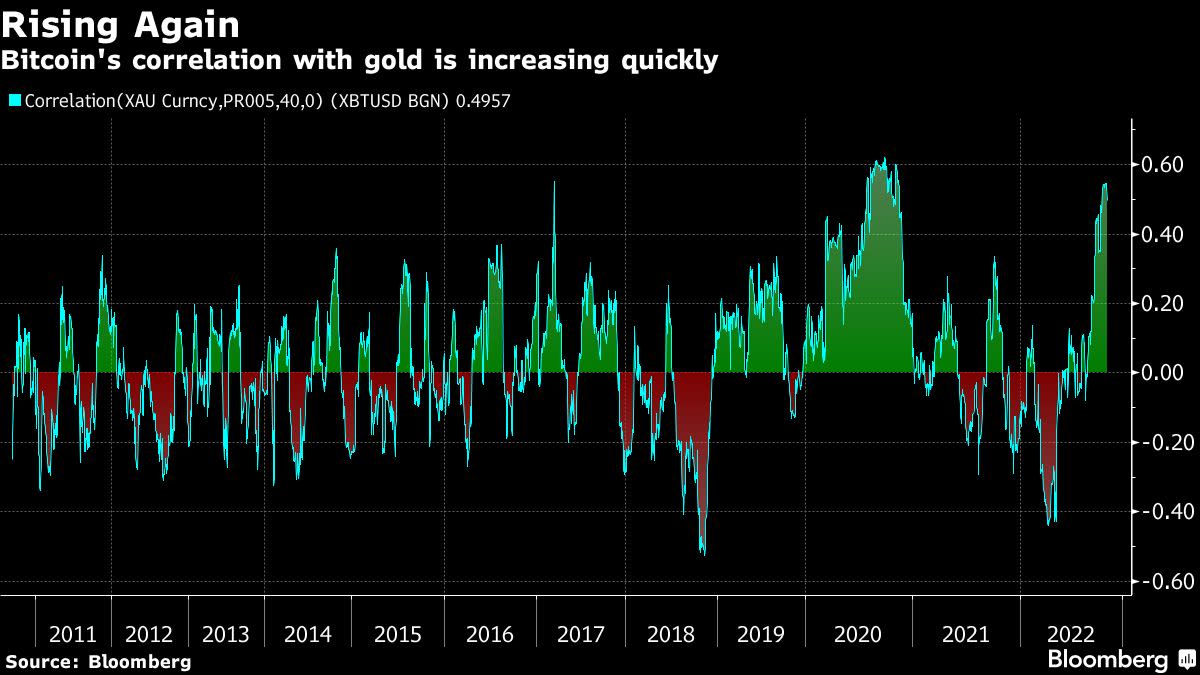

Market strategists from Bank of America’s securities division, Alkesh Shah and Andrew Moss, detailedIt was revealed this week that gold and bitcoin have shown a high degree of correlation in recent months. The news follows the recent report published by the crypto data provider Kaiko, which says bitcoin has been less volatile than the Nasdaq and S&P 500 indices. According to the Bank of America strategists, bitcoin’s (BTC) price fluctuations, in terms of other global assets, have caused investors to think BTC is a safe-haven asset.

“A decelerating positive correlation with SPX/QQQ and a rapidly rising correlation with XAU indicate that investors may view bitcoin as a relative safe haven as macro uncertainty continues and a market bottom remains to be seen,” Bank of America’s securities division analysts wrote.

BTC (Bitcoin) and gold prices were range bound on Monday October 24th and are less volatile than equity markets. BTC trades at just over $19K per unit while an ounce.999 gold can be bought for 1,646.70 U.S. Dollars. Bank of America’s Shah and Moss have been monitoring the 40-day correlation with gold, which is around 0.50 this week. This rating, 0.50, is closer to gold than the August zero rating that the most popular crypto asset BTC received.

It comes as macro uncertainty is increasing and analysts are warning that U.S. Federal Reserve Rate hikes might cause a U.S. Treasuries liquidity emergency. Although market observers anticipate an aggressive rate rise next month, strategists predict that the Fed’s pivot will take place by December. Both gold and BTC have fallen a great deal since the two asset’s all-time price highs. For example, on March 8, 2022 when gold hit $2,074 per anounce, it reached its highest ever lifetime value against the U.S. dollars.

The U.S. Dollar has dropped 20.49% since gold’s all-time peak of 230 days ago. After reaching $69,044 for each unit, bitcoin (BTC), has lost 72% to the dollar over the past year. Gold today has an overall market capitalization of around $10.895 trillion, while BTC’s market capitalization is around $369 billion.

What do you think about Bank of America’s Shah and Moss explaining that gold and bitcoin have been correlated during the last 40 days? Do you think investors perceive bitcoin as a safe-haven amid today’s macro uncertainty? Comment below to share your views.

Image creditShutterstock. Pixabay. Wiki commons. Credit: Bloomberg.

DisclaimerThis information is provided for educational purposes only. This is not an invitation to purchase or sell directly, nor a suggestion or endorsement of products, services or companies. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.