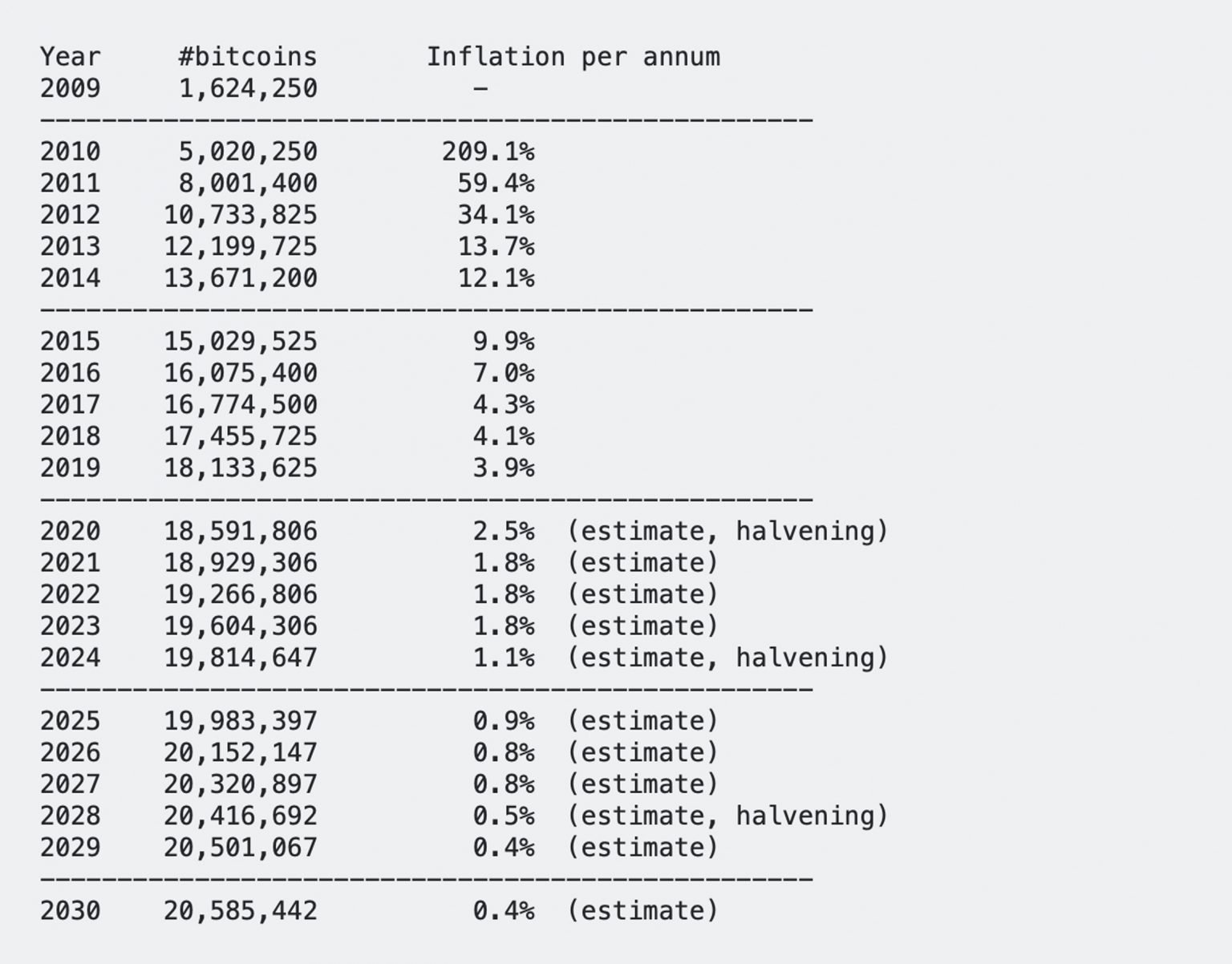

Records show that 19.3 million bitcoins were mined in April. 133 days later there is still 1.88 million bitcoins to be mined. The network’s block subsidy halving is expected to occur on or around April 20, 2024, as there are less than 91,000 bitcoins left to mine until that point. While Bitcoin’s inflation rate per annum is 1.73% today, after the halving in 2024, the crypto asset’s yearly inflation rate will be down to 1.1%.

The Institute of Mathematics: ‘Bitcoin Can Only Function Because of the Clever Mathematics Which Is in the Background Enabling It to Exist’

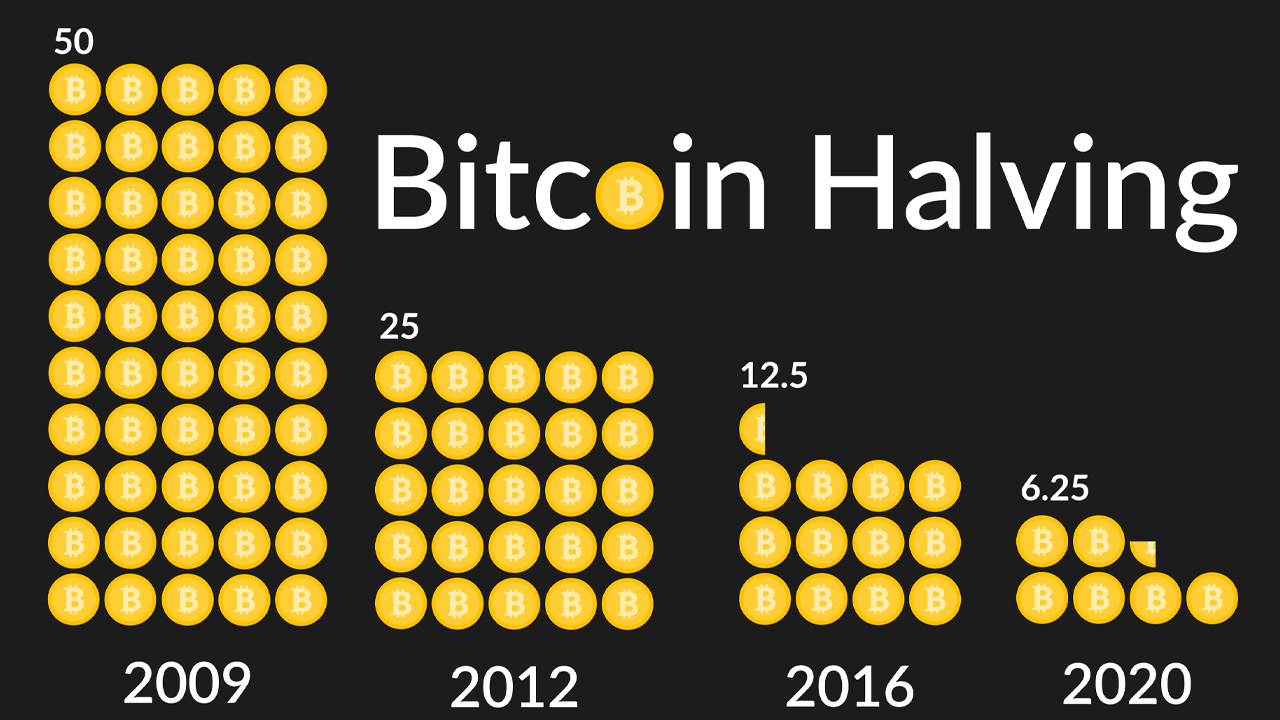

Time goes by fast and today, there’s less than two years left until the next Bitcoin reward halving takes place roughly 617 days from now. Bitcoin rewards miners for discovering a block by someone who dedicates hashrate to it. As of the writing, miners receive 6.25 bitcoins for each block. On or about April 20, 2024 the block reward will drop to 3.125 Bitcoins per block. The mining process will make it much harder to acquire bitcoins. Today, only 1.88million bitcoins remain to mine.

Bitcoin can be used to predict the future and operate in an autonomous manner. Unlike the unpredictable inflation rate in the U.S., people can safely predict Bitcoin’s inflation rate per annum. There’s no stimulus added to the equation and central bankers cannot change Bitcoin’s issuance rate per year on a whim as they often do when there’s an ‘emergency.’ When the next Bitcoin halving takes place, Bitcoin’s issuance rate per year will be 1.1%. With Bitcoin’s open network, the public knows this for a fact. On the other side, the Federal Reserve can create booms or busts by raising the monetary supply, hiking, and lowering its benchmark federal funds rate.

Gold’s Correlation to Inflation and the Precious Metal’s so-Called Scarcity

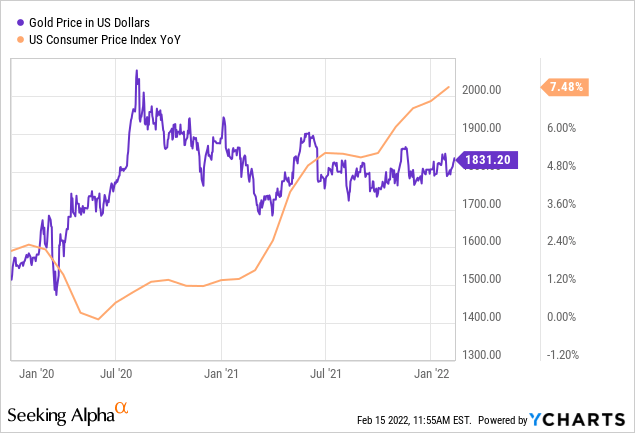

While the precious metal gold is considered scarce and people suspect the price of gold will rise during economic uncertainty, that’s not necessarily a fact. Research shows that gold has “an extremely low correlation to inflation.” While Bitcoin is a very predictable financial system, the crypto asset itself has a low correlation to inflation as well. The U.S. inflation rate and the consumer price index (CPI), both rose, and bitcoin’s (BTC) value dropped. Inflation rates worldwide have also increased. While BTC hasn’t seen much correlation with inflation — like gold and silver — it is still a more predictable asset class than precious metals.

There are rough estimates of how much gold gets mined each year. Statistics show that around 2,500 tons is extracted every year from the earth. This estimate, however, is based on gold smuggling and may be an educated guess. Surprise gold deposits also hurt gold’s alleged scarcity factor and it is well known that there are massive gold deposits under the ocean floor, and within asteroids in space as well. However, human beings cannot currently access gold under the seafloor or in space. These elements make gold scarce. A U.S. Geological Survey estimate says there’s roughly 50,000 tons of gold under the earth’s surface, but the estimate is assessed as “a moving number.”

Fiat currency Issuance rates for gold and fiat currencies are not reliable, while bitcoin is a far more predictable monetary asset

As far as Bitcoin’s monetary supply is concerned, the public knows for a fact that there will only be 21 million bitcoin. With gold we know there’s roughly 20% of the earth’s gold remaining, but because some methods of mining are uneconomical right now, there’s a chance they could become profitable in the future. Meaning, there’s a chance that technology advances enough to where gold miners can access the precious metals buried under the ocean floor or in asteroids out in space. This could lead to gold and other precious metals becoming less rare, just as central banks print fiat currency at will. With Bitcoin, we know that’s not the case, and won’t be, as the network’s inflation rate per annum will continue to decline.

As of this writing, the Bitcoin inflation rates are around 1.7%. The next halving will bring it down to 1.1%, in 2024. By the next year in 2025, Bitcoin’s inflation rate per annum will drop below 1% and by the 2028 halving, the issuance rate will be around 0.5% per annum. While we know the end of bitcoin mining in 2140 is imminent, it’s not clear if that will happen for gold mining. Moreover, after the central bank’s monetary expansion over the last two years, estimating the inflation rate bankers set is like trying to read tea leaves.

Although bitcoin is not the most effective hedge against inflation right now, it can be guaranteed that the asset will remain scarce and more predictable than other monetary assets.

What do you think about Bitcoin’s Mathematical Monetary Policy being more predictable than gold or fiat currencies? Comment below and let us know how you feel about the subject.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.