For both Bitcoin and the international financial markets, the Federal Reserve (FED), continues to be the determining factor. With that in mind, everyone’s eyes will be on November 02th, when the Federal Open Market Committee meeting (FOMC), is set.

While this may be an external market threat, it is not the only one that’s currently developing. A Bitcoin miner capitulation is another historical risk.

The lower Bitcoin falls and the longer the price stays at the current level, the more pressure is put on Bitcoin miners’ margins by a divergence of price and hash rate.

Bitcoin’s Mining Difficulty Reaches A New ATH

The Bitcoin mining difficulty adjustment of yesterday showed that it rose by 3.44%. It follows an historical adjustment that took place on October 10, where the mining difficulty rose by 13.55%.

#BitcoinMining difficulty just rose by +3.44%. This is a new record as the hash rate keeps rising.

They are never tired. pic.twitter.com/4GEyHxYoZ8

— Dylan LeClair 🟠 (@DylanLeClair_) October 24, 2022

In order to reflect fluctuations in the hash power of the network, the difficulty is adjusted approximately every 2 weeks. Also to make sure that there are new Bitcoins being created approximately every 10 min (block time),

Yesterday’s adjustment is thus likely to put further pressure on already struggling miners who are seeing dwindling profits. Will Clemente is co-founder and CEO of Reflexivity Research. asserted that “miners are the biggest intra-Bitcoin market risk right now IMO”.

A compelling theory for the steady rise in the hash rate, he says, is that a well-funded player is trying to squeeze out inefficient miners and acquire their assets on the cheap, “Rockefeller-style”.

Miner capitulation may result. The non-profitable miner would need to sell their Bitcoins and mining hardware during this time. This could cause significant selling pressure to the Bitcoin price on a large scale as was seen in past miner capitulations.

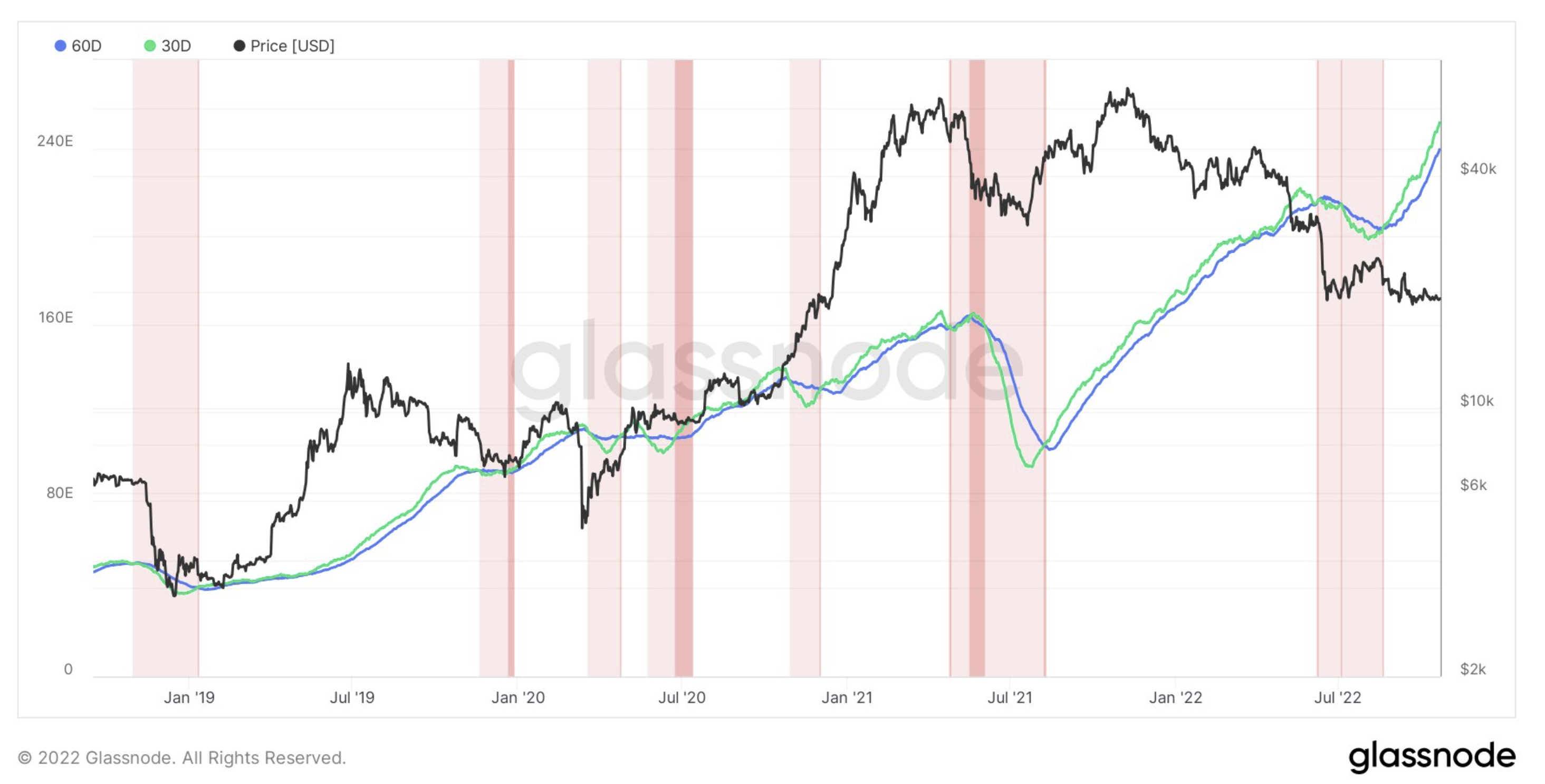

Clemente indicated that it is more likely to see a second miner capitulate after the June period. Haveh ribbons should be the leading indicator.

Clemente concluded:

Thinking about who this entity(s) is that feels that it’s advantageous to mine with BTC price down 70%, energy prices high, & hashprice at all-time lows. It is possible that the large players have excess energy and/or access to dirt-cheap electricity. […] That’s why I’m so curious because this would have to be someone with extremely low energy costs. Haven’t seen any great answers thus far.

Big Name Bitcoin Miners In Trouble?

Dylan LeClair is a senior analyst with UTXO Management. He also co-founded 21stParadigm. notedThe 2020 record low for the hash price (or miner revenue per TeraHash) was just passed by the latter. According to him, price falls are just beginning if the past bear markets continue.

In addition, he revealed that he has heard “some juicy rumors flying around about some big name Bitcoin miners being in trouble here”.

According to him, there are two possible outcomes for the continued pressure placed on Bitcoin miners. Or, this could be the bottom. “The lack of vol shows apathy from sellers. Extended consolidation/accumulation period,” LeClair stated.

Analysts believe that BTC will reach $6,000 by 2019 and this scenario is more probable. The increasing pressure on miners will lead to a capitulation event if the hash rate keeps rising.

As of press time, BTC prices remained steady at $19,000.