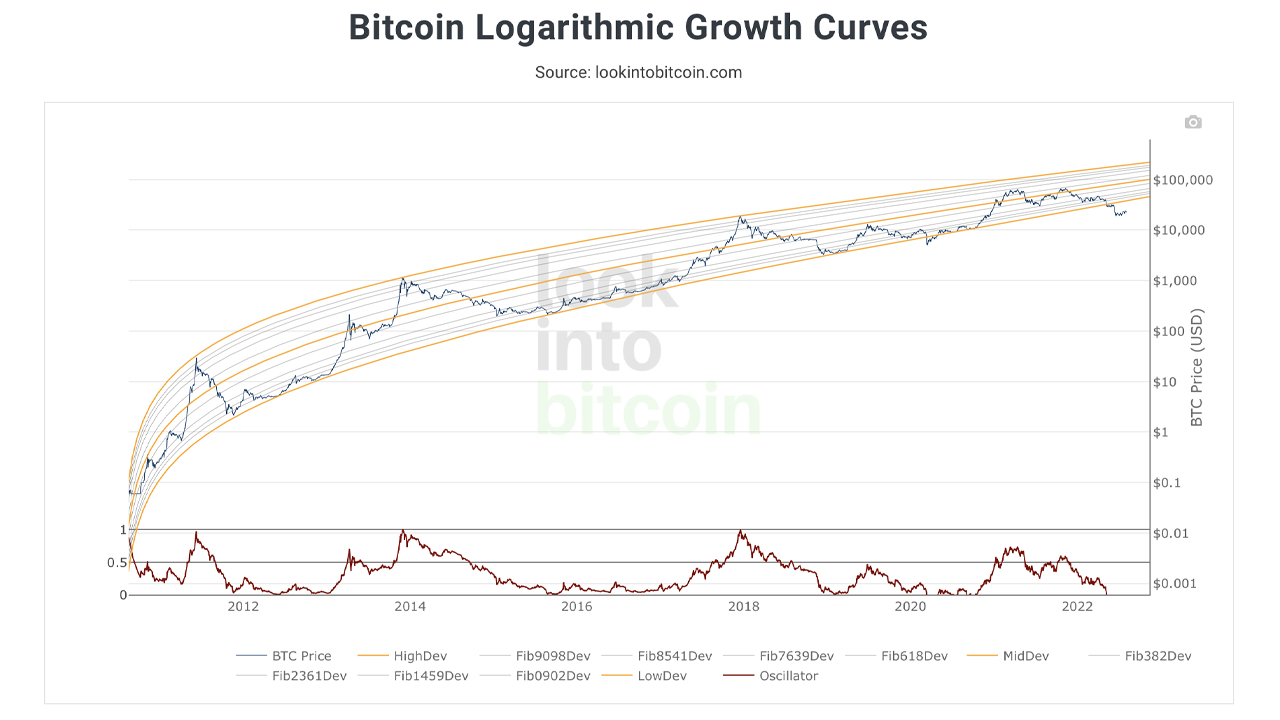

As more than $2 trillion has been lost to the cryptocurrency economy, 2022’s bear market was brutal. In addition to record values lost, the crypto winter has managed to break a number of popular bitcoin price models like the rainbow price chart and Plan B’s infamous stock-to-flow model. Moreover, since May 11, 2022, the well known power-law corridor model or logarithmic growth curves chart has also broken, and it’s deviated below the lower band for roughly 86 days.

A Deviation From the Norm: 2022’s Bitcoin Bear Market Breaks Some of the Most Popular Price Models

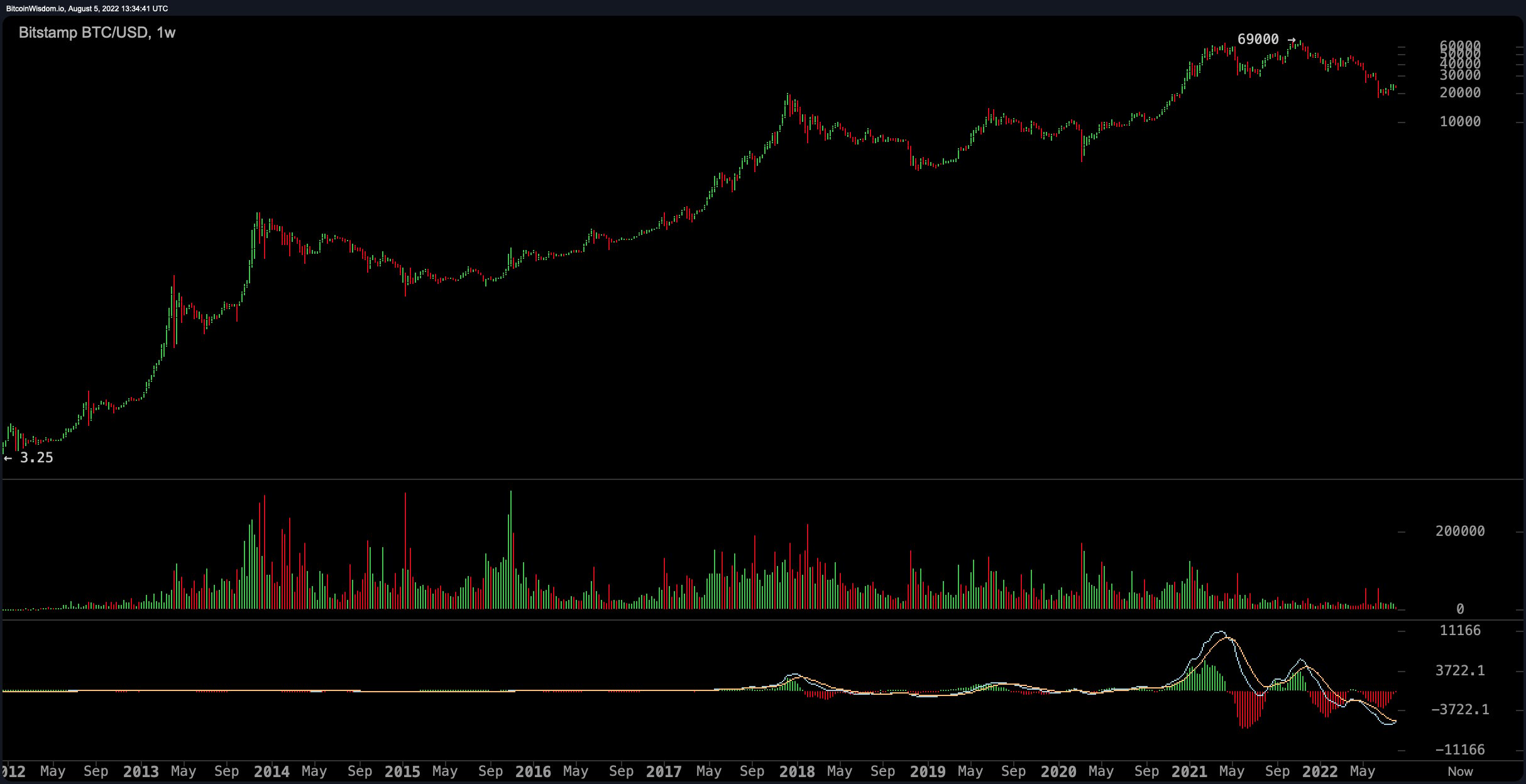

Crypto traders have used charts and tools for years to forecast the value of bitcoin and other digital assets. Bitcoin.com News has written about Plan B’s stock-to-flow (S2F) price model on many occasions and in 2021 the S2F model was fairly accurate up until the end of November.

A lot of bitcoiners also depend on various charts and price models, such as the Fibonacci sequences, rainbow model and logarithmic curves for growth. During the last quarter of 2021, bitcoin traders expected BTC to reach $100K per coin by the year’s end.

In September 2021, when BTC was swapping for prices between $45K and $50K, the lead insights analyst at Blockware Solutions, Will Clemente, tweeted about a new price model he called the “Illiquid Supply Floor.” At that time, Clemente said the model combined Glassnode’s illiquid supply data with Plan B’s S2F model and said it created a bitcoin floor price based on BTC’s real-time scarcity.

The floor value Clemente predicted was $39K and as time passed the analyst’s Illiquid Supply Floor model broke. Even after Plan B’s S2F “worst-case scenario” prediction deviated at the end of November, the pseudonymous analyst said he was confident that bitcoin’s price was still “on track towards $100K.”

These price models did not work out as predicted, and the cryptocurrency bear market was just beginning, so they were not a good idea. openly mockedIt was denounced widely by the crypto community. The Illiquid Supply Floor was not solid, S2F broke, and people made fun of the popular “Rainbow” price indicator.

For the rainbow chart, I have created an improved and new model pic.twitter.com/zgjbqQtOb1

— LevelsDennis.lens (@levelsdennis) June 19, 2022

Popular Power-Law Corridor Model has gotten an 86 consecutive day break from the Norm

A popular Bitcoin price model known as power-law corridor, also called logarithmic growth curves chart or the power law corridor, was broken on May 11, 2022. The chart is favored because BTC’s price timeline can be seen from a logarithmic perspective. A log price chart is a popular tool in crypto- and financial technical analysis.

Charts of Bitcoin logarithmic growth curves are available on cryptocurrency web portals like lookintobitcoin.com or coinglass.com. The current deviation is unusual as BTC’s price has only dropped below the lower band two times in history prior to 2022. This was the first noticeable deviation, which occurred in October 2010. The second one took place March 11, 2020.

March 11, 2020, otherwise known as ‘Black Thursday,’ was an interesting day for every asset on planet earth as financial markets shuddered across the board. BTC was trading below $4K, with the movement falling below the low-dev line of the logarithmic curves chart.

This specific occurrence didn’t last very long as global markets rebounded from the initial Covid-19 scare, and a bull market took place almost immediately after. Bitcoin’s price skyrocketed to the $64K zone in April 2021, and above that range to $69K on November 10, 2021.

Nine months later, bitcoin’s (BTC) price is down 66% below the $69K all-time high, and the popular and often reliable logarithmic growth curves model has been broken for 86 consecutive days. While BTC has seen the first bear market rally, the price still has a ways to go to get back into the power-law corridor’s lower band.

The price must be in the 35K to $35K price range to allow the price to rise. The price of bitcoin has never breached below the low band line for so long, and it is unusual when looking at BTC’s 13 years of price cycles. The break shows that markets often follow specific mathematical laws, patterns, and models, but these types of technical methods don’t always ring true.

Currently, the latest bear market rally and other factors indicate that it’s quite possible the bottom is in for this specific crypto winter, but as charts and signals like these have broken in the past, it means no one can truly guarantee the crypto market bottom is in.

Let us know your thoughts about past bitcoin price model failures. We’d love to hear your opinions on the subject below.

Image creditShutterstock. Pixabay. Wiki commons. Lookintobitcoin.com. Twitter.

DisclaimerThis article serves informational purposes. This is not an invitation to purchase or sell directly, nor a suggestion or endorsement of products, services or companies. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.