On-chain data shows the Bitcoin taker buy/sell ratio has recently crossed above ‘1,’ a sign that the crypto could experience short-term bullish momentum.

The Bitcoin Buyer’s Buy/Sell Ratio reaches a Level Above 1

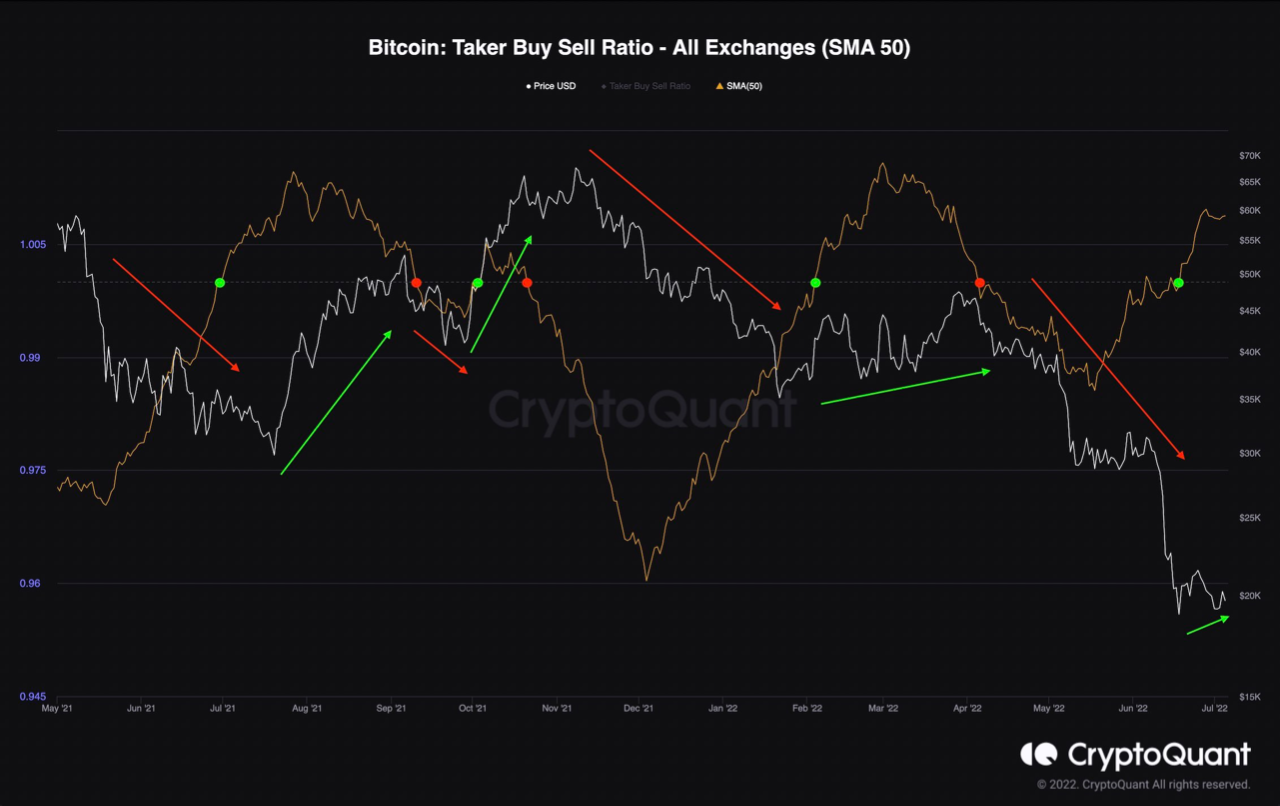

An analyst explained in CryptoQuant that the BTC Taker Buy/Sell ratio trend could suggest that the cryptocurrency might experience sideways movement, or even a bearish turn in the near-term.

The “taker buy/sell ratio” is an indicator that tells us about the ratio between the long and short volumes in the Bitcoin futures market.

This metric indicates the dominant long volume at this moment when the value is higher than 1. This trend indicates that bullish sentiment prevails right now.

Bitcoin Long-Term Holder Capitulation Approaching Bottom Zone, But Not Quite There Yet| Bitcoin Long-Term Holder Capitulation Approaching Bottom Zone, But Not Quite There Yet

On the other hand, the indicator’s value being less than that implies that the selling pressure is currently stronger than the buying pressure in the Bitcoin market.

Here’s a chart showing the trends in the BTC 50 day moving average taker sell/buy ratio for the past year.

Source: CryptoQuant| Source: CryptoQuant

The graph above shows that the quant marked the key points of the trend in Bitcoin Taker Buy/Sell Ratio.

It seems like whenever the indicator has sunk below a value of one, the coin’s price has observed a bearish trend soon after.

Related reading: Experts Call Out Bitcoin Dead.| Experts Are Calling Out That Bitcoin Is Dead. Gnox (GNOX), Fantom and FTM are two examples of projects that will usher in a new age of crypto.

Similar to the above, a ratio crossing the one line is usually followed by bullish reversals or sideways movements for crypto.

In recent weeks, the taker buy/sell ratio’s value has once again observed a surge and has now gone past the “one” threshold.

Bitcoin could see a temporary bullish trend reversal, or even sideways movement, based on the historical trends.

BTC Prices

At the time of writing, Bitcoin’s price floats around $20.5k, up 2% in the last seven days. The crypto’s value has dropped 31% over the last month.

Below chart displays the trends in the value of the coin during the last five working days.

Over the past 24 hours, crypto's value seems to have risen. Source: TradingView - BTCUSD| Source: BTCUSD on TradingView

Bitcoin’s value has been consolidating in a sideways fashion over the past few days. However, in the past twenty-four hours or so, the coin’s value seems to have gained some upwards momentum as it now breaks above the $20k mark again.

Featured image by Kanchanara at Unsplash.com. Charts from TradingView.com and CryptoQuant.com.