On-chain data shows the Bitcoin flow from spot exchanges to derivatives exchanges is currently painting a trend that has historically been bullish for the crypto’s price.

Bitcoin Spot To Derivatives Exchanges Flow Starts Sharp Decline

An analyst pointed out in CryptoQuant that the BTC spot-to-derivatives flow could be pointing to a bullish outcome.

The “spot exchanges to derivatives exchanges flow” is an indicator that measures the total amount of Bitcoin moving from spot wallets to derivatives wallets.

This metric’s rise in value means that more coins will be transferred to derivatives markets from spot to allow investors to trade futures.

In the past, the indicator’s value has usually moved faster whenever the price of the crypto has observed a large decrease.

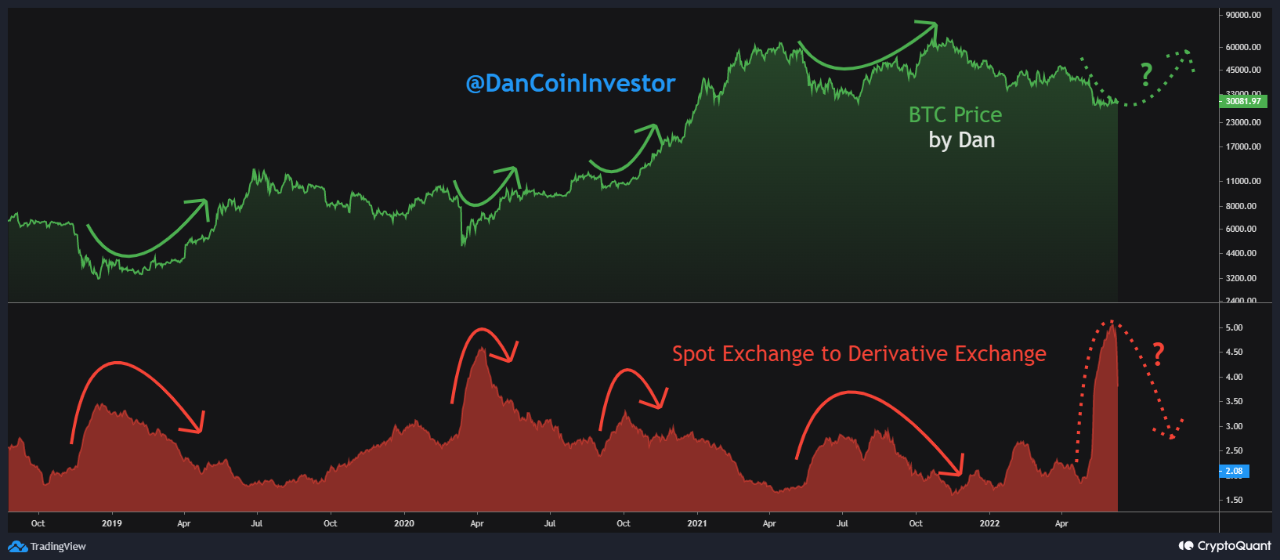

Here’s a chart showing the change in Bitcoin spot to derivatives trading flows over the past few years.

According to CryptoQuant, the value of this metric has been experiencing a dramatic decline in recent weeks. Source: CryptoQuant| Source: CryptoQuant

You can see that quant has highlighted the areas of Bitcoin spot trend to derivatives flow in the graph.

The indicator shows that the cryptocurrency’s value has risen whenever it has seen a sudden increase in high values, followed by a drop.

Related Reading| When Greed? Bitcoin Market Crashed in One Month of Fear

During 2018, 2020, and 2021, this pattern formed shortly after the coin’s price had a sharp decrease and hit a bottom.

This may indicate that, as Bitcoin nears a bottom in value, whales send large quantities of crypto to derivatives exchanges to open long positions.

Just recently, the spot to derivatives flow’s value sharply rose up, and now it seems to be plunging back downwards.

Bitcoin Bullish Signal: Exchange Reserves Hit New 4-Year Lows| Bitcoin Bullish Signal: Exchange Reserves Hit New 4-Year Lows

This could mean that the metric has once again started to form the same pattern, and if history is anything to go by, this can prove to be bullish for the crypto’s price, at least in the short term.

BTC price

At the time of writing, Bitcoin’s price floats around $29.5k, up 1% in the last seven days. In the past month, crypto lost 2%.

Below is a chart showing the change in coin price over the past five days.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Bitcoin appeared to have gained some ground recently above the $30k mark, but it has now fallen back below that mark.

Unsplash.com's featured image. Charts by TradingView.com. CryptoQuant.com chart.