Bitcoin fell to $40K, the crypto’s flagship currency after the Federal Reserve Bank of the United States issued hostile comments.

Powell said on Thursday, that the Federal Reserve may raise the benchmark interest rate 50 basis points (0.5%) at the Federal Open Market Committee’s meeting.

Bitcoin drops below $40K

Just a few days back, the top cryptocurrency reached a record high of $43,000. This was its highest point in more than 10 days. This is a surprising price considering the fact that this asset was at its lowest point in a month, $39,000 earlier in the week.

BTC on the other side was quickly rejected by its peak locality and rapidly reversed. The asset’s value plummeted to $40,000 in a matter of hours.

The bulls are losing the $40,000 support level. This level has not been established this year as a reliable line. There is no shortage of negative predictions for the next few months.

Bitcoin’s price failed to retain the important levels of $41,500 and $40,000 despite a strong negative control. From Monday bears should aim to hit the swing low at $38,536. This is an objective that all traders still have. BTC prices could fall as low as $36,000 if the swing low is not met.

As a result, bitcoin’s market capitalization has dropped to $750 billion, after briefly surpassing $800 billion earlier this week.

Why A “Boring” Bitcoin Could Be A Good Thing| Why A “Boring” Bitcoin Could Be A Good Thing

Do you want to buy or sell?

BTC must open at $44,088.73 Monday. A Macron win will result in the Greenback falling further which could lead to further upside opportunities. The fact that Ukraine news is receding in the background and becoming less relevant indicates that negotiations are ongoing. This means that a resolution could be reached anytime, since Russian military operations are now focusing on the West, and not the entire country of Ukraine.

There is a major risk in the French election this weekend. Expect huge market shifts and shocks on Sunday and Monday if Le Pen, a far right candidate, wins Macron’s election.

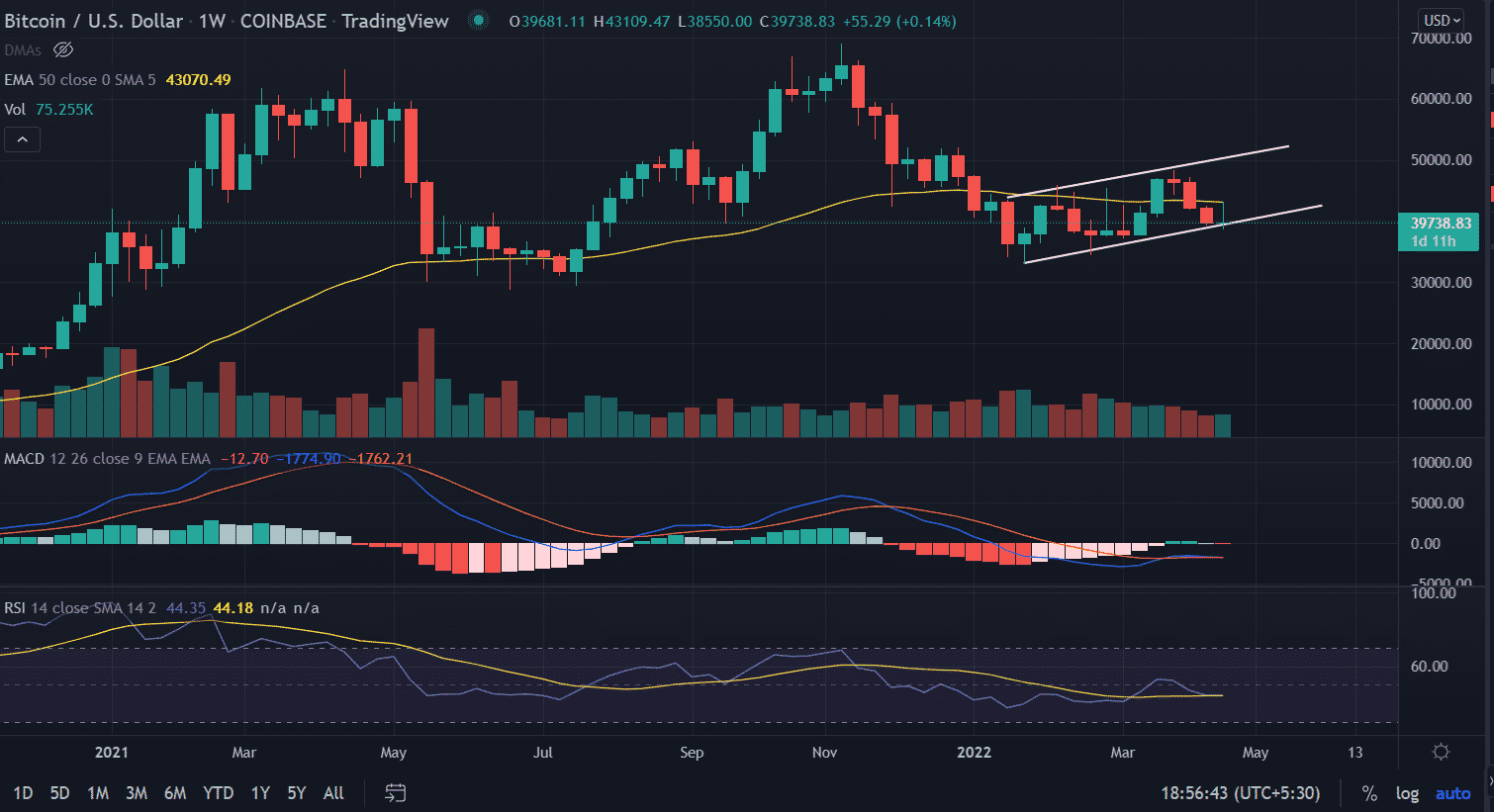

Currently, investors are ‘waiting and watching’ to see how the supply-demand situation will react to the support area. Since late January, the BTC price has been trading in a ‘rising wedge pattern,’ as shown on the weekly chart.

BTC/USD Trades on TradingView at $39K Source: TradingView

The bulls are targeting the 51,000 level and expect a bounce back at the current price. The bulls should close above the $43,071 EMA (Exponential Moving average) 50 days before they can continue their journey.

Is Bitcoin Gonna See Another Big Drop Soon?| Is Bitcoin Gonna See Another Big Drop Soon? The past may prove to be true

Featured Image from Pixabay. Chart by Tradingview.com