Bitcoin saw its biggest single-day price increase in one year, as the Russian ruble plunged 20% against the dollar amid worldwide sanctions placed on the country following the attack on Ukraine.

Bans on Bitcoin

The most influential countries in the world have imposed penalties on Russia aiming for its economic collapse to stop Putin’s efforts to invade Ukraine. Penalties aren’t just for politicians, but also common citizens.

Nikolai Arefiev (Communist Party deputy to the State Duma) stated that Russians may have their savings confiscated by Russia’s government.

“If all funds that are abroad are blocked, then the government will have no other choice but to seize all the deposits of the population – there are about 60 trillion rubles – in order to get out of the situation.”

As they seek to make crypto trading more convenient and safe for their wealth, both Russians as well as Ukrainians, the volume of cryptocurrency trading has increased dramatically.

Bitcoin was also used to make donations to the Ukrainian effort. Tether and bitcoin are the cryptocurrencies with the greatest trading volume in these countries.

Bitcoin’s original narrative seems to be winning amongst the people who need it and so, its price has increased while recording other historical marks.

Bitcoin Soared 20% In Two Session With Crypto Demand As Haven| Bitcoin Soared 20% In Two Session With Crypto Demand As Haven

The Pump

According to Arcane Research data the price of bitcoin rose 14.5% Monday. This is its biggest pump since February 8, 2021 when it reacted positively after Elon Musk’s announcement that Tesla had purchased $1.5 billion worth bitcoin.

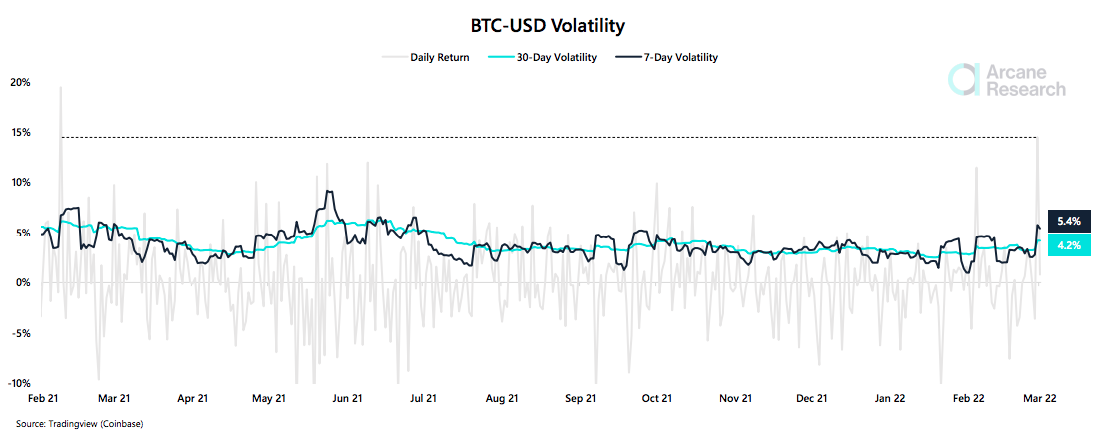

Data also shows that after one month of volatility, the digital currency was able to provide better returns. Bitcoin’s 7-day volatility increased to 5.4%, its highest mark since June 2021. Arcane Research notes this proves that the digital coin “behaves opposite of the rest of the financial markets concerning volatility, as upwards price movements often cause the most significant volatility spikes.”

Similar to what many had expected, the correlation between Bitcoin and tech stocks has been weakened. The bitcoin price increased 5% in the past 24 hours while the closing prices of equity stocks dropped. Bitcoin might not be considered a safe place to hold value, but it could become a good investment.

Before Monday’s big pump, bitcoin trading volume reached over $10 billion last Thursday as a reaction to Russia’s attack on Ukraine. This level is at its highest since December 4th.

Related Reading: Bitcoin surpasses 50 days SMA. Can BTC ride it to $50,000?| Bitcoin Breaks Above 50-Day SMA, Will BTC Ride It Out To $50,000?

BTC Prices

Arcane data further noted that the digital coin has returned to its $40-44k trading range and the resistance level of $44,000, found during early February’s rally, is an important mark since the coin has yet to convincingly break through that resistance.

Data suggests that if BTC breaks through $44k again, then “$47,000 is the next resistance area to pay attention to.”

Bitcoin was up slightly in the past 24 hours. At the time of writing the digital coin’s price is $43,894.