The popular penny token Shiba Inu has revealed details of its much-anticipated virtual reality project, “SHIB: The Metaverse.” Ethereum’s native cryptocurrency, Ether, has been set as a land pricing token.

This new venture, which was created by the meme coin, will include 100,595 plots. Some of these will be kept private. In phases, the sequence of lands is released.

Edul Patel (CEO and co-founder of Mudrex), stated that the main purpose of SHIB is to create one of the most powerful communities in crypto history. Its important announcements of entering metaverse space and offering over 100,000 plots of virtual space have gathered over 3 million followers, further increasing the token’s value.

The plots are priced between 0.2 to 1 Ether (ETH) and are divided into four categories: Silver Fur, Gold Tail, Platinum Paw, and Diamond Teeth. The neutral cryptocurrency has been fixed for land pricing to ensure that Shiba Inu’s native token has no downside. Shibarium will create the metaverse, which is an additional layer for SHIB.

To use the ecosystem tokens we have, we’d need to cash out our tokens or dump them.

Pratik Gauri is the CEO and founder of 5ire. According to him, Shiba Inu already has ShibuArmy which allows users to make passive income.

Market experts believe that Shiba inu will join the metaverse to rival Decentraland.

The Shiba Inu SHIB Price is currently up 15.49% at $0.00002675 as of the writing. According to CoinStats data, the token had a market cap of $14.8 million.

According to Lokesh Rao, CEO and co-founder of Trace Network Labs, the entry or creation of any metaverse is beneficial to the industry’s growth because the future lies in the metaverse. He said that these platforms allow people to do business and their expansion is directly related to increased revenue generation and job creation.

Blog says that all of the tokens $SHIB ($BONE), $LEASH and $BONE will be utilized in the Shiba Ecosystem.

Developers stated that land owners would have the ability to generate passive income and in-game rewards, as well as earn passive income. The token can be used to rename landowners and allow them to burn the dog-themed token.

There are still risks that cryptocurrency could sink. The Federal Reserve will tighten its monetary policy to $30,000 in the coming months.

YEREVAN (CoinStats.app) — Bitcoin (BTC) has climbed above $41,000 as investors are returning to riskier assets amid persistently higher inflation in the U.S. and the U.K.

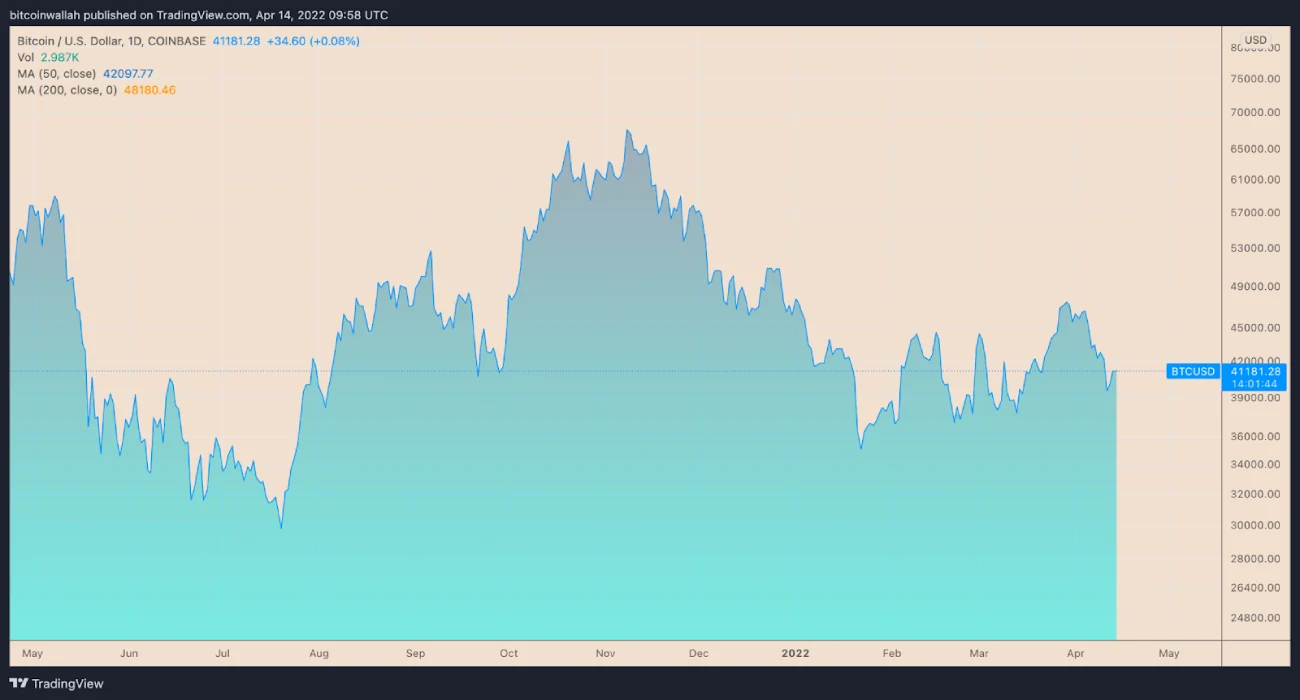

The flagship cryptocurrency, often touted as “digital gold” by hardcore Bitcoin supporters, rose to over $41,500 this Thursday. After a correction of 14.6% in the month, Bitcoin’s bids fell to $39,204. The rally began April 11. As a result, Bitcoin’s overall paper profits in the last three days came out to be a little over 6%.

Inflationary Pressures

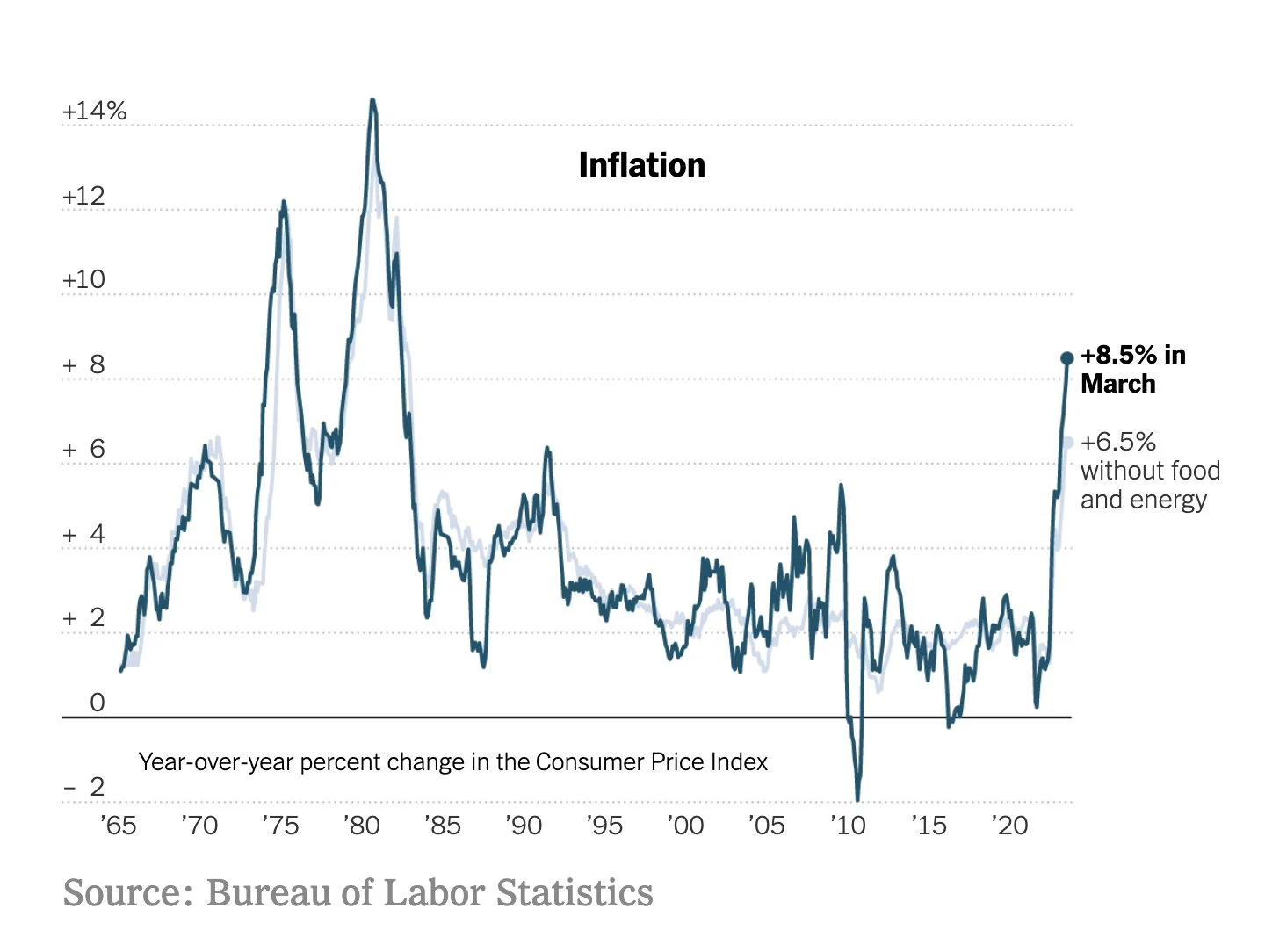

Bitcoin’s modest rebound this week came with two key reports on inflation. According to the Bureau of Labor Statistics, March’s Consumer Price Index (CPI), 8.5% was higher than a year earlier, which is the highest in over four decades.

Due to increasing fuel prices, U.K. inflation rose to 7% in March. This is the first increase in the last 30 years.

Eric Weiss, founder, and chief investment officer at Blockchain Investment Group, a New York-based digital asset hedge fund, blamed the U.S. Federal Reserve for causing “bad inflation” after printing 41% more U.S. dollars than in its lifetime since March 2020.

Weiss saw Bitcoin as a long-term remedy for rising consumer prices. He said that Bitcoin was worth his while.

Similar sentiments appeared across Crypto Twitter, with many analysts posting “buy Bitcoin” texts after the inflation reports.

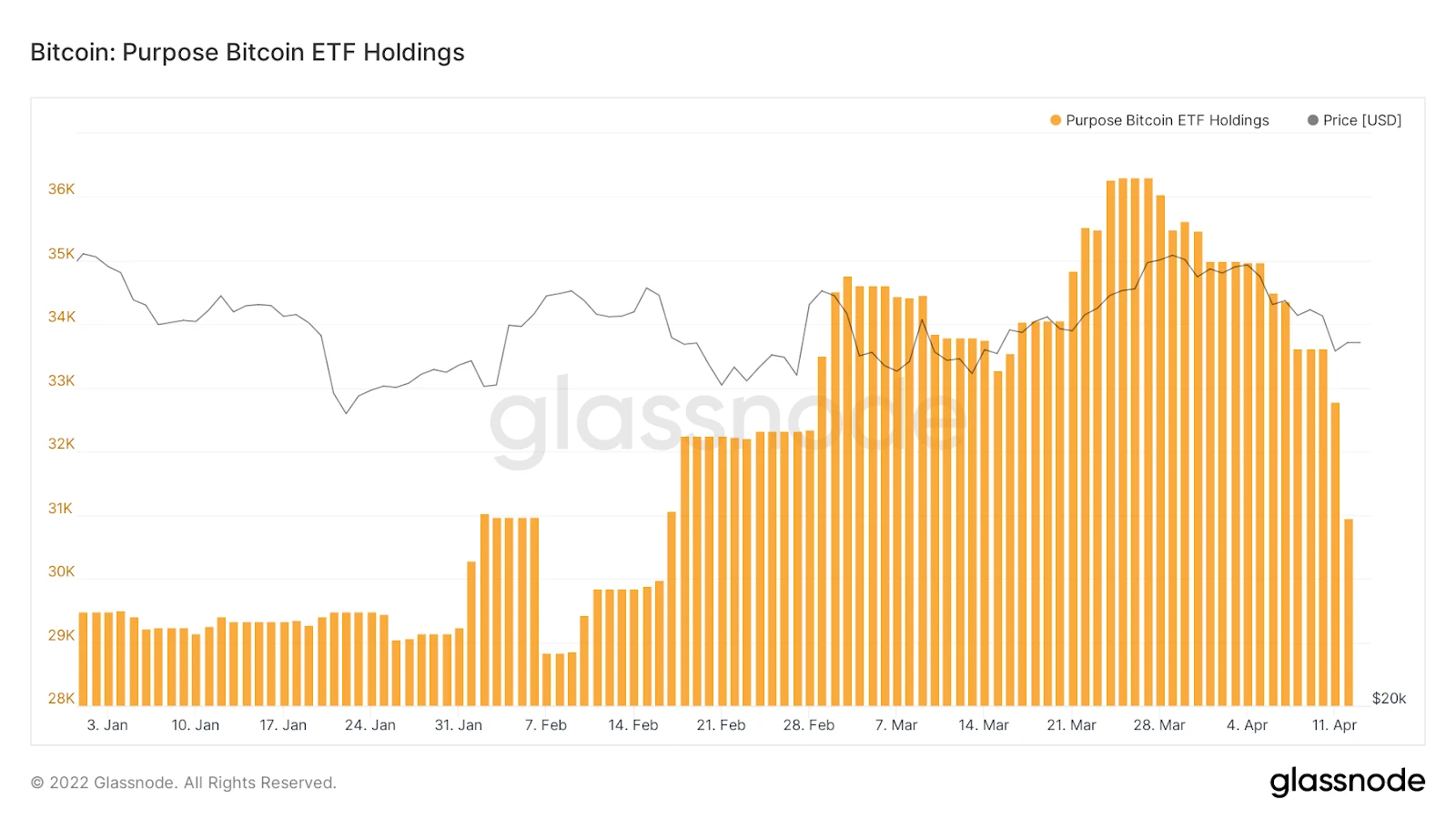

Nonetheless, some of them also highlighted flaws in the “buy Bitcoin” strategy. For instance, Jan Wüstenfed, an economist at Quantum Economics, a market research newsletter, cited massive outflows from the Purpose Bitcoin ETF as an indication of investors reducing exposure to BTC.

On April 12, investors drew 840 BTC out of the spot fund. They took another 1,830 BTC the next day.

“Notable is the more frequent occurrence of outflows and the relatively big size of outflows since March,” wrote Wüstenfed, adding:

“While the outflows themselves should not be market moving, it is a possible indication that investors are reducing exposure to #Bitcoin in times of high inflation, high uncertainty, and a FED that is tightening monetary conditions.”

Technical outlook

Technically, Bitcoin is defined as the movement of the bearish flag.

Bearish flags, which are patterns on candlestick charts that indicate the continuation of the downtrend after the temporary pause has ended, can be described as candlestick chart patterns. The price action will consolidate within the parallel trend lines that are in opposition to the downtrend after a strong downtrend. When the supporting trend line breaks, the bear pattern becomes active and the price action moves lower.

Consequently, Bitcoin’s current skew indicator is shifting to the downside.

Bitcoin could be retested at the $30,000 mark.