Following a strong rejection in August that saw Bitcoin prices fall to levels below $20,000, the cryptocurrency market has now turned green. There could be volatility as the market heads into weekend. Two major events are scheduled for the following days.

Bitcoin prices trade at $21,000 as of the writing. There has been a 10% profit and 4% profit over the past 24 hours and seven days respectively. Coingecko’s data shows that BTC performs well in crypto top 10, based on market cap, while other assets are lagging and show minor losses.

Bitcoin Price near Overhead Resistance. Can Bulls Hold On?

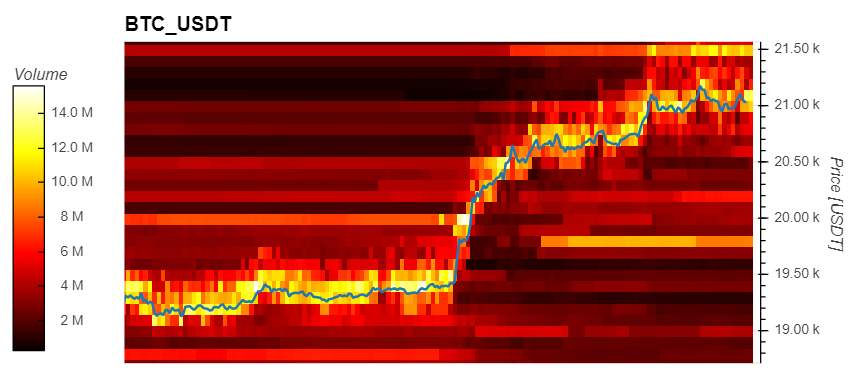

Material Indicators data (MI), which show liquidity, have started showing Bitcoin’s current level of support. After breaking through critical resistance at $22,000, the benchmark crypto was capable of filling more than $15,000,000 in requests orders.

The $21,500 level is now the key resistance, and it’s only temporary. The Bitcoin price has seen selling orders rise from $7 million up to $12 million over the last 12 hours. These orders could act as resistance, slowing down bulls’ attempts to reach higher levels.

The current price action has been bought both by small investors as well large investors who have placed orders exceeding $100,000. Should Bitcoin prices continue their bullish trend, then the investors should bid on the currency and keep supporting it.

However, investors with $100,000 bid orders have stayed flat as BTC’s price trends to the upside. These indicators point to a possible retest of support at $19,500-19,800, which could be used to stop further losses and maintain a bullish short-term bias.

Bitcoin price critical levels for longer timeframes

Caleb Franzen of Cubic Analytics’ Senior Market Analysis has additional information that shows Bitcoin is showing a similar price movement through 2022. In previous months, the cryptocurrency’s downside trend has been followed by periods of consolidation.

The below graph shows that these times have indicated more downside. If the Bitcoin price falls below $25,000, $28,000 and $32,000 then there is a risk that it will plunge further. Franzen saidYou can also share the following chart

Bitcoin was stable for 107 consecutive days beginning in the early quarter of 2022, before it began to fall for its next lower leg. This consolidation period has now lasted 83 days. I don’t expect the current market will match the 107-day range, but it’s worth noting that they can last for a while.