The $19,400 price mark is still a strong support for Bitcoin. In the past 24 hour, bitcoin price has declined by 2.9%. Bitcoin prices had seen a short recovery at the beginning of February, but were then under selling pressure.

This level was attracted to the charts by buyers after the coin began hovering around $18,000. BTC quickly moved up its chart in the following two weeks. The technical outlook of the coin indicated that the bears hadn’t given up yet.

Should the coin break past the immediate resistance, then the bulls may return to chart. BTC’s buying strength was less than the chart and an increase in purchasing power could propel it upwards.

BTC may rise to $20,000 if bulls stay put during the next trading session. The chance to rally near the $22,000 price level also can’t be called impossible once the bulls clear the $20,000 level.

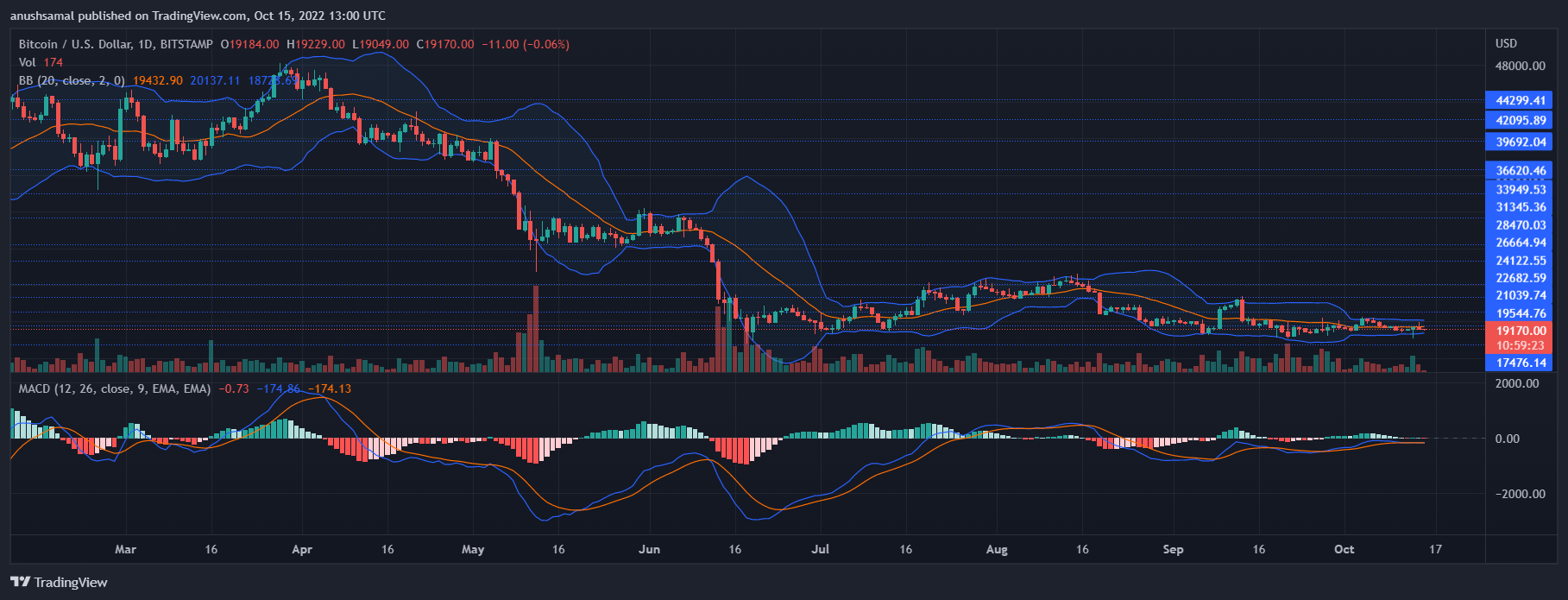

One-Day Bitcoin Price Analysis

BTC trades at $19190 as of this writing. Significant resistance was seen at $19,400. The coin will gain momentum if it moves above that price level to reach the $21,000 resistance mark.

The bulls may help BTC rise further once Bitcoin prices reach $20,000 BTC support was at $18,000, and any fall would propel it to $17.400. If buyers don’t resurface over the next trading sessions, a fall to the $18,000 price zone looks likely.

The amount of Bitcoin that was traded in the previous trading sessions has fallen, which indicates a decrease in buying pressure.

Technical Analysis

As the coin showed, as it tried to break through immediate resistance, sellers began to take over and buyers lost confidence. Relative Strength Index was below half-line which means that buyers’ strength remained low.

Bitcoin could challenge the next level of its price resistance if Bitcoin buyers keep up their momentum. The same reading indicated that the asset’s price was lower than the 20-SMA, which was an indicator that the sellers are driving price momentum at the moment of writing.

At the time of writing, BTC was being dominated by the sellers The coin started to display a sell signal, indicating that it could be possible for the price to drop further.

Moving Average Convergence Divergence shows the price’s momentum and direction, MACD underwent a bearish crossover and started to show tiny red histograms, which were sell signal.

Bollinger Bands are a visual representation of volatility. Bollinger Bands indicate volatility of the asset.