According to on-chain data, the Bitcoin NUPL metrics currently have values which would indicate that the bear market may not yet be in its full swing if the coin has one.

The Bitcoin NUPL value is still not as low as previous bear markets

As pointed out by an analyst in a CryptoQuant post, the BTC NUPL metric suggests market hasn’t neared a bear market bottom yet.

The “net unrealized profile/loss” (or NUPL in short) is an indicator that tells us about the ratio of profit and loss in the Bitcoin market.

The metric’s value is calculated by taking the difference between the market cap and the realized cap, and dividing it by the market cap.

If the NUPL is greater than 0, it indicates that there are more coins in profit and less in loss.

Conversely, investors who see negative numbers of this indicator are generally in loss.

Related reading: Bitcoin Bullish Signal: Exchange Reserve Loses 50k BTC During the Past Week| Bitcoin Bullish Signal: Exchange Reserve Loses Another 50k BTC Over Past Week

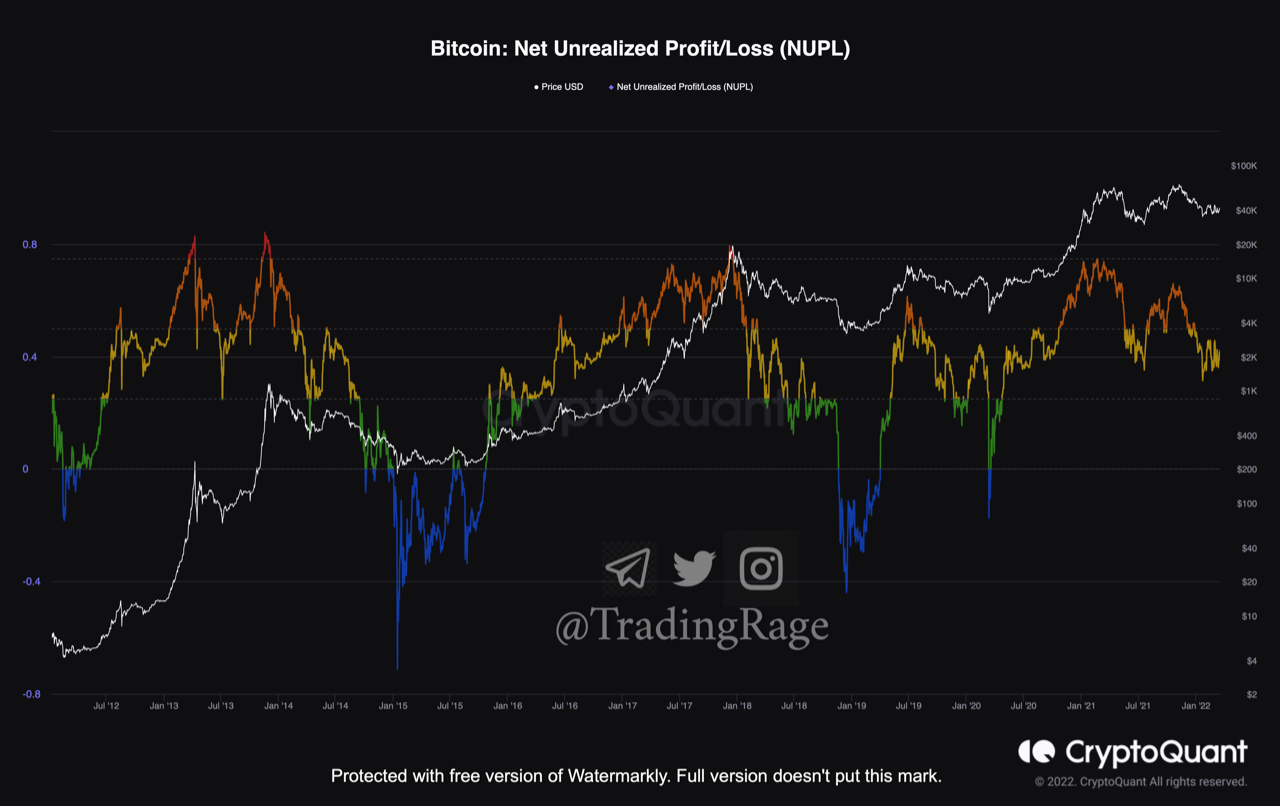

This chart shows how the Bitcoin NUPL has changed over time.

The indicator seems to be at a value above zero. Source: CryptoQuant| Source: CryptoQuant

You can see that Bitcoin NUPL has often been capable of predicting top and bottom formations by its many colored zones.

In the previous bear markets, the indicator’s value has usually fallen off below zero (blue) as a bottom approached.

These bearish periods were preceded by the green and yellow phases. However, currently the NUPL appears to remain in the yellow zone.

If Bitcoin has entered a bearish market already, this could mean it has some way to go until total capitulation or bottom formation.

Similar Reading: What is Bitcoin’s Role after the End of Petrodollar System| What’s Bitcoin Role After End of Petrodollar System? Arthur Hayes Says

However, it’s worth noting that there have been instances before where the indicator dropped into the yellow zone after a bull rally, but then jumped back up soon after as the bullish trend continued, indicating a mid-cycle bottom formation instead.

This was the latest instance of it during the mini bear period in May-July 2021. The coin dropped to $28k at the bottom and then rallied to a new ATH.

BTC Prices

At the time of writing, Bitcoin’s price floats around $41.4k, up 6% in the past week. The crypto gained 8.8% over the past month.

The chart below shows how the cryptocurrency’s price has changed over the past 5 days.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Unsplash.com featured image, Charts from TradingView.com and CryptoQuant.com charts