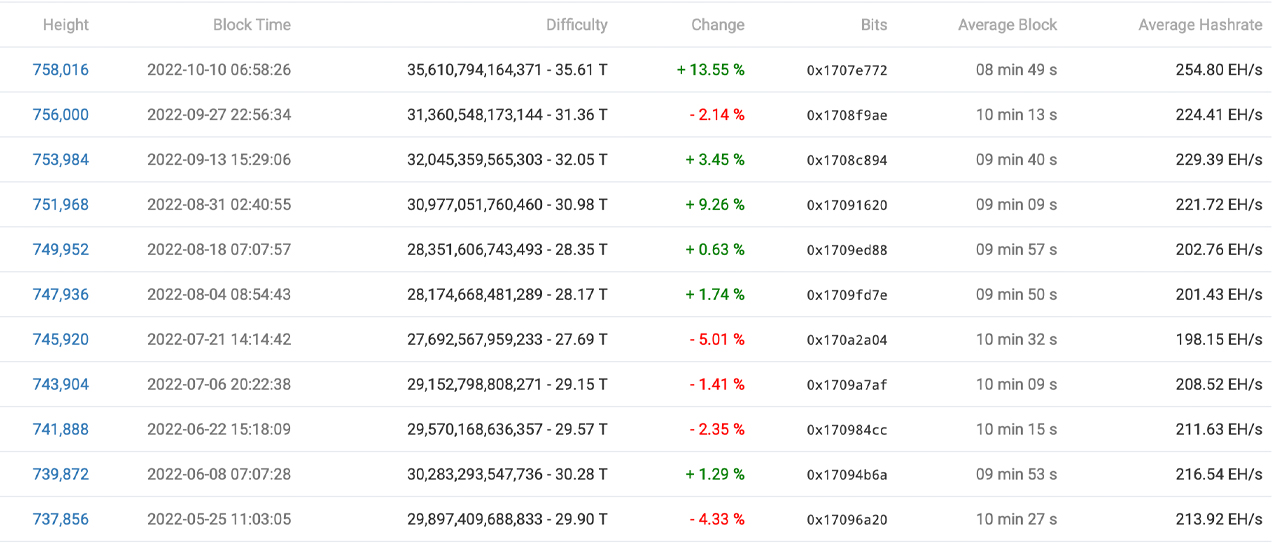

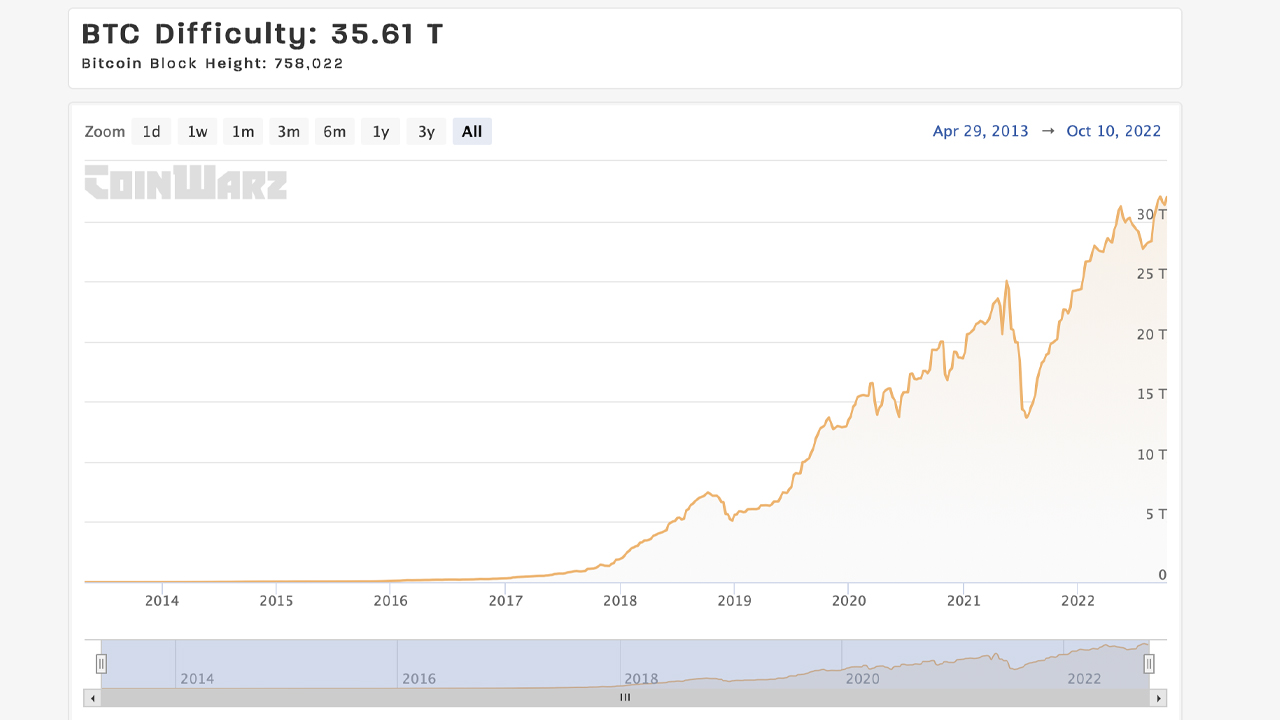

Bitcoin’s mining difficulty reached an all-time high on October 10, which means it’s more difficult than ever before to mine the leading crypto asset. Following the difficulty reduction on September 27, the network’s mining difficulty increased 13.55% higher at block height 758,016 as it printed the highest difficulty rise recorded this year.

It’s Now 13.55% More Difficult to Discover a Bitcoin Block Reward, as Network’s Mining Difficulty Reaches an All-Time High at 35.61 Trillion

Five days ago, Bitcoin’s hashrate reached an all-time high (ATH) when it tapped 321.15 exahash per second (EH/s) at block height 757,214. Although the hashrate is much higher than usual, it has not been possible to find blocks at a faster rate of less than 10 minutes each interval. When blocks are mined faster than usual, after 2,016 blocks are mined, the network’s difficulty adjustment retargets with increased difficulty. If blocks are not discovered in the 2-week 2,016 block period, the difficulty will decrease.

Tap the hashrate ATH October 5 and block times remained longer than the ten-minute standard. On October 9, blocks intervals spread 7:65 minutes. At the time of writing, even after the latest difficulty increase, Bitcoin’s block generation times are around 8.7 minutes. The current hashrate after the difficulty increase is approximately 244.03 EH/s. According to records, the 13.55% difficulty increase was notable and the highest of 2022, while the ninth largest (9.32%) occurred on January 20, 2022.

The latest rise pushed the network’s difficulty above the previous all-time difficulty high that was recorded on September 13 at 32.05 trillion. The current difficulty level is now 35.61 trillion, and will be for the next 2 weeks, after the retarget. Presently, the top mining pool on Monday, October 10, is Foundry USA as it commands 29.22% of the network’s total hashrate. Foundry USA has approximately 75.87 EH/s for the BTC blockchain, and it discovered 149 of the 510 blocks during the past three days.

Antpool holds 20.39% of all global hashrate, or approximately 52.95 EH/s. Antpool, Bitmain’s mining pool, discovered 104 blocks of the total 510 in three days. Statistic shows that there are twelve known mining pools currently devoted to SHA256 havehrate towards the BTC Chain. The unidentified hashrate also known as stealth mining, command 5.09 EH/s Monday. This is approximately 1.96%. Ten of the blocks that were discovered in the 72-hour period by unknown hashrate had been rewarded with their earned money.

With bitcoin prices so low, the network’s mining pools are making less money amid the highest difficulty rating recorded in over 13 years. Prior to the latest change, mining revenue per petahash per second (PH/s) was around $80 per PH/s and today it’s now $70 per PH/s. Only three mining rigs are currently profitable at $0.12 per Kilowatt Hour (kWh) and 35 other mining rigs are making a profit today at $0.07/kWh electrical cost.

Do you agree with the increasing mining difficulty target and reaching an average of 13%? Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerInformational: It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.