Bitcoin’s value against the U.S. dollar lost 7.3% during the last 24 hours after more than $600 million in value was removed from the $1.07 trillion crypto economy. According to data from cryptoquant.com, statistics show that many bitcoin miners gave up over the past two weeks. They sold 5,925 bitcoins worth millions.

There have been more than 6100 Bitcoin sold in the months since the beginning of each month, following a short miner capitulationpause

Bitcoin’s U.S. dollar value slid from $23,593 per unit to $21,268 per coin at 8:30 a.m. (EST) on Friday morning. BTC has lost 7.3%, while ETH fell 7.4% in the past day. This means that more than $600,000,000 was wiped out of the crypto-economy. Several other coins saw their values drop against the U.S. dollars. BNB lost 5% while XRP lost 9% and ADA lost 10.3% in the last 24hrs.

Data from cryptoquant.com shared Ali MartinezDuring the past 14 days, bitcoin miners gave up. “Bitcoin miners appear to have taken advantage of the recent upswing to book profits,” Martinez said. “Data shows that miners sold 5,925 BTC in the last two weeks, worth roughly $142 million.”

Following Martinez’s tweet, cryptoquant.com data shows more than 6,100 BTC have been sold since the first of August. The web portal’s Miners’ Position Index says bitcoin miners are “moderately selling” bitcoin. Using today’s crypto market values, 6,100 BTC equates to $130.80 million, a much lower value than Martinez’s quote price.

After a rush of bitcoins being sold in the months before August 1, 2022, miners decided to take a rest from trading BTC. The end of miner capitulation is near according to a Blockware Intelligence Newsletter, published July 29. “According to the hash ribbon metric, Bitcoin is 52 days into a miner capitulation,” the Blockware newsletter said. Blockware’s report added:

Historical bear market bottoms are marked by the ending of a miner capitulation.

BTC managed to hit $25,212 for each unit in the second week of August. BTC has lost 14.58% since the August 14 high and it’s currently down 69% from the $69,044 per unit price recorded on November 10, 2021. This past week Bitcoin’s mining difficulty rose by 0.63% making it more difficult for miners to discover BTC blocks and with prices lower, mining bitcoin is less profitable today than it was five days ago.

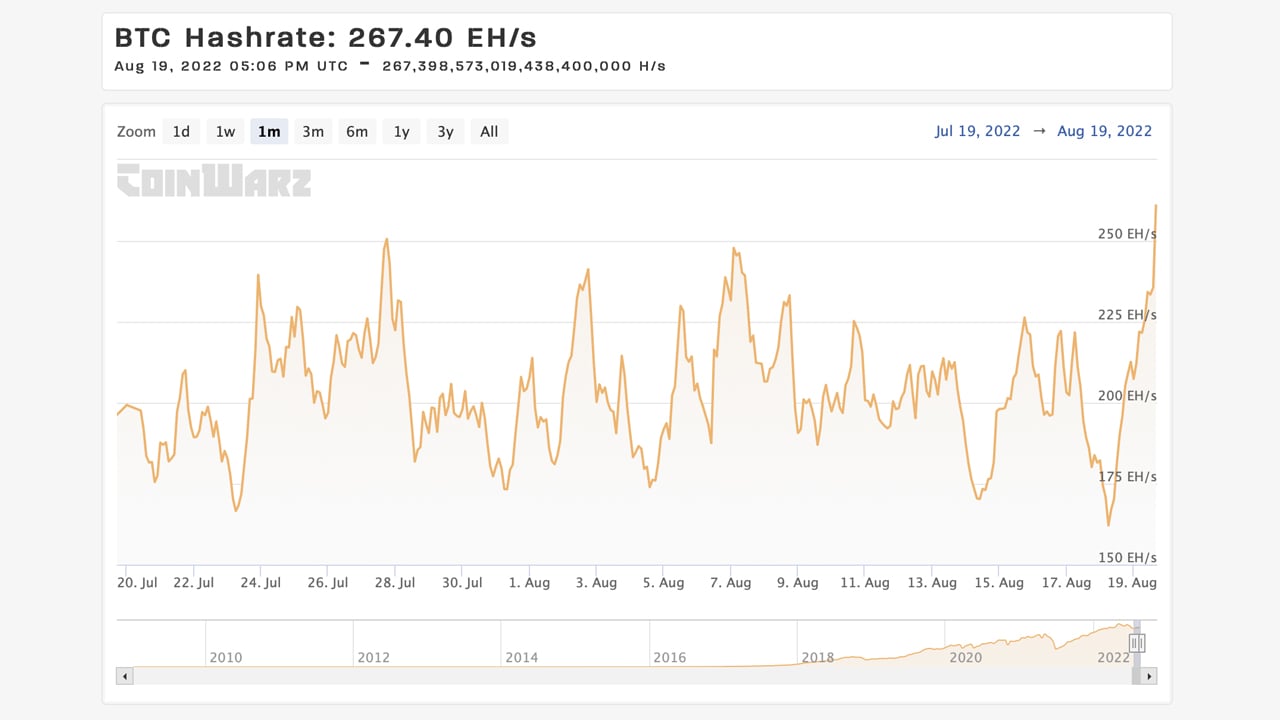

Bitcoin Hashrate soared by 46% during the 24 hour period following the latest difficulty rise

Despite the difficulty rise, after coasting along under the 200 exahash per second (EH/s) zone at 182.40 EH/s the day prior on August 18, 2022, BTC’s hashrate has skyrocketed to 267.40 EH/s. That’s a 24-hour increase of around 46.60% higher than the 182 EH/s recorded on Thursday afternoon (EST).

Using the current difficulty parameter, BTC’s current market value and a cost of around $0.12 per kilowatt hour (kWh), a Bitmain Antminer S19 XP with 140 terahash per second (TH/s) can get an estimated $4.85 per day in profit. According to market statistics, the Microbt Whatsminer M50S with 126 THB/s launched July can earn an average of $2.74 per daily in profit.

How do you feel about the miners who sold 5,925 bitcoin in two weeks? Are you convinced that miner capitulation has ended or will it continue? Comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.