Bitcoin mining profits have plummeted more than 75% since the peak of Bitcoin, which is at its lowest point since October 2020.

Bitcoin Prices Plummet Further

Bitcoin’s price plummeted to a 52-week low of $20,800 on Wednesday, down from an all-time high of $68,788 by more than 70%. Important market indicators indicate that bears continue to hold a firm grip on current markets, despite the fact that Bitcoin’s price is back above $21,000.

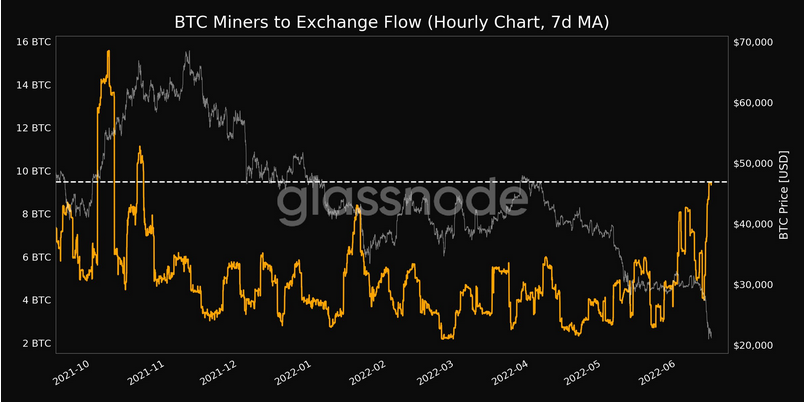

Bitcoin Miners to Exchange Flow is a metric which measures how much BTC has been transferred to cryptocurrency exchanges from miners. It reached a high of 9,476 over seven months. This suggests that miners may be selling BTC to offset a drop in price.

BTC miners'exchange flow. Source: Glassnode.

See also: Crypto investors and exchange inflows rise as they clamor to leave the market| Exchange Inflows Ramp Up As Crypto Investors Clamor To Exit Market

Signals from Miners: Market Sentiment

BTC miners’ activities often mirror broader market sentiment, as they typically sell BTC to avoid losing money on their mining payouts. Bitcoin miners’ selling activity has increased due to the significant drop in profitability mining.

Mining profitability has plummeted by more than 75% since its peak, and Bitcoin’s hash price is at $0.0950/TH/day, the lowest since October 2020.

BTC/USD drops to 52-week low Source: TradingView

Also, the netflow from miners to exchanges is improving. If the miner netflow becomes positive it indicates that there are more coins being sent to exchanges than individuals’ wallets. This indicates that miners have negative views on the market and feel pressured by sellers.

Many BTC mining equipment have been rendered unprofitable by the falling price of Bitcoin. If the price doesn’t recover, they may close down. As the whole market value went below $1 trillion, the rest of the crypto market followed BTC’s price behavior.

BTC has been through several bull cycles over the past decade. Each cycle was followed by a drop of 80%-90% from its peak. The BTC price, on the other hand, has never gone below the previous cycle’s all-time high. BTC trades currently at $19 783, its high in 2017. Any sell-off could push it into 2017 territory.

Related Article: TA – Bitcoin Signals Recovery; $23K Shows Resistance| TA: Bitcoin Shows Signs of Recovery, $23K Presents Resistance

Featured Image from Getty Images. Chart from TradingView.com