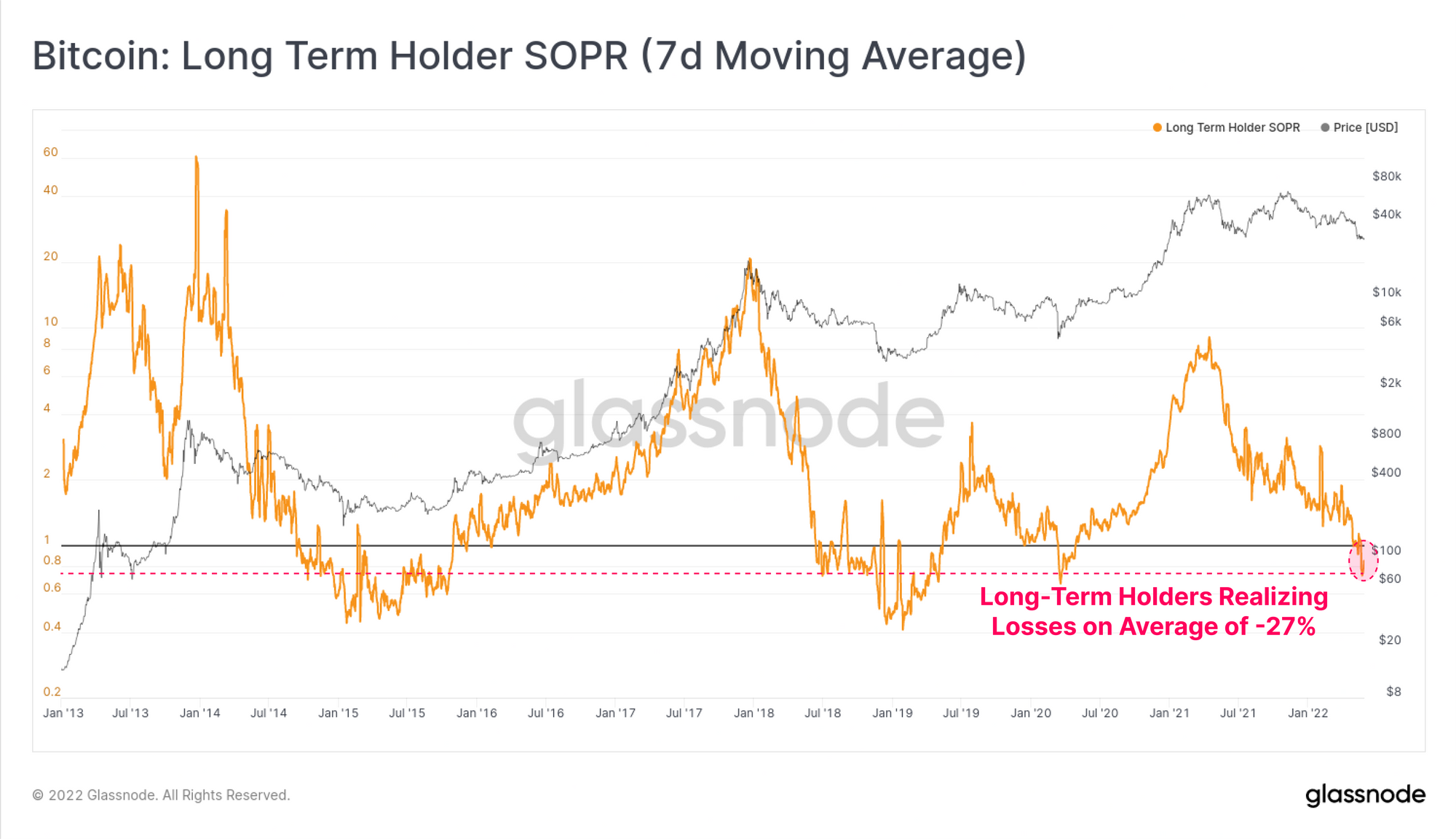

The data shows that Bitcoin holders who have been long-term owners of the currency have suffered significant losses in recent months. This could indicate that there is a final capitulation.

The Average Loss of Bitcoin Long-Term Holder SOPR is 27%

The latest Weekly Report from Glassnode shows that BTC Long-Term Holders seem to have suffered some losses in this week’s Bitcoin market.

The “spent output profit ratio” (or the SOPR in short) is an indicator that tells us whether Bitcoin investors are selling at a profit or a loss right now.

This metric is based on the online history of every coin sold, to find its most recent price. This price must be lower than current, otherwise the coin will have been sold profitably.

However, if the selling price of the previous coin is higher than that of the current one, it would indicate that the sale has resulted in a loss.

If Bitcoin SOPR value exceeds one, this means that coins currently moving at profit are selling on an average basis.

Related reading: Bitcoin on-Chain Data Signs A Long Squeeze Brewing in Futures Market| Bitcoin On-Chain Data Signals A Long Squeeze Brewing In Futures Market

Although the indicator is smaller than 1 it indicates the general market is trading at a loss. The ratio of 1 to 1 indicates that investors are making an average profit.

Here is the chart showing the Bitcoin SOPR trend for long-term holders. This cohort holds its coins at least for 155 days prior to selling.

Source: Glassnode's The Weekly Update - Week 22, 2022| Source: Glassnode's The Weekly Update - Week 22, 2022

You can see that Bitcoin’s long-term holder SOPR is experiencing a decline in its value this week, as you can see from the graph.

Current value suggests that every LTH coin purchased in the previous seven days experienced an average 27% loss.

Read Related Articles: Tim Draper, Billionaire, On What Will Start The Next Bitcoin Bull Market| Billionaire Tim Draper On What Will Trigger The Next Bitcoin Bull Market

It is noted that similar values to the metric in history have been only observed at the last capitulation lows during bear markets.

The current Bitcoin market may also be at its lowest point. However, the LTH SOPR plunged even more in 2015 and 2018 and then corrected before reaching its lowest point.

BTC price

At the time of writing, Bitcoin’s price floats around $31.7k, up 9% in the last seven days. The crypto’s value has fallen 18% over the last month.

The chart below shows how the currency’s price has changed over the course of five days.

Bitcoin appears to be gaining in value over the past few days. Source: BitcoinUSD on TradingView| Source: BTCUSD on TradingView

Unsplash.com featured image, Charts from TradingView.com and Glassnode.com charts