The sharp drop in Bitcoin’s price has caused panic among the market, according to data from the Bitcoin chain.

Bitcoin CDD Inflow indicator jumps up, indicating that long-term holders have been selling

CryptoQuant posted that long-term Bitcoin holders have been forced to sell due to the recent drop in price.

“Coin days” are the number of days a Bitcoin has remained dormant for. An example: if 1 BTC doesn’t move for 5 days, it accumulates 5 coin days.

When such a coin would be transferred or moved, its coin days would be “destroyed” as the number will reset back to zero.

Bitcoin Slips Below $33k As Exchange Inflows Reach Highest Value Since July 2021| Bitcoin Slips Below $33k As Exchange Inflows Reach Highest Value Since July 2021

The “coin days destroyed” (CDD) metric naturally measures how many of these coin days are being destroyed in the entire market at any given time.

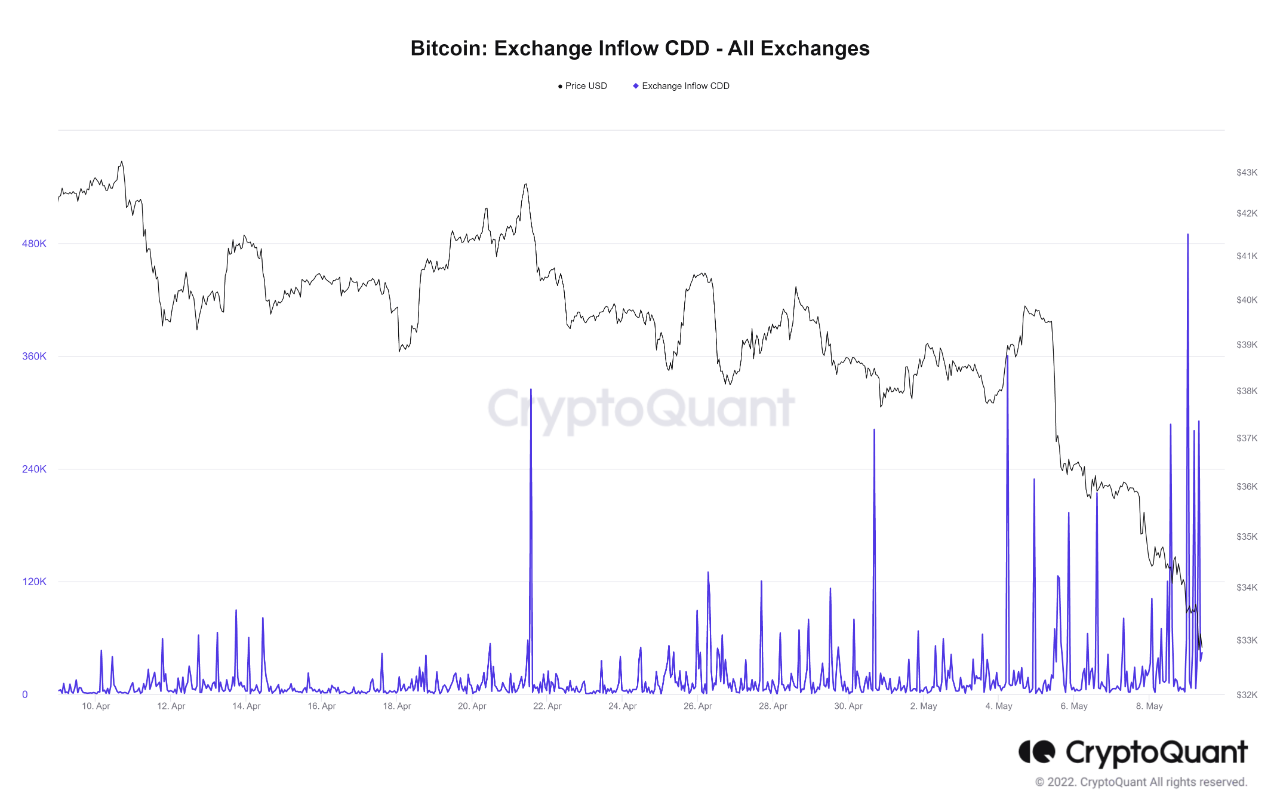

A modification of this indicator, called the “Bitcoin exchange inflow CDD,” tells us about only those coin days that were destroyed by a transfer to exchanges.

An inflow CDD with a high value indicates that long-term coin holders (who have accumulated a lot of coin days), are moving their coins onto exchanges.

In order to make a profit, investors often sell their Bitcoins on exchanges. LTHs of large numbers of bitcoins can bearish the cryptocurrency price.

Here’s a chart showing the monthly trend of the BTC Inflow CDD.

Source: CryptoQuant| Source: CryptoQuant

You can see that Bitcoin Exchange Inflow CDD saw some significant increases in value over the past few days, as you can see from the graph.

It is clear that the panic caused by the drop in market prices from $38k down to $30k has led to long-term investors selling.

Terra Beats Tesla As Second-Largest Corporate Bitcoin Holder After $1.5B Purchase| Terra Beats Tesla As Second-Largest Corporate Bitcoin Holder After $1.5B Purchase

LTHs could be experiencing a capitulation phase, as evidenced by the particularly large spikes over the last 2 days.

LTHs are the most likely Bitcoin buyers, so capitulation is usually a bad sign for the currency’s price.

BTC price

At the time of writing, Bitcoin’s price floats around $31.6k, down 18% in the last seven days. In the past month, crypto lost 26%.

Below chart displays the trends in coin prices over the last 5 days.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Bitcoin’s drop has continued today as the crypto briefly touched below $30k for the first time since July of last year, before rebounding back to the current level.

Unsplash.com featured image, Charts from TradingView.com and CryptoQuant.com charts